Where Does Cisco Stand In The Ethernet Switch Market?

Over the last few years, IT hardware manufacturers have observed a slowdown in product sales due to low global demand. This trend was evident in 2016, with global IT spend declining by around 0.6% to $3.38 trillion, according to a Gartner estimate. [1] Networking hardware vendors including Cisco (NASDAQ:CSCO) have not been immune to this change, and have reported revenue declines across multiple product lines over the years. Cisco’s core hardware product sales – including network switches and routers – have witnessed limited growth since 2011. Both of these revenue streams combined formed roughly 60% of Cisco’s product revenues (and around 45% of net revenues) in 2016.

Below we take a look at key growth drivers for Cisco’s network switches segment. Cisco’s network switches division generated roughly 40% of product sales and 30% of net revenues in 2016. According to our estimates, this segment makes up around 20% of our $162 billion valuation for Cisco or $33 per share of Cisco’s stock. Our price estimate is in line with the current market price.

Ethernet Switch Market Size & Cisco’s Presence

- Down 6% In Last 3 Months, Will Cisco Stock See A Recovery Following Q2 Results?

- Why Is Cisco Buying Splunk?

- Why The Digital Infra Theme Continues To Outperform

- What To Expect As Cisco Publishes Q3 Earnings?

- Cisco Stock Looks Like A Buy At $52

- Here’s Why Cisco Systems Stock Has Returned Just 9% Since Late 2018

Ethernet switches are primarily used by enterprises and service providers that have large-scale network requirements. Switches are designed in a way to help users scale up their operations and deploy networking services without impacting network performance. Switches provide a strong foundation for transferring converged data, voice and using video services. The need to transfer more data has led to an industry-wide transition from the older 1Gb Ethernet (or GbE) switches to 10GbE and 40GbE switches for better performance, higher bandwidth and lower latency.

According to IDC, worldwide Ethernet switches sales increased 3% over the previous year to $24.4 billion in 2016. Through the year, 10GbE, 40GbE and other high performance switches were key growth drivers for the market, reporting growth in unit shipments as well as revenues. Comparatively, sales and unit shipments for 1GbE switches continued to decline. [2]

Cisco has enjoyed a more than 60% share in the Ethernet switch market over the last few years, with all its nearest competitors – Huawei, Juniper Networks (NYSE:JNPR) and Hewlett-Packard Enterprise (NYSE:HPE) – maintaining single-digit market shares in this market segment. However, Cisco’s share in this market has fallen from around 75% in 2011 to just under 60% in 2016. Cisco’s switching revenues fell 3% y-o-y to $14.3 billion while its market share fell by 360 basis points to 59.1% in 2016, as shown below. Similarly, HPE’s market share fell by around 3 percentage points to 6.5% as revenues fell almost 30% y-o-y to $1.6 billion

Comparatively, Juniper’s share improved by 30 basis points to 3.5% as revenues grew 12% y-o-y to $860 million. Moreover, new entrant Huawei reported 60% annual growth in revenues to $1.7 billion while its market share expanded from 4.5% in 2015 to 7.1% in 2016. Much of the growth in the Ethernet switch market came from fast-growing geographies such as Asia-Pacific and Latin America. [2]

Long-Term Outlook For Cisco

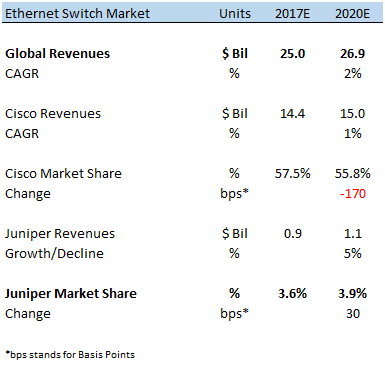

According to Gartner, the slowdown in global IT spend could reverse beginning this year. Worldwide IT Spending could grow at around 2.7% over the next few years to over $3.5 trillion by the end of 2018. [1] We forecast global network switches revenue to grow at a steady 2% – broadly in line with the industry-wide growth.

We forecast Cisco’s network switches revenue to grow at a pace slower than the industry-wide growth. If Cisco’s switching revenues grow at a CAGR of around 1% over the next three years to around $15 billion, Cisco’s share in the Ethernet switch market will fall to around 170 basis points to just over 55%, as shown below.

Gross Margins Likely To Continue To Improve

Cisco’s combined product gross margin improved by almost 230 basis points to over 62.6% in 2016, while its Services gross margin improved by 160 basis points over previous year levels to 66%. The improvement in gross margins can be attributed to two main factors. Firstly, the company is looking to emphasize more software-based (or SaaS) solutions, which typically have higher margins compared to hardware products. [3] Secondly, Cisco sold off its low-margin SP Video CPE business in order to improve its overall profitability. In the long run, we forecast Cisco’s product gross margins to improve further to around 63.5% by the end of the decade.

You can modify the interactive charts in this article to gauge how changes in Cisco’s Ethernet switch market share, growth in the global market or Cisco’s gross margins can have on our price estimate for Cisco.

See our full analysis of Cisco

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- Gartner Says Worldwide IT Spending Forecast to Grow 2.7 Percent in 2017, Gartner Press Release, January 2017 [↩] [↩]

- IDC’s Worldwide Quarterly Ethernet Switch and Router Trackers Show Slight Yet Continuous Growth for 4Q2016 and Full-Year 2016, IDC Press Release, March 2017 [↩] [↩]

- Cisco Q4 FY 2016 Earnings Call Transcript, Seeking Alpha, August 2016 [↩]