How Have Mergers And Acquisitions Led To The Consolidation Of The US Airline Industry Over The Last Decade?

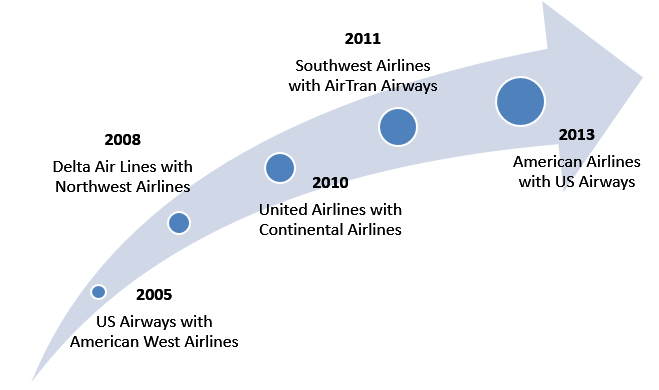

Having made heavy losses over the last several decades, the US airline industry has always been considered as a laggard by active investors. The sector suffered combined losses of over $52 billion between 1977 to 2009. Further, the economic slowdown in 2009-2010 forced the legacy carriers – American Airlines, United Continental Holdings and Delta Air lines – to significantly slash down their capacity to match the lower demand for air travel. While the recession further magnified the losses of the airlines, these legacy carriers continued to follow capacity discipline even after the air travel demand improved post 2010. Although this enabled the airlines to raise the air fares, and reduce their losses, it wasn’t sufficient to pull the industry out of its heavy losses. Consequently, a number of airlines were pushed into bankruptcy post the slowdown, resulting in a number of mergers and acquisitions over the last decade. Below we show some of the most significant mergers that have materialized over the last decade and changed the dynamics of the industry. For instance, Continental Airlines merged with United Airlines in 2010 and US Airways merged with American Airlines in 2013 to bail the latter out of its bankruptcy.

Apart from pulling out the airlines from bankruptcy, these deals were instrumental in changing the landscape of the US airline industry. These mergers resulted in the consolidation of capacity with the top 4 US airlines in the industry, namely American, United, Delta, and Southwest Airlines. At present, these airlines hold almost 85% of the market share, as opposed to only 65% share (on average) held by the top 4 US airlines in the past. As a result, these airlines currently operate as an informal oligopoly and control the dynamics of the overall air travel market, even though the sector is monitored by a number of regulatory bodies.

Apart from pulling out the airlines from bankruptcy, these deals were instrumental in changing the landscape of the US airline industry. These mergers resulted in the consolidation of capacity with the top 4 US airlines in the industry, namely American, United, Delta, and Southwest Airlines. At present, these airlines hold almost 85% of the market share, as opposed to only 65% share (on average) held by the top 4 US airlines in the past. As a result, these airlines currently operate as an informal oligopoly and control the dynamics of the overall air travel market, even though the sector is monitored by a number of regulatory bodies.

Source: Company filings; Alaska Air Merger Presentation

- Spurred By Stellar Earnings, Can United Airlines Holdings Stock Extend Its Run?

- United Airlines Holdings Stock Looks Set For A Come Back

- Down 13% Last Week, Can United Airlines Holdings Stock Bounce Back?

- Is United Airlines Stock On The Move?

- Company Of The Day: United Airlines

- Will United Airlines Stock Rise After Recent Correction?

Have more questions about United Continental (NYSE:UAL)? See the links below:

- Lower Unit Revenue And Higher Tax Expense Caused United Continental’s 1Q’16 Earnings To Drop Despite Fuel Cost Savings

- Currency Headwinds To Offset United Continental’s Fuel Cost Savings For 1Q’16

- How Will United’s Equity Value Be Impacted If The Crude Oil Prices Rebound To $100 Per Barrel By 2018?

- How Will United’s Equity Value Be Impacted If The Crude Oil Prices Average At $50 Per Barrel In 2018?

- How Will United’s Revenue And EBITDA Grow Over The Next Five Years?

- How Important Is United’s International Division For Its Overall Equity Value?

- What Is United’s Fundamental Value Based On 2016 Estimated Numbers?

- Why We Think United Continental Is Worth $65 Per Share?

- What Drove United’s Revenue And EBITDA Growth Over The Last Five Years?

- How Has United’s Revenue And EBITDA Composition Changed Over The Last Five Years?

- What Is United Continental’s Revenue And EBITDA Breakdown?

- How Has United Continental Utilized Its Cash Flows Over The Last Three Years?

- How Have Plummeting Crude Oil Prices Impacted United Continental’s Operating Margin?

Notes:

1) The purpose of these analyses is to help readers focus on a few important things. We hope such lean communication sparks thinking, and encourages readers to comment and ask questions on the comment section, or email content@trefis.com

2) Figures mentioned are approximate values to help our readers remember the key concepts more intuitively. For precise figures, please refer to our complete analysis for United Continental

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap