How Will Focus On Cloud Impact Google’s 2019?

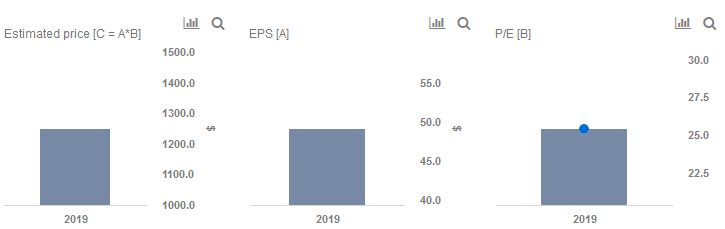

Alphabet (NASDAQ:GOOG) reported its Q4 earnings on February 4. The company’s results beat consensus expectations on revenue and EPS. While management mentioned that cloud remains one of its fastest-growing businesses, management did not break out the specific figures for cloud. Our interactive dashboard on Google’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

For Q4, key takeaways are below:

- Google advertising: Revenue grew to $32,635 million (+19% y-o-y)

- Google properties: Revenue grew to $27,022 million (+21% y-o-y)

- Google Network Members’ properties: Revenue grew to $5,613 million (+12% y-o-y)

- Google Other (cloud, hardware and play) revenue grew to $6,487 million (+30% y-o-y)

- Total Google segment (advertising plus other) revenue grew to $39,122 million (+21% y-o-y)

- Other Bets: Revenue grew to $154 million (+17% y-o-y)

- Beating S&P 500 by 37% Since The Start Of 2023, Where Is Alphabet Stock Headed?

- Beating The S&P 500 By 40% Since The Start Of 2023, What To Expect From Alphabet Stock In Q4?

- After 50% Move This Year Alphabet Stock To Outperform The Estimates In Q3

- Alphabet Stock Outperformed The Street Expectations In Q2

- What To Expect From Alphabet Stock ?

- Alphabet Stock Lost 10% In One Week, What’s Next?

The company’s operating margin declined to 21.3% (-3% y-o-y) due to sustained investments in machine learning capabilities and sales and marketing headcount, most notably for cloud.

Along expected lines, cloud was a big topic of interest on the call. However, management’s lack of a detailed breakup of Google’s other revenue and specific numbers around cloud was somewhat disappointing to investors – as many competitors have been providing cloud numbers in detail. On the bright side, management commentary did suggest that the cloud offerings have been seeing significant traction (doubling of deals over $1 million and multiyear contracts).

We will continue to look for additional commentary on incremental productization of the company’s native offerings in the cloud and color on how investments in advertising business can enhance margins of the core business.

Do not agree with our forecast? Create your own price forecast for Google by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.