What Will Drive Delta’s Near Term Growth?

Delta Air Lines (NYSE:DAL) has managed to post rather optimistic financials in 2018 thus far. In both the elapsed quarters, the company was able to beat the revenue and earnings consensus estimates by a modest margin. Further, in the latest quarter, the company posted a record top line figure, leading to a near 4.1% increase in unit revenues. These improvements were only possible thanks to heavy growth across all geographical areas, strong cargo results, and consistent double-digit growth in loyalty revenues. As demand continues to surge, we expect the top line to improve consistently through the remainder of the year.

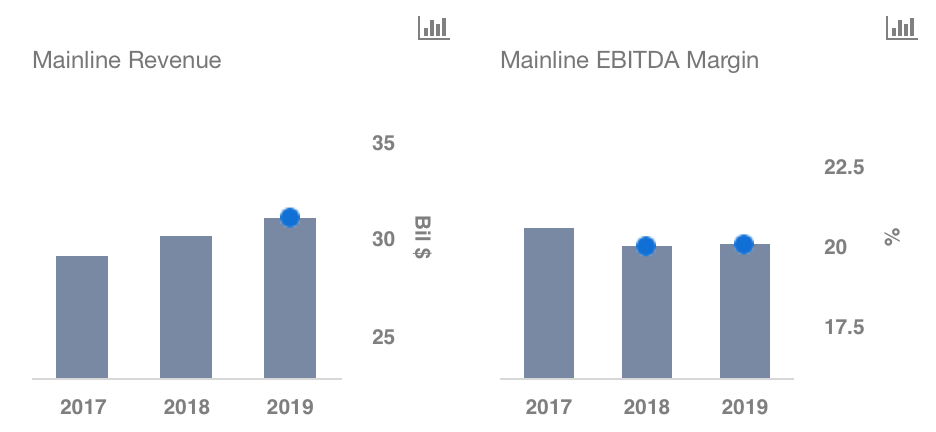

We have created an interactive dashboard What Is The Outlook For Delta Airlines on the company’s expected performance in 2019. You can adjust the revenue and margin drivers to see the impact on the company’s overall revenues and earnings.

- What’s Next For Delta Air Lines Stock After 10% Gains In A Month And An Upbeat Q1?

- Should You Pick Delta Stock Around $40 After Its Q4 Beat?

- After Over 20% Gains In 2023 Will Delta Air Stock Outperform Alaska Air?

- Should You Pick Delta Stock At $34 After Q3 Beat?

- What To Expect From Delta’s Q3?

- Which Is A Better Pick – Delta Stock Or United Airlines?

The most worrying thing for most airline companies at the moment is the fact that fuel prices have been rising at a previously unprecedented rate. For this reason, the company now estimates fuel to cost it about $2 billion in 2018. While this is a cause for concern in the near term, Delta has put into place a few strategies that are expected to contain its effects in the long term.

- The first strategy involves increasing the top line in an effort to curb the negative effects of the higher fuel charges. Through its diverse revenue streams, the company has managed to report two consecutive record quarters in the year. In this respect, management has decided to up its full year revenue guidance for 2018 by almost 8%, reflecting strong demand, pricing momentum, and record unit revenue premiums.

- Secondly, the company is on track to change its cost trajectory. In Q2, it managed to keep unit cost growth rates down for the third quarter in a row. This trend is expected to continue through the remainder of the year as well as nudging the airline back into its target range of less than 2% annual growth for 2018 and beyond.

- Lastly, management is continuing to invest in the airline’s international franchise. Through organic expansion and joint ventures, the company is building a rather strong global network for its customers.

Through these strategies, the airline hopes to deliver a fourth consecutive year of pretax earnings above $5 billion, representing a result largely in line with last year despite the significant fuel headwinds.

Overall, the company is one of the best performing airlines among its peers. The strategies implemented now are expected to poise the company for good long term growth over the coming years, with positive changes in financials to emerge as quickly as 2019.