Why Activision Blizzard’s Stock Increased By 60% In The Last Year

Gaming giant Activision Blizzard‘s (NYSE:ATVI) stock has rallied by almost 60% in the last year following strong results in all four quarters of the last fiscal year. The company’s performance was particularly impressive in the most recent quarter, in which it posted its highest-ever quarterly revenues of $2.01 billion, significantly higher than its own guidance and almost 52% higher than its prior year quarter results, and adjusted EPS of $0.65 per share, 25 cents higher than its guidance. Following the release of the fourth quarter results, the company’s stock rose almost 20% to an all time high of $47.23.

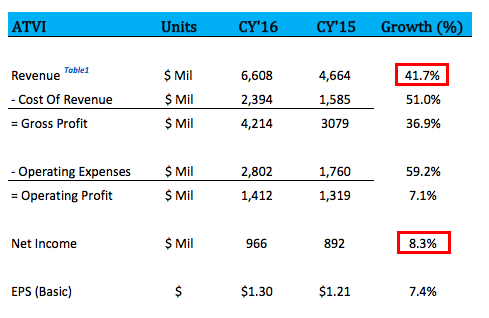

For the full year, Activision reported revenues of $6.61 billion, 42% higher than the prior year, and EPS of $1.28, a 7% increase over 2015.

- What’s Happening With Activision Blizzard Stock?

- What’s Next For Activision Blizzard Stock After An 11% Fall Yesterday?

- Up 10% In A Month, Does Activision Blizzard Stock Have More Upside?

- What To Expect From Activision Blizzard’s Q4?

- What’s Next For Activision Blizzard Stock After FTC Plans To Block The Microsoft Acquisition?

- What’s Happening With Activision Blizzard Stock?

Digital Content, Mobile Drives Growth

In 2016, Activision witnessed growth across all major platforms – PC, Mobile and Consoles. The acquisition of King Digital helped the company gain an incremental 20% in revenues and also helped it expand its footprint in Asia. Moreover, the revenues from Digital Content, which almost doubled over the last year, helped the company bolster its revenues for the full year. At the same time, an increase in the digital packages for the company’s offerings helped increase its monthly active user base, which was reported at 36 million for the last year, an increase of 37% over the prior year. Per the company, it kept its gamers engaged for 43 billion hours in the last year, which was almost on par with the engagement levels of Netflix.

Last year, Activision completed the acquisition of King Digital, which was aimed at consolidating the company’s position in the mobile gaming space. The acquisition helped the company expand its mobile user base and improve monetization. During the last year, the company’s revenues from the mobile platform rose 4x over last year to $1.7 billion. We expect the company’s mobile revenue, which is a key driver of its valuation, to increase steadily to over $3 billion by the end of our forecast period.

An important point to note is that Activision’s growth was not just limited to its top line. The company’s overall financial position improved during the last year, which positively impacted investor sentiment.

For the full year, the Activision’s free cash flow increased 76% over the prior year to $2 billion. The increase in the company’s free cash flow was aided by a surge in its cash flows from operations, which increased on the back of higher net income, one-time charges and non-cash items. The company also refinanced a significant portion of its long term debt, which bodes well for its future cash flows.

Outlook for the Year

Coming off a stellar performance in 2016, Activision released strong guidance for the next quarter and full fiscal year 2017. In the first quarter, the company expects to generate $1.55 billion in revenues and $0.25 in EPS. With fewer new releases in the current year, the company expects digital content to drive its revenues going forward.

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)