What Is The Path That Lies Ahead For Starbucks?

Since the opening of the first Starbucks store in Seattle in 1971, the chain has come a long way, making a brand name for itself synonymous with premium coffee. Presently, Starbucks has over 24,000 company-owned stores worldwide, including 3,581 internationally (primarily in Europe and China). Its sales have grown at an impressive CAGR of 12.4% in the past 5 years to over $20 billion in FY 2016.

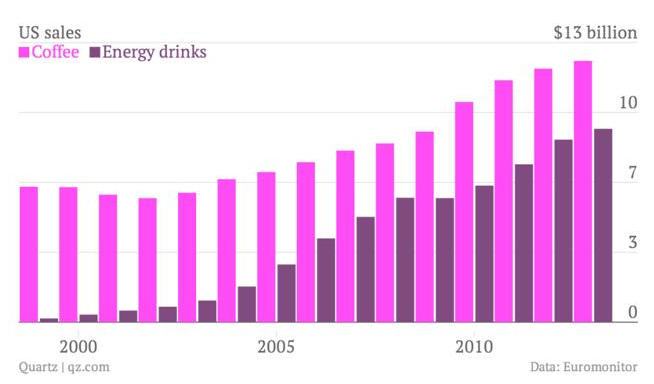

The biggest advantage Starbucks has is that its product is addictive. How many of us can’t function without a mug of coffee the first thing in the morning? The answer to that question would likely give you an idea about the potential Starbucks holds to continue growing at a tremendous pace, despite competition and the downtrend seen in comparable sales for the last few quarters.

- Down 9% This Year, What Lies Ahead For Starbucks Stock Following Q2 Earnings?

- Down 7% Since 2023, Can Starbucks’ Stock Reverse This Trend Post Q1 Results?

- Down 26% From Its Pre-Inflation Shock High, What Is Next For Starbucks Stock?

- After 6% Drop This Year, Pricing Growth To Bolster Starbucks’ Q4

- Can Starbucks Stock Return To Pre-Inflation Shock Highs?

- Starbucks’ Stock To See Little Movement Past Q3?

Moreover, the declining working conditions of the labor force have fueled the sales of caffeinated beverages over the last seven years. An estimated 6 out of 10 Americans aged 25-39, and 4.8 out of 10 Americans, aged 18-25, consume at least one cup of coffee a day. According to the International Coffee Organization, the global demand for coffee is expected to rise 1.2% from Oct’16 to Oct’17, with its popularity growing in the traditionally tea-drinking countries of China, India, and Japan.

Historically, the Americas have been the largest market for Starbucks, contributing $14.8 billion or 69.4% of total company sales in FY 2016. America has already witnessed a 1.5% y-o-y increase in coffee consumption, in the year so far.

Going forward, the company’s dependency on the U.S. may be about to change in favor of China. As we have mentioned in our previous articles, Starbucks is banking big on China for its future growth. Currently, the China/Asia-Pacific (CAP) segment contributes $3 billion or 13.8% of total revenue. But as the Chinese population grows to over 1.4 billion (forecast according to the Economist Intelligence Unit) in 2030, and its low income bracket falls to only 11% of the total population, we can expect 89% of the population to be able to afford a regular cup of coffee from Starbucks, as opposed to approximately 60% right now. In line with this, Starbucks has set itself a goal of opening and operating about 5,000 stores in China by 2021, thus, providing tremendous growth in the top-line.

However, the higher dependency on China may impact Starbucks’ top-line considerably, given the strength in the U.S. dollar as compared to the Chinese yuan. China’s recent decision to devalue its currency to an eight year low of 6.87, has resulted in the erosion of almost 8% to the currency value. The foreign exchange headwinds to be expected from this move are likely to affect the company’s sales.

USD to CNY (Dec’15-Oct’16)

Further, the increased demand for coffee has led to a reduction in the inventory levels of coffee beans for the past twelve consecutive quarters. According to ICO, this is the longest such streak since the organization began collecting data in 1995. To compound the situation, the drought in Brazil and Vietnam, the largest producers of coffee beans, has adversely affected the coffee harvest this year. This, in turn, has caused a spike in the prices. Since coffee is the main raw material used, a hike in the coffee prices, coupled with supply shortage, will affect Starbucks margins negatively, unless the company is able to pass on the hike to its customers.

In another surprising turn of events, three cities — San Francisco, Oakland, and Albany — have levied a tax on sodas and other sugary drinks. The move is an effort towards curbing the growing incidence of obesity and diabetes in America. A similar vote is also in motion in Colorado. If other states also adopt the tax on soda, given the health concerns, and this incidence turns out to be more widespread, we can expect a further deterioration in the company’s margins. In such a case, if the tax is passed on to the consumers, it may even discourage sales.

In conclusion, as is indicative in our price estimate for Starbucks at $66 per share, we expect Starbucks to outperform the restaurant industry, on the back of the potential in the Chinese market and the growing demand of coffee world-wide. However, it does have its challenges on the road ahead, in the form of higher prices which may eat away its margins, and, if passed on, may cause sales to drop.

Have more questions on Starbucks? See the links below.

- Starbucks’ Continues To Grow In September Quarter, Though Downtrend In Comps Persists

- Starbucks Q4 FY 2016 Earnings Preview: Focus On China To Continue; Reverting Comps To Historical Levels A Priority

- How Is Starbucks Maintaining Its Competitive Edge?

- Why Are We Bullish On Starbucks?

- Why Is China The Center-Piece Of Starbucks’ Growth Story?

- Why Has Starbucks’ Stock Price Stagnated In The Year So Far?

- What Is Starbucks’ Growth Strategy?

- K-Cups, Expansion In China Drive Growth For Starbucks In The June Quarter

- Starbucks Q3 FY 2016 Earnings Preview: Continued Focus On China, Expansion Of The Single-Serve Segment To Drive Results

- Starbucks’ Expansion Plans in China & Digital Channels Drive Growth In Q2 FY 2016

- Starbucks Q2 FY 2016 Earnings Preview: New Developments In China/Asia Pacific Region To Steal The Limelight

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)