A Look At AT&T’s Pay TV Business A Year After The DirecTV Deal

AT&T (NYSE:T) became the largest U.S. pay TV player following its July 2015 acquisition of satellite TV behemoth DirecTV. Although the U.S. Pay TV market has been facing challenges, amid high penetration levels (roughly 84% of U.S. households) and cord cutting in favor of online streaming, AT&T has been executing relatively well by focusing on improving profitability while keeping customer attrition in check. Below we take a look at some of the key developments in AT&T’s pay TV business over the past year.

See our complete analysis for AT&T | Comcast | Dish Networks

We have a $48 price estimate for AT&T, which is about 20% ahead of the current market price.

- How Will An Expanding Postpaid Phone Business Drive AT&T Stock’s Q1 Results?

- Down 50% From 2021, We Think There’s Upside For AT&T Stock

- Will AT&T Stock See Gains Post Q2 Results?

- At $15, AT&T Stock Appears Oversold

- AT&T Stock Held Up In A Tough Market. What Does 2023 Hold?

- What’s Happening With AT&T Stock?

Promoting DirecTV Over U-Verse To Bolster Profitability

AT&T’s total pay TV subscriber base stands at about 25 million, slightly ahead of Comcast (NASDAQ:CMCSA), which has roughly 22 million customers. While AT&T’s legacy pay-TV brand U-Verse has seen sharp declines since the DirecTV acquisition, much of this stems from AT&T’s decision to promote its satellite offerings, which have lower costs and higher ARPU. As of last year, AT&T noted that content cost per DirecTV subscriber was roughly $17 less per month compared to U-verse customers, implying that margins could be significantly thicker. That said, the overall decline in video subscribers (-0.5% since the acquisition) is roughly in sync with the broader industry, implying that AT&T is largely keeping users in its fold.

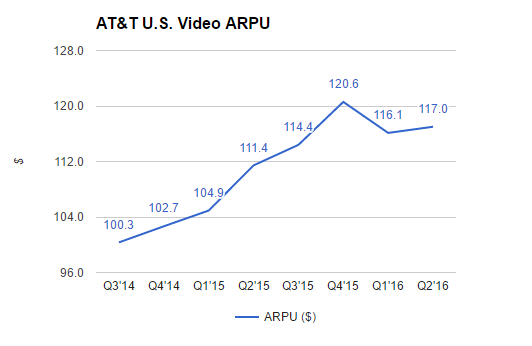

Price Hikes Have Continued, But Expect ARPU Growth To Slow Over The Long-term

Pay TV price hikes are typically an annual occurrence in the U.S., and AT&T has been raising its prices on its offerings in order to recoup the growing costs for programming, such as sports and entertainment. In early 2016, the company increased rates on both DirecTV as well as U-Verse by between $2 to $8 per connection. However, we believe that price increases of this magnitude could be difficult to sustain over the longer term, given the industry-wide decline in subscribers and pressure from lower-priced streaming services.

Revenue Synergies Via Wireless Subscriber Base

AT&T has also been focusing on providing bundled services (mobile, landline, high-speed Internet and pay-TV) in order to improve customer loyalty and cut costs, and DirecTV significantly improves the scope for that, given its larger coverage footprint. DirecTV reaches roughly 100 million homes compared to just about 30 million for U-Verse. AT&T has also been offering exclusive promotions to its pay TV users. For instance, the carrier reinstated the unlimited wireless data option that it stopped about five years ago, for wireless customers who subscribe to one of its pay TV services. AT&T also initially offered its latest iPhone 7 deal to DirecTV subscribers, although it has now extended them to all customers.

Doubling Down On Streaming

AT&T intends to become a leader in content distribution across various platforms, including mobile, high-speed Internet and TV. The carrier is slated to launch an launch an Over-The-Top (OTT) streaming TV subscription service dubbed DirecTV Now by the end of this year. The product will likely be targeted at customers who currently do not subscribe to a video service and prefer a streaming option. AT&T has also been bolstering streaming options for DirecTV’s NFL Sunday Ticket, which allows subscribers to watch out-of-market football games. The firm is offering free live streaming access to all satellite subscribers who opt for the Sunday Ticket package, in addition to making the service available to students and apartment dwellers via a streaming-only option, without requiring a satellite TV subscription.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research