How Much Of Total Outstanding Loans In The U.S. Were Handed Out By The Five Largest Banks?

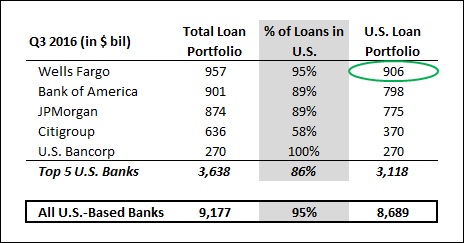

The 5 largest U.S. banks had over $3.6 trillion in outstanding loans worldwide in Q3 2016, with more than $3.1 trillion of these loans being handed out in the U.S. Having emerged strong from the economic downturn of 2008 thanks to its acquisition of Wachovia, Wells Fargo’s strength in the mortgage industry has propelled it to the top of the list of U.S. banks in terms of outstanding loans.

The figures above represent average loans for each bank over Q3 2016 as detailed in their latest SEC filings. The proportion of loans in the U.S. is based on individual disclosures by the banks about non-U.S. loans at the end of the period. The total loans for all U.S.-based commercial banks are compiled by the FDIC.

The table below focuses on the market share of each of these banks in the U.S. in terms of total loans outstanding in the country. Notably, Wells Fargo, Bank of America and JPMorgan Chase are together responsible for just under 30% of all outstanding loans in the U.S. – roughly the same as the proportion of total deposits in the country that they hold. On the other hand, Citigroup – which was once the largest bank in the world – has been forced to slash its mortgage operations in the U.S. and has also been working on reducing its global footprint. This has resulted in a sizable reduction in the size of its loan portfolio since the downturn.

The loan portfolio for the five largest U.S. banks have grown by 5.6% over the last five quarters. While JPMorgan gained the most with a 10% jump in loans over this period, growth was just 2% for Bank of America and Citigroup. The slow growth figure for these two banks is primarily due to their efforts to shrink their legacy mortgage portfolio. Additionally, Citigroup’s geographically diversified business model has also seen headwinds from negative exchange rate movements over recent quarters.

Loans for U.S. commercial banks have seen considerable growth since 2010 as the U.S. economy recovered from the downturn. Growth rates were aided by the Fed’s decision to maintain interest rates at record low levels over 2009-15. The 25 basis point rate hike last December did not weigh on loan growth, as steady economic growth continued to fuel the demand for new loans – especially commercial loans. The total loan portfolio for all U.S. banks has swelled by almost 10% over the last 12 months.

The Fed is likely to keep benchmark interest rates low in the immediate term given global macroeconomic uncertainty, because of which we expect the loan portfolio across U.S. banks to continue their brisk growth rate in the near future. But once the regulator resumes the rate hike process at the end of this year or early next year, there should be a noticeable reduction in the rate at which loans grow. The chart below shows Wells Fargo’s commercial loan portfolio over the years and our forecast for it going forward. You can understand the partial impact of changes in loan growth on our estimate for Wells Fargo’s share price by modifying this chart.

See full Trefis analysis for U.S. Bancorp | Wells Fargo | JPMorgan | Bank of America | Citigroup

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research