What to Expect from Newmont Mining’s Q3 Results

Newmont Mining Corporation (NYSE:NEM) is set to release its Q3 2017 results and conduct a conference call with analysts on 26th Oct, 2017. [1] The company had beaten market estimates last quarter by 76% by reporting non-GAAP EPS of $0.46.

The company has been consciously working towards strengthening its operations by increasing their output and reducing their operating costs to prepare for an environment of subdued gold prices. Gold is considered as a safe haven asset for investment purposes and its price has seen a significant surge this year owing to the uncertainty prevailing in the Korean peninsula. However, with the US and North Korean delegates seeking for peaceful resolution to this issue and in addition, an increase in the probability of US interest rate hikes with its improving economic condition, the long term sustainability of increased gold prices remains questionable. Below is our price forecast for gold for the upcoming years.

Operational efficiency coupled with elevated gold prices in the first half of the quarter are most likely to convert into steady third quarter results. Below are the consensus EPS and revenue estimates for the company followed by significant highlights to look out for when the company releases its third quarter results.

Efficient Project Pipeline

The company has consciously invested in projects which would deliver strong IRR and significantly lower its average all-in sustaining cost (AISC). The AISC is a comprehensive metric which captures all costs (production costs as well as sustaining capital expenses) required to sustain ongoing mining operations.

The company in its Q2 2017 earnings presentation, had highlighted that it has 8 profitable projects in the pipeline which would enable the company to achieve an estimated average annual output of 5 million ounces of gold and lower its AISC level to $650-$750 levels over the span of the next 5 years. ((Q2 2017 Earnings presentation, Newmont Investor relations)) The recent commencement of commercial production of the company’s Tanami mines expansion project in Australia supports the company’s trajectory towards this effort. [2] This expansion would lower the mine’s AISC to $700-$750 levels, in line with the company’s objective of maintaining AISC at the $900-$950 level for 2017. The company aims to self-fund these projects without having to burden itself with significant amounts of debt.

Strong Balance Sheet Fundamentals

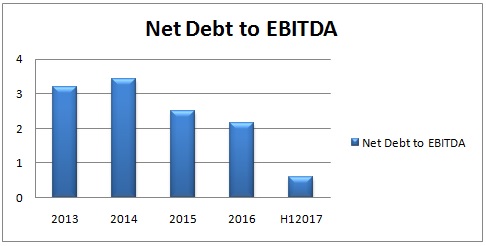

The company since 2013 has maintained a strategic focus to sustain high liquidity and reduce net debt in order to minimize its near term maturity obligations. The company has successfully reduced nearly 68% of its net debt since 2013 and the company’s leverage position has improved significantly with its net debt-EBITDA as on H1 2017 at .06.

Better than expected gold prices have also aided towards maintaining this focus and also enabled the company to provide significant return to its shareholders.The company has a dividend yield of 0.8%, which is among the highest in the industry. This makes the stock more attractive than gold ETFs which are non- yielding assets and only provide capital appreciation to its investors. As per the latest outlook presented by Newmont’s CEO and President, Gary Goldberg, the company plans to maintain its high dividend policy even in an environment of subdued gold prices. ((Newmont Mining CEO Goldberg on the company’s outlook, Bloomberg))

While elevated gold prices are most likely to help the company achieve better earnings for the quarter, the company’s cost reduction initiatives would enable the company to sustain its earnings in the long term amid an environment of fluctuating gold prices.

Have more questions about Newmont Mining? See the links below.

- Newmont Mining Maintains Strategic Focus On Low-Cost Mining Operations With Tanami Mine Expansion

- Gold Prices To Average Marginally Lower For The Full Year Despite Decline In Supply Propping Up Prices In Q2

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)

Notes:- Newmont Announces Revised Timing for Q3 2017 Earnings Call, Newmont Mining News release [↩]

- Tanami Expansion Project Adds Profitable Production and Extends Mine Life, Newmont Mining Newsroom [↩]