Will Power Solutions Help Johnson Controls Power Through The Second Quarter?

Johnson Controls (NYSE:JCI) is set to report its second quarter results on April 27, 2017, wherein earnings of $0.49 per share on revenues of $7.08 billion are expected.

As per the company’s guidance, disclosed in the first quarter earnings conference call, an EPS within the $0.48 and $0.50 range is estimated. This guidance had disappointed investors, as consensus trends at that time had called for earnings of 53 cents per share. The last quarter was the first full quarter combining the operations of the buildings and batteries business of Johnson Controls, with the buildings business of Tyco. Acquisition, integration, and restructuring costs had weighed on the results, and these expenses are expected to negatively impact the results in this quarter, as well. Below we’ll highlight key events which took place in the quarter.

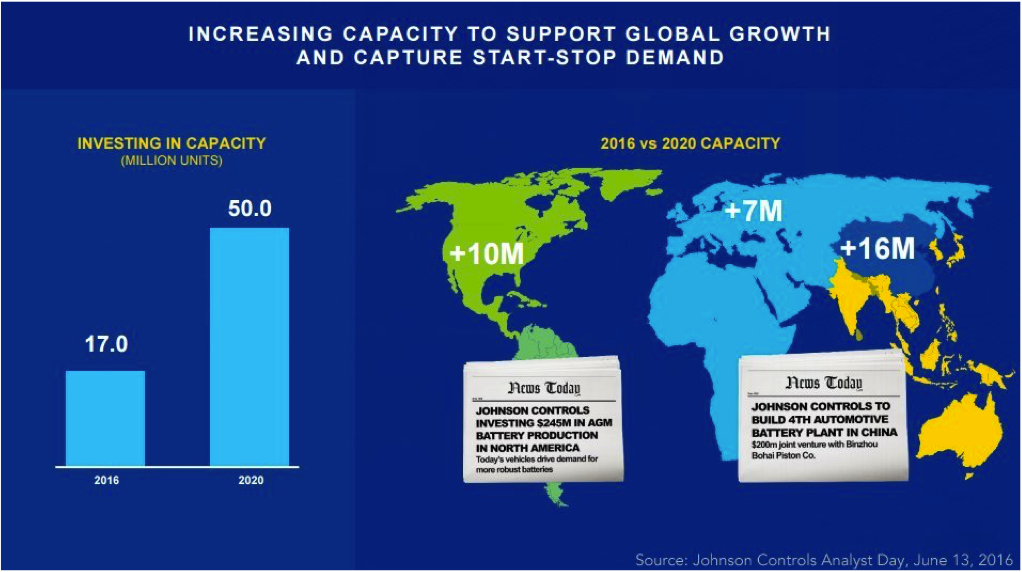

Investment To Expand Battery Production

Johnson Controls announced, in 2016, plans to invest $445 million to boost the output of its Absorbent Glass Mat (AGM) batteries. These are technologically advanced car batteries that are more expensive than a conventional lead acid battery, but are better equipped to handle the strain of frequent engine restarts and the ever-increasing load placed on car batteries. They are employed in vehicles with the start-stop technology, which, despite being fuel-saving, can tax a car battery since the electrical system still uses the energy from the battery when the vehicle turns off. Of the investment, $245 million will be expended to double its battery output in North America by investing in existing plants, and $200 million will go towards building a new battery plant in China. JCI also stated that it plans to invest a total of $780 million globally by 2020 to increase the production of these batteries.

As part of this investment, JCI had, in the quarter, stated its intentions to invest $50 million to expand capacity at eight plants in the US, aimed at increasing its aftermarket and supply capabilities. This investment is expected to boost the US production by 10 million batteries in 2017. With the addition of an increased number of safety and convenience features in cars, the power demands on batteries have been on the rise. This also gives a boost to the replacement opportunities, and according to Joe Walicki, Johnson Controls’ Power Solutions president, “in the last year alone, the US battery replacement market has grown 8%.”

Besides this, the company is also investing $100 million into its plant at Toledo, Ohio. The fuel savings with the start-stop technology is one of the main drivers for its increased adoption. Under average driving conditions, savings amount to 3% to 5%. However, with a high number of stops and with traffic lights staying red for extended periods, the figure can rise to 10%, according to Robert Fascetti, vice president for powertrains at Ford. Car manufacturers are also under intense pressure to meet strict fuel economy standards by 2025, and with the increased fuel efficiency of AGM batteries, this technology is destined to be in a majority of cars in the next few years.

Sale Of Scott Safety To 3M

During the quarter, 3M announced that it has inked a deal with Johnson Controls to acquire its Scott Safety business for $2 billion. Scott Safety is a manufacturer of equipment such as self-contained breathing apparatus (SCBA) systems, respirators, thermal imaging cameras, escape equipment, communications gear, and other protective instruments. Scott Safety’s products provide protective solutions in industries such as fire services, chemical, construction, petroleum, industrial, and emergency services. The deal is expected to close in the second half of the year.

For Johnson Controls, this deal helps them to focus their portfolio on its two core platforms of Buildings and Energy, positioning them to execute on its strategic plan, and deliver a 12% to 15% earnings per share CAGR by FY 2020. The net cash proceeds from the transaction are expected to approximate $1.8 to $1.9 billion, which will be used to repay a portion of Tyco’s $4 billion of merger related debt. The EBITDA attained by Scott Safety on a trailing 12-month basis was of approximately $155 million, translating into a very healthy margin of 27%, and indicating the purchase price to EBITDA multiple of 13.

Click here to see our complete analysis of Johnson Controls

- Q4’23 Earnings Preview: Down 21% YTD Will Johnson Controls Stock Continue To Underperform?

- What’s Next For Johnson Controls Stock After An 8% Fall Yesterday?

- Margin Expansion To Drive Johnson Controls’ Q3?

- What’s Next For Johnson Controls Stock After An Upbeat Q2?

- Here’s What To Expect From Johnson Controls’ Q2

- Here’s What To Expect From Johnson Controls’ Q1

Have more questions on Johnson Controls? See the links below: