Should You Buy or Sell Autodesk Stock Ahead of Its Upcoming Earnings?

Autodesk (NASDAQ:ADSK), a software company specializing in design and digital creation tools, is scheduled to report its earnings on Thursday, August 28, 2025. An analysis of the past five years reveals a marginally positive bias: the stock experienced a positive one-day return following earnings announcements in 53% of cases (with a median of 1.4% and a maximum of 10.3%).

For event-driven traders, while the near-term direction appears uncertain based on this historical split, understanding these patterns can still offer potential advantages. The actual market reaction will, of course, heavily depend on how the reported results compare to consensus estimates and market expectations. There are two primary strategies to consider:

- Pre-Earnings Positioning: Analyze the historical probabilities of positive and negative reactions and establish a position before the earnings release, acknowledging the even odds.

- Post-Earnings Positioning: Examine the correlation between the immediate market response to the earnings and the subsequent medium-term stock performance, then position your trades accordingly after the announcement.

Currently, consensus estimates project Autodesk to report adjusted earnings of $2.45 per share on sales of $1.72 billion for the latest quarter. This represents an increase compared to the same quarter last year, where the company reported earnings of $2.15 per share on sales of $1.5 billion.

From a fundamental perspective, Autodesk currently has a market capitalization of $61 billion. Over the trailing twelve months, the company generated $6.3 billion in revenue, achieving an operating profit of $1.4 billion and a net income of $1.0 billion.

- AST SpaceMobile: Is This Starlink Rival Stock Poised To Soar Higher?

- Where Is Alphabet Stock Headed?

- How To Earn 8.2% Yield While Waiting to Buy WYNN 30% Cheaper

- What Could Light a Fire Under Costco Wholesale Stock

- The Hidden Dangers Facing Amazon.com Stock

- Cash Rich, Low Price – Ardent Health Stock to Break Out?

That being said, if you seek an upside with less volatility than holding an individual stock, consider the High Quality Portfolio. It has comfortably outperformed its benchmark—a combination of the S&P 500, Russell, and S&P MidCap indexes—and has achieved returns exceeding 91% since its inception. Separately, see – What’s Happening With KDP Stock?

See earnings reaction history of all stocks

Image by StockSnap from Pixabay

Autodesk’s Historical Odds Of Positive Post-Earnings Return

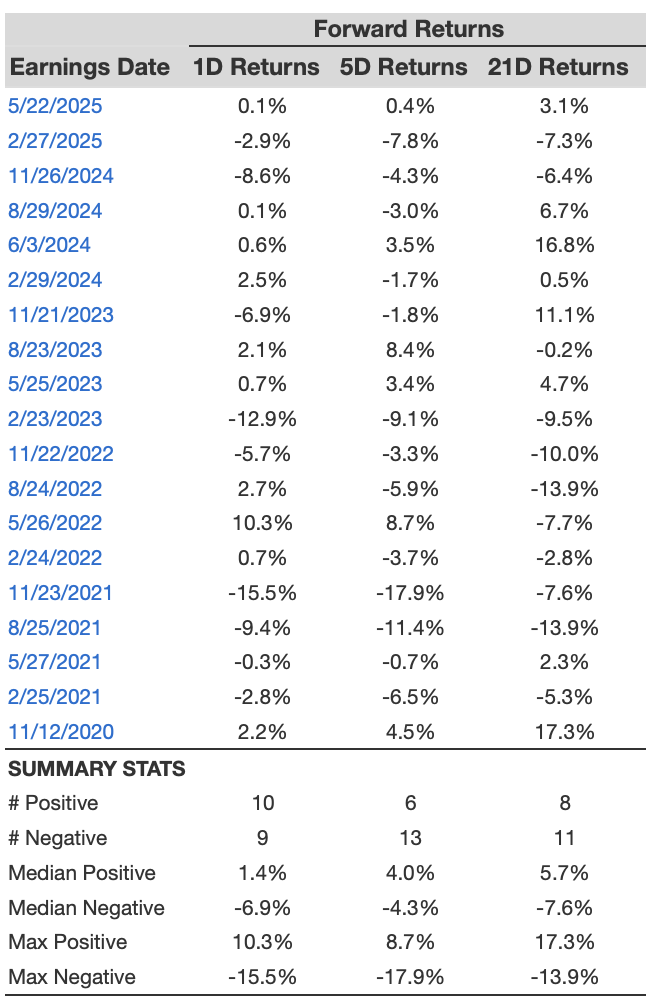

Some observations on one-day (1D) post-earnings returns:

- There are 19 earnings data points recorded over the last five years, with 10 positive and 9 negative one-day (1D) returns observed. In summary, positive 1D returns were seen about 53% of the time.

- Notably, this percentage increases to 55% if we consider data for the last 3 years instead of 5.

- Median of the 10 positive returns = 1.4%, and median of the 9 negative returns = -6.9%

Additional data for observed 5-Day (5D) and 21-Day (21D) returns post earnings are summarized along with the statistics in the table below.

ADSK 1D, 5D, and 21D Post Earnings Return

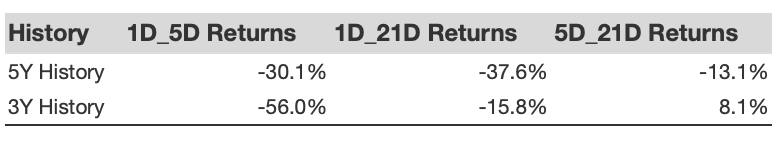

Correlation Between 1D, 5D, and 21D Historical Returns

A relatively less risky strategy (though not useful if the correlation is low) is to understand the correlation between short-term and medium-term returns post earnings, find a pair that has the highest correlation, and execute the appropriate trade. For example, if 1D and 5D show the highest correlation, a trader can position themselves “long” for the next 5 days if the 1D post-earnings return is positive. Here is some correlation data based on a 5-year and a 3-year (more recent) history. Note that the correlation 1D_5D refers to the correlation between 1D post-earnings returns and subsequent 5D returns.

ADSK Correlation Between 1D, 5D, and 21D Historical Returns

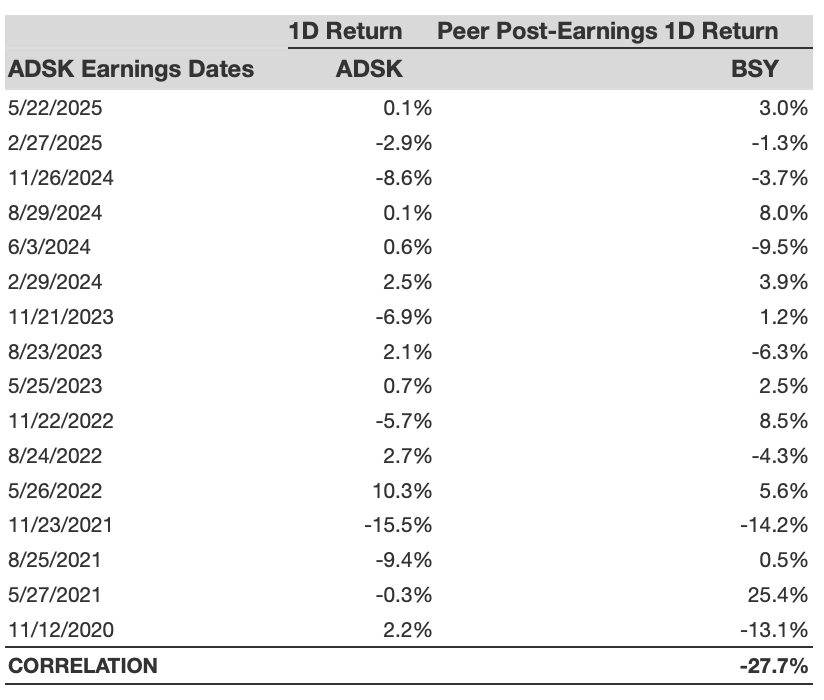

Is There Any Correlation With Peer Earnings?

Sometimes, peer performance can have an influence on post-earnings stock reaction. In fact, the pricing-in might begin before the earnings are announced. Here is some historical data on the past post-earnings performance of Autodesk stock compared with the stock performance of peers that reported earnings just before Autodesk. For fair comparison, peer stock returns also represent post-earnings one-day (1D) returns.

ADSK Correlation With Peer Earnings

Learn more about Trefis RV strategy that has outperformed its all-cap stocks benchmark (combination of all 3, the S&P 500, S&P mid-cap, and Russell 2000), to produce strong returns for investors. Separately, if you want upside with a smoother ride than an individual stock like Autodesk, consider the High Quality portfolio, which has outperformed the S&P and clocked >91% returns since inception.

Invest with Trefis Market-Beating Portfolios

See all Trefis Price Estimates