The State Of The Aluminum Market Validates Alcoa’s Strategic Shift Towards Value-Added Products

Alcoa (NYSE:AA) has announced a $60 million expansion of its R&D center in Pennsylvania, a step aimed at boosting the company’s 3D-printing capabilities, in order to meet the demand for high performance 3D-printed parts, primarily from the aerospace and automotive sectors. [1] This step is a part of a strategic shift of the company’s product portfolio away from its upstream commodity businesses towards its value-added products. Alcoa is seeking to reduce its dependence on its commodity businesses, in the backdrop of weakness and volatility in aluminum pricing. In this article, we will take a look at the current state of the aluminum market, specifically the major reasons for the weakness in pricing, which are steering aluminum producers, such as Alcoa, away from the primary aluminum business.

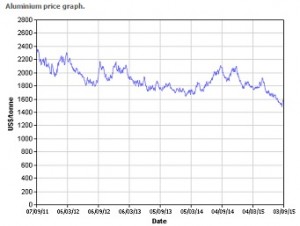

Aluminum Prices

Aluminum prices have been trending downwards over the last few years. In addition, there has been a fresh bout of weakness this year. We will take a look at the reasons for these developments.

Aluminum is a widely used metal in industrial applications. It is an important input in the packaging, aerospace, automotive, construction, commercial transportation, power generation, capital goods, and consumer durables industries. Given the wide scope of application of aluminum, demand for the metal is often broadly considered a proxy for economic growth and more specifically, for industrial growth. China is the world’s largest consumer of aluminum. Slowing economic growth in China, which fell from 9.5% in 2011 to 7.4% in 2014, and economic weakness in Europe, have dampened aluminum demand over the last few years. [2]

Despite the weakness in demand over the past few years, global aluminum supply was not rationalized in response to weak demand conditions. The effect of smelting capacity reductions by global aluminum majors like Alcoa and Rusal was offset by additions to smelting capacity by Chinese companies. Since China accounts for nearly half of the world’s aluminum production, the expansion in production by Chinese producers more than made up for capacity cuts by global majors. [3] State intervention, in the form of provision of subsidies and renegotiated power contracts to smelters, allowed Chinese producers to boost production despite weakness in demand and pricing. Part of the excess production was absorbed by aluminum inventory backed financing deals, which were enabled by low interest rates. [4] These inventory-based financing deals kept LME aluminum inventory at elevated levels over the past few years. Oversupply and high LME inventory levels kept a lid on aluminum prices over the past several quarters.

Rising Chinese exports have worsened the oversupply of aluminum so far this year. In addition to worsening the supply glut, competition from a rising tide of cheap Chinese aluminum exports has driven down global prices of the metal. Chinese aluminum producers were boosted by an announcement of the Chinese government to provide tax breaks and subsidized power to domestic aluminum smelters earlier on in the year. [5] In addition, the Chinese government also cut export taxes on Chinese exports of the metal earlier in the year. [6] A combination of these factors has provided a sharp boost to Chinese exports of aluminum. Chinese aluminum exports are at multi-year highs in the first seven months of 2015, as illustrated by the chart shown below.

If Chinese aluminum production and exports continue growing unabated, aluminum prices are likely to remain weak. Whether, and how soon, the Chinese government removes state support for aluminum production is a difficult question to answer. With economic growth in the world’s largest aluminum consumer continuing to slow, aluminum prices are unlikely to improve significantly.

Alcoa’s Response

The state of the aluminum market has prompted Alcoa to undertake its strategic shift towards value-added products. The contribution of value-added products to Alcoa’s revenues (considering only sales to third parties) has risen from 54.4% in 2012 to 57.7% in the first half of 2015. [7] In addition, Alcoa has curtailed high cost smelting capacity, as it seeks to better align its business to the lower aluminum pricing environment. Alcoa’s smelting capacity currently stands at 3.4 million tons per year (MTPY), as compared to 4.04 MTPY at the end of 2013. [8] Since most of Alcoa’s value-added products are aluminum-based, the company cannot become completely immune to fluctuations in aluminum prices. However, the pricing for these products is less impacted by fluctuations in aluminum prices as compared to that of the company’s primary aluminum shipments. A reduction in the scale of the primary aluminum business and the strategic shift towards value-added products will certainly lessen the company’s dependence on aluminum prices. Given the current state of the aluminum market, this looks like a wise move.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

Notes:

- Alcoa Expands R&D Center to Deepen Additive Manufacturing Capabilities, Alcoa News Release [↩]

- GDP Growth Data, World Bank [↩]

- Global aluminum production; the sound of one hand clapping, Reuters [↩]

- Aluminum Price Premiums: Disconnect Between LME and Reality Continues, Metal Miner [↩]

- China measures set to boost aluminium supply, Financial Times [↩]

- China ends export tax on rare earths and other metals, Financial Times [↩]

- Alcoa’s Q2 2015 Earnings Release, Alcoa Website [↩]

- Alcoa to Close Poços Smelter in Brazil, Alcoa News Release [↩]