Will Western Digital’s Upcoming Earnings Move Its Stock?

Western Digital (NASDAQ: WDC is set to report its fiscal fourth-quarter earnings on Wednesday, July 30, 2025. Analysts project adjusted earnings of $1.48 per share on $2.47 billion in revenue, marking a year-over-year increase of 3% in earnings and a 34% decline in revenue, compared to $1.44 per share and $3.76 billion, respectively, reported in the same quarter last year. Notably, this will be the company’s second earnings release following the successful completion of its planned separation from SanDisk, a strategic move that enables Western Digital to focus exclusively on its core hard disk drive (HDD) business.

Historically, Western Digital’s stock has declined following earnings announcements 53% of the time, with a median one-day loss of 3.1% and a maximum post-earnings decline of 10%. The company has $24 Bil in current market capitalization. Revenue over the last twelve months was $19 Bil, and it was operationally profitable with $2.5 Bil in operating profits and net income of $1.7 Bil.

For event-driven traders, historical performance trends and the discrepancy between actual earnings results and market expectations can offer valuable insights ahead of the upcoming announcement. Traders may adopt one of two primary strategies: positioning in advance of the earnings release by leveraging historical probabilities and consensus forecasts, or responding after the announcement by analyzing how short- and medium-term returns typically correlate with the reported results. That said, if you seek upside with lower volatility than individual stocks, the Trefis High Quality portfolio presents an alternative, having outperformed the S&P 500 and generated returns exceeding 91% since its inception. See earnings reaction history of all stocks.

Image by K. Mishina from Pixabay

- Western Digital vs Seagate Technology: Which Is the Stronger Buy Today?

- With Dell Technologies Stock Up 9.1% in a Day, Is It Time to Compare It Against Western Digital Stock?

- Seagate Technology Stock’s One-Day Drop Offers a Chance to Reevaluate Western Digital Stock

- S&P 500 Movers | Winners: AMD, TSLA, MPWR | Losers: VZ, SBUX, WDC

- WDC Up 23% In A Week. Do You Buy Or Wait?

- WDC Stock Up 23% after 5-Day Win Streak

Western Digital’s Historical Odds Of Positive Post-Earnings Return

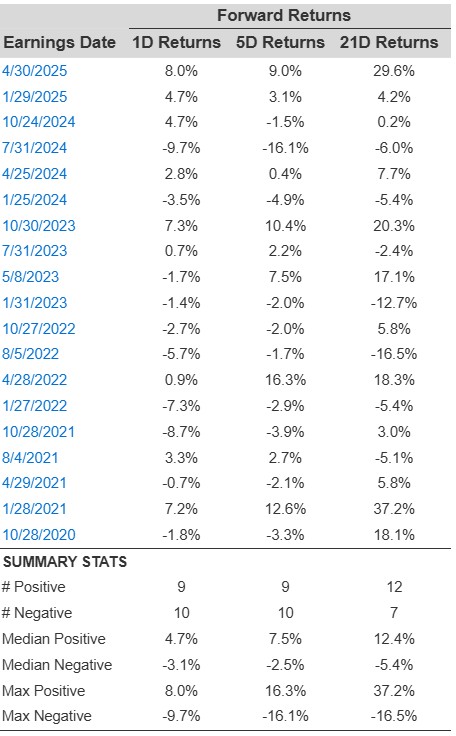

Some observations on one-day (1D) post-earnings returns:

- There are 19 earnings data points recorded over the last five years, with 9 positive and 10 negative one-day (1D) returns observed. In summary, positive 1D returns were seen about 47% of the time.

- Notably, this percentage increases to 50% if we consider data for the last 3 years instead of 5.

- Median of the 9 positive returns = 4.7%, and median of the 10 negative returns = -3.1%

Additional data for observed 5-Day (5D), and 21-Day (21D) returns post earnings are summarized along with the statistics in the table below.

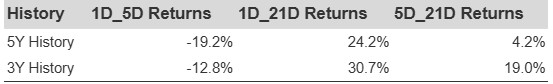

Correlation Between 1D, 5D, and 21D Historical Returns

A relatively less risky strategy (though not useful if the correlation is low) is to understand the correlation between short-term and medium-term returns post earnings, find a pair that has the highest correlation, and execute the appropriate trade. For example, if 1D and 5D show the highest correlation, a trader can position themselves “long” for the next 5 days if 1D post-earnings return is positive. Here is some correlation data based on 5-year and 3-year (more recent) history. Note that the correlation 1D_5D refers to the correlation between 1D post-earnings returns and subsequent 5D returns.

Learn more about Trefis RV strategy that has outperformed its all-cap stocks benchmark (combination of all 3, the S&P 500, S&P mid-cap, and Russell 2000), to produce strong returns for investors.

Invest with Trefis Market-Beating Portfolios