Transaction Volume Growth Continues To Drive Visa’s Results

American financial services company Visa (NYSE: V) reported solid third quarter financial results earlier this week driven by strong payment volume growth globally due to the healthy macro-economic environment. Further, the company’s continued to expand its network of co-branding partners and improving technology to compete in the online payments segment, which complemented its top-line as well as bottom-line growth. Backed by the stronger performance in the first half of fiscal 2018, Visa reiterated its guidance for fiscal 2018, expecting its net revenue to grow in low double digits on a nominal dollar basis.

View our interactive dashboard for Visa and alter the key drivers such as revenue and earnings to visualize the impact on its valuation.

Key Highlights of 3Q’18 Results

- Visa experienced double digit growth in payments volume and processed transactions, which caused its revenue to increase by 15% to $5.2 billion. Further, the growth in cross-border volumes augment its top-line growth. The cross-border volumes rose due to strong growth in Asia, driven by China, India, and Korea, and in Latin America, driven by Brazil.

- As expected, the client incentives were lower due to some contract signing delays. The company expects higher client incentives in the fourth quarter due to these signings.

- Visa bought 13.6 million shares of class A common stock for $1.8 billion during the quarter, leaving $5.8 billion in its share repurchase program as of June 30.

Going Forward

- Visa reiterated its guidance for revenue and profits for the fiscal year 2018. Both net revenue growth (nominal basis) and operating expense growth (adjusted for special items) are expected to be in the low double-digits. Further, the adjusted EPS growth is likely to be in the low 30% range.

- Visa continued to grow its partnerships to enhance its Visa Direct Program. For instance, the company partnered with MoneyGram, the second largest money transfer provider in the world, to deliver domestic and cross-border remittances utilizing debit credentials to receive funds. Further, the company entered into a partnership with Postmates, a logistics company that operates a network of couriers who deliver goods locally, to enable instant payouts to the delivery couriers in their fleet.

- Beginning of fiscal 2019, the company plans to adopt a new revenue recognition standard, which could negatively impact its top-line in the coming fiscal year.

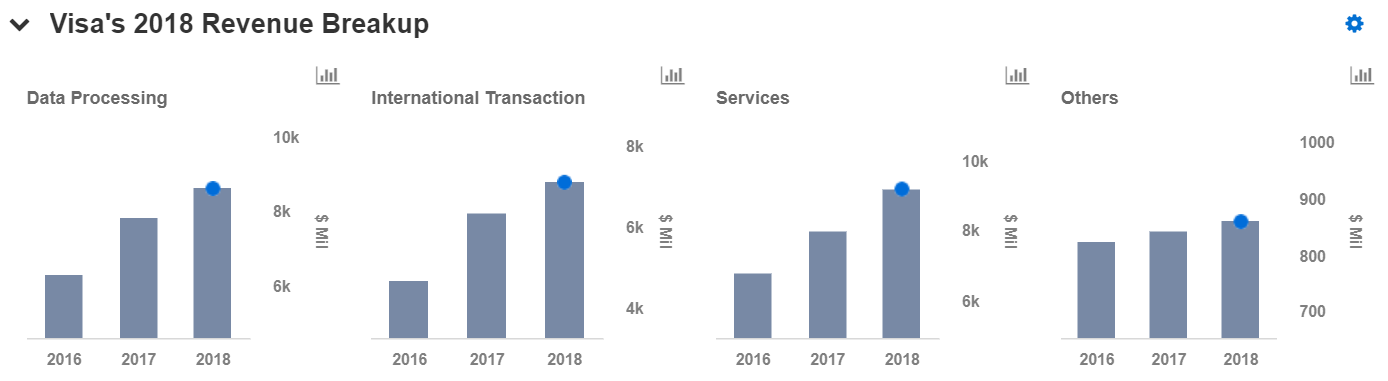

Disagree with our forecasts? Create your own price estimate for Visa by changing the base inputs (blue dots) on our interactive dashboard.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.