How Might Twilio Stock React To Upcoming Earnings?

Twilio (NYSE:TWLO) is set to report its earnings on 13th Feb, 2025 after market close. While a lot will depend on how results stack up against consensus and expectations, understanding historical patterns might just turn odds in your favor if you are an event-driven trader. There are two ways to do that – understand the historical odds and position yourself prior to the event, or look at the correlation between immediate return and medium-term return post earnings and position yourself accordingly post-event.

Twilio’s Historical Odds Of Positive Post-Earnings Return

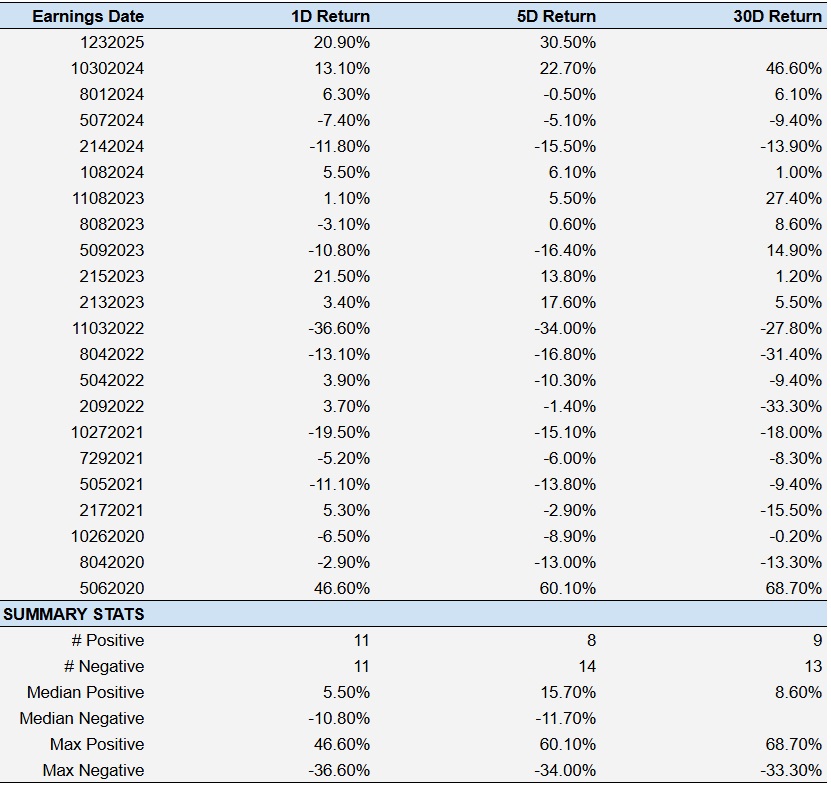

Some observations on one-day (1D) post earnings returns:

- In the past 5 years, 22 earnings data points recorded, with 11 positive and 11 negative one-day (1D) returns observed. In summary, positive 1D returns seen about 50% of the times.

- In fact, this percentage has increased to 57% if we consider last 3 year data instead of 5.

- Median of the 11 positive returns = 5.5%, and median of the 11 negative returns =-11%

Additional data for observed returns 5-days (5D), and 30-days (30D) post earnings are summarized along with the statistics, in the table below:

- The Iran War Trade Investors Are Missing

- Broken Windows: How Microsoft Loses Its AI Premium

- GE Aerospace: Blue-Chip Performance, Red-Line Valuation

- Why Betting Against Amazon Stock In 2022 Was A Mistake

- How To Earn 12% Yield While Waiting to Buy RCL 30% Cheaper

- Where Could The Next Breakout for Applied Materials Stock Come From

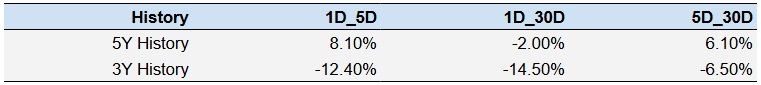

Correlation Between 1D, 5D and 30D Historical Returns

A relatively less risky strategy is to understand correlation between short-term and medium-term returns post earnings, find a pair that has highest correlation and execute appropriate trade. For example, if 1D and 5D show the highest correlation, a trader can position themselves “long” for the next 4 days if 1D post-earnings return is positive. Here is some correlation data based on 5-year and 3-year (more recent) history.

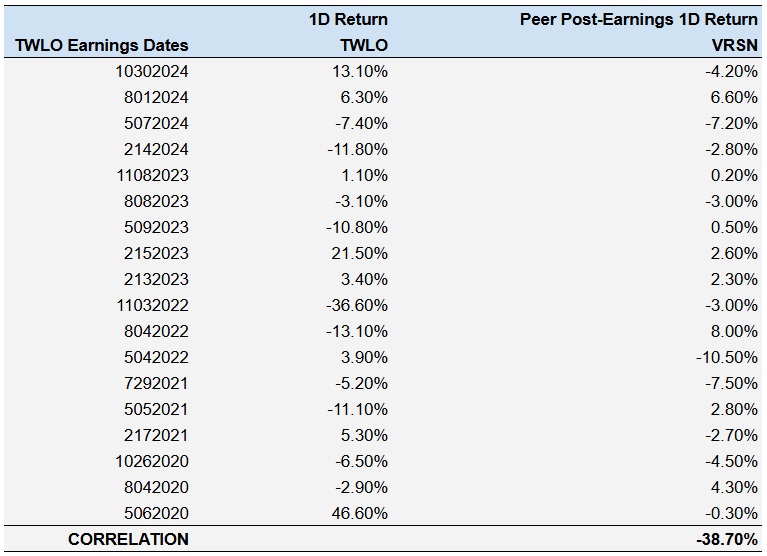

Is There Any Correlation With Peer Earnings?

Sometimes, peer performance can have influence on post-earnings stock-reaction. In fact, the pricing in might begin before the earnings are announced. Here is some historical data on past post-earnings performance of Twilio stock compared with stock performance of peers that reported earnings just prior to Twilio. Peer stock returns are between their earnings report date and TWLO earnings report date.

Learn more about Trefis RV strategy that has outperformed its all-cap stocks benchmark (combination of all 3, the S&P 500, S&P mid-cap, and Russell 2000), to produce strong returns for investors. Separately, if you want upside with a smoother ride than an individual stock like Twilio, consider the High Quality portfolio, which has outperformed the S&P, and clocked > 91% returns since inception.