An Overview Of Seagate’s 2017 Performance

Seagate (NASDAQ:STX) has reported a mixed set of results this year, with revenue declines across major segments. Seagate’s Compute segment and Enterprise Storage segments have under-performed this year, with revenue declines through the year. Comparatively, Client Non-Compute and other revenues partially offset the aforementioned declines. The biggest positive for Seagate this year was the improvement in gross margins driven by an improved sales mix. Seagate’ non-GAAP gross margin for fiscal 2017 ended June was almost 6 percentage points higher than fiscal 2016. Below we take a look at how Seagate’s individual segments performed this year and how the company’s operational efficiency helped improve profitability.

We have a $39 price estimate for Seagate, which is slightly lower than the current market price. Seagate’s stock price has fluctuated between $31 and $50 this year.

[trefis_slideshow ticker=”STX” rhs=”3″]

Trends Across Segments

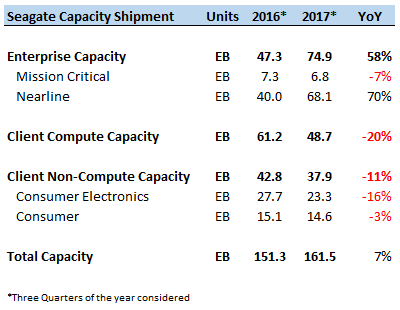

Weakness in the enterprise storage segment has been the prevalent trend over the last few quarters. While the price per unit for enterprise hard disk drives has led to lower revenues, the capacity shipped has consistently grown in recent years. Within enterprise storage, nearline storage has grown considerably while mission critical storage has witnessed somewhat low demand. The nearline enterprise market caters to high capacity storage requirements, particularly in the surveillance, gaming, DVR (TV digital video recording) and NAS (network-attached storage) markets. As shown below, combined enterprise capacity shipments have increased 58% this year, largely driven by nearline storage.

On the other hand, capacity for the client compute and non-compute segments has declined this year, with low demand for consumer storage. This has largely been driven by retail customers transitioning to cloud storage rather than local storage. As evidenced in the table above, the total capacity demand has increased, but the consumer storage segments have faced capacity declines through the year.

- IQOS Helps Philip Morris Navigate Well In Q1

- Down 45% Year To Date, What’s Happening With Sirius Stock?

- Meta Platforms Stock Dropped 10.6% In A Day, What’s Next?

- What Factors Will Drive Pfizer’s Q1 Performance?

- A Rebound In Asia Travel Will Likely Drive Estée Lauder’s Q3 Performance

- Higher Medical Costs Likely Weighed On CVS Health’s Q1 Earnings

In terms of revenues, combined Enterprise Storage revenues fell 12% y-o-y to $3.2 billion for the first three quarters of the calendar year. Similarly, client compute revenues were down 5% to $2 billion for the year.

[trefis_forecast ticker=”STX” driver=”1619″]

Comparatively, Client Non-Compute segment revenues were up 6% over the comparable prior year period to $2.9 billion. Note that this segment includes consumer electronics storage drives, branded hard drives as well as other non-categorized revenues other than revenues from hard drives and solid state drives.

[trefis_forecast ticker=”STX” driver=”1675″]

To offset the revenue pressure, Seagate has reported an improvement in gross profit margins this year. Non-GAAP gross margin improved by over 4 percentage points to 28.8% through the first three quarters of the year, which is within the company’s long term intended margin range of 28-33%. Margins improved due to a favorable product mix and cost savings due to the company’s ongoing workforce reductions and manufacturing consolidation activities.

In addition, the company successfully reduced operating expenses (non-GAAP) by 6% on a y-o-y basis through the first three quarters of the calendar year to just under $1.3 billion. As a result, its operating profit was up 50% over the comparable prior year period to $950 million while its operating margin expanded by 450 basis points. The resulting net income and diluted earnings per share were up in double digits, as shown above.

[trefis_forecast ticker=”STX” driver=”1627″]

Weak Outlook For December Quarter

Seagate’s guided net revenues for the December quarter would imply a decline of around 5% on a year over year basis at $2.74 billion. Additionally, margins are expected to remain to be around 30%. Over the last few quarters, Seagate has managed to restrict the increase in its operating expenses, attributable to improved operating efficiency and workforce reductions. This trend is expected to continue through the end of the year as well. Despite lower operating expenses, the company’s diluted non-GAAP EPS is expected to fall by over 20% over the prior year period to around $1.00 for the December quarter, according to consensus estimates.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research