Sirius XM Stock Appears Attractive At $6 Levels

[Updated: 11/26/21] SIRI Stock Update

Sirius XM (NASDAQ: SIRI) recently reported its Q3 report, wherein revenues and earnings both were in line with our estimates. The company surpassed expectations on the top and bottom lines in its Q3 earnings with reported revenues of $2.2 billion, up 9% year-over-year (y-o-y), and EPS of 8 cents, up 33% y-o-y. It also reported a record 616,000 net new SiriusXM self-pay subscribers in Q3, and raised its full-year guidance after hitting its previous subscriber plan of approximately 1.1 million net additions in just nine months. The company’s operating and net income jumped as operating expenses remained largely flat at $1.6 billion amid the revenue boost. To add to this, the company also announced a 50% boost to its quarterly dividend starting in November.

For the full year 2021, Sirius XM increased its guidance for self-pay net subscriber additions, revenue, adjusted EBITDA, and free cash flow. SIRI has a long history of providing conservative guidance and it typically raises those figures throughout the year as it did in its Q3 report. For the full year, SIRI now expects total revenue of approximately $8.65 billion (up by $150 million from the previous forecast), adjusted EBITDA of $2.75 billion, (up by $80 million from prior estimates), and free cash flow of over $1.8 billion (up $100 million from the prior forecast). We have updated our model following the Q3 release. We now forecast Sirius Revenues to be $8.6 billion for the full year 2021, up 8% y-o-y. Looking at the bottom line, we now forecast EPS to come in at 31 cents, compared to our earlier estimate of 25 cents. Given the changes to our revenues and earnings forecast, we have revised our Sirius XM Valuation at $7 per share, based on $0.31 expected EPS and a 23.1x P/E multiple for fiscal 2021 – almost 15% higher than the current market price. We believe that the company’s stock appears cheap at the current levels.

- Down 45% Year To Date, What’s Happening With Sirius Stock?

- Down 10% Since 2023, Will Sirius Stock Recoup These Losses After Q4 Results?

- What To Expect From Sirius’ Q3 After Stock Down 28% This Year?

- What’s Next For Sirius Stock After A 26% Fall This Year?

- Sirius Q2 Earnings: What Are We Watching?

- What To Expect From Sirius XM’s Stock Post Q1?

[Updated: 10/27/21] Sirius XM Q3 Pre-Earnings

Sirius XM (NASDAQ: SIRI), a leading provider of satellite radio, is scheduled to announce its fiscal third-quarter results on Thursday, October 28. We expect Sirius XM stock to likely trade higher due to better-than-expected Q3 results with revenue and earnings both beating market expectations. The company reported 31.4 million self-pay subscribers (as of June 2021) – who are paying for premium radio despite so many connected cars having access to unlimited free or almost free alternatives. Now that there are more cars on the road – the company expects to add 1.1 million accounts this year. It has already added 355,000 net new self-pay Sirius XM subscribers to its rolls through the first six months of this year, so it expects that pace to accelerate through the final six months of 2021. Sirius XM has a long history of providing conservative guidance for revenue, self-pay net subscriber additions, free cash flow, and adjusted EBITDA. The company typically raises those guidance figures throughout the year as it did in its Q2 report. For the full year, SIRI now expects total revenue of approximately $8.5 billion (up by $200 million from the previous forecast), adjusted EBITDA of $2.67 billion, and free cash flow of $1.7 billion, both up $100 million from prior estimates.

Our forecast indicates that Sirius XM’s valuation is around $7 per share, which is above the current market price of $6. Look at our interactive dashboard analysis on Sirius XM Pre-Earnings: What To Expect in Q3? for more details.

(1) Revenues expected to be slightly above the consensus estimates

Trefis estimates Sirius XM’s Q3 2021 revenues to be around $2.19 Bil, marginally ahead of the consensus estimate. The satellite radio company benefited from strong auto sales and dramatic ad growth in Q2. For context, Sirius XM revenue grew 15% year-over-year (y-o-y) in Q2, driven by a 4% increase in the company’s average revenue per user (ARPU) to $14.57 and a 3% increase in Sirius XM self-pay subscribers. Ad revenue jumped 82% compared to last year and topped 2019 levels by 19%. Overall, the company’s quarterly revenue was up by 9% from where it was two years ago in Q2. In addition, churn was low in Q2, coming in at 1.5%.

(2) EPS likely to beat consensus estimates marginally

Sirius XM’s Q3 2021 earnings per share (EPS) is expected to be 8 cents as per Trefis analysis, higher than the consensus estimate of 7 cents. In Q2, the company’s net income grew 75% y-o-y and rose 11% higher from the pre-pandemic quarter. This growth was higher on a per-share basis to almost a 2x growth y-o-y to $0.10, as a result of Sirius XM’s aggressive buybacks.

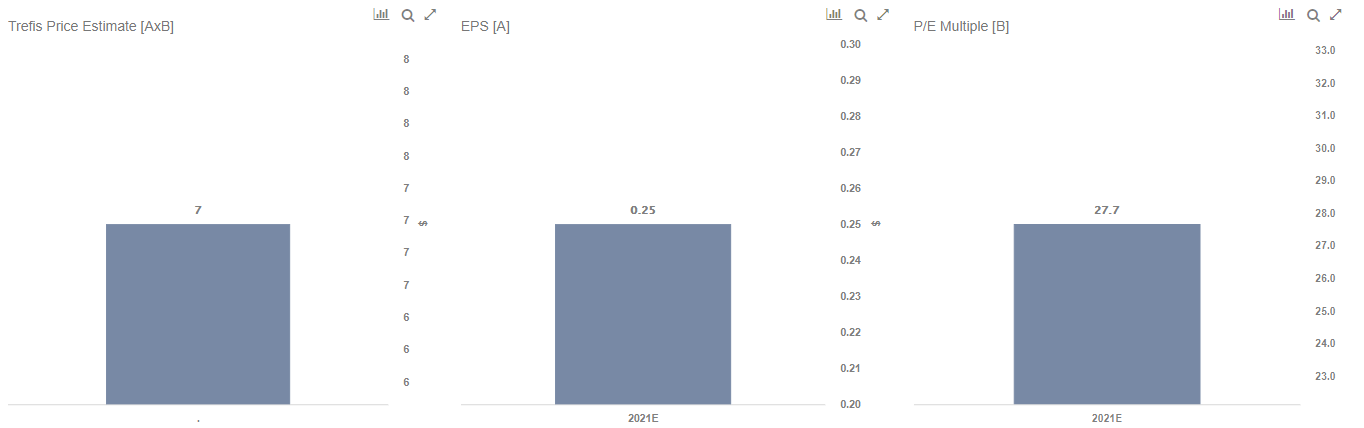

For the full year, we expect Sirius’ net margin to grow to 12.8% in fiscal 2021 from a mere 1.6% in 2020. This coupled with an 8% growth in Sirius XM revenues, could lead to a rise of $1 billion y-o-y in net income to $1.1 billion in 2021. All this could result in a possible EPS increase from $0.03 in FY 2020 to around $0.25 in FY 2021.

(3) Stock price estimate higher than the current market price

Going by our Sirius XM’s Valuation, with an EPS estimate of around 25 cents and P/E multiple of around 28x in fiscal 2021, this translates into a price of almost $7, which is 15% ahead of the current market price of $6.

Note: P/E Multiples are based on Share Price at the end of the year, and reported (or expected) Adjusted Earnings for the full year

It is helpful to see how its peers stack up. SIRI Stock Comparison With Peers shows how Sirius XM compares against peers on metrics that matter.

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio that’s beaten the market consistently since the end of 2016.

| Returns | Nov 2021 MTD [1] |

2021 YTD [1] |

2017-21 Total [2] |

| SIRI Return | 4% | -3% | 40% |

| S&P 500 Return | 3% | 25% | 110% |

| Trefis MS Portfolio Return | -2% | 49% | 304% |

[1] Month-to-date and year-to-date as of 11/25/2021

[2] Cumulative total returns since 2017