Growing Demand For Smokeless Products To Drive Altria’s Performance In The Fourth Quarter

Altria Group Inc. (NYSE: MO), one of the largest tobacco corporations in the world, will release its fourth quarter 2018 results on January 31, 2019. The market expects the company to report net revenue (net of excise) of $4.82 billion, 2.3% higher on a year-on-year basis. Adjusted earnings for the quarter are expected to be $0.95 per share compared to $0.91 per share a year ago. The higher EPS is likely to be the result of higher prices of tobacco products, as well as growth in the smokeless products segment, and better premium-mix in the wine category.

We have a price estimate of $61.65 per share for the company, which is higher than its current market price. Our detailed estimates for Altria’s key drivers that impact its price estimate are available in our interactive dashboard – How Will Altria Group Inc End 2018? You can make changes to our assumptions to arrive at your own price estimate for the company.

- What’s Next For Altria Stock After A 15% Fall In A Year?

- What’s Next For Altria Stock After A 6% Fall In A Month Amid Downbeat Q3?

- Is Boston Scientific A Better Pick Over Altria Stock?

- Will Altria Stock Rebound To Its 2022 Highs?

- Here’s What To Expect From Altria’s Q1

- Should You Buy Altria Stock At $44?

Key Factors Affecting Q4 Results

- Decline in smokeable product segment: As the young generation is not taking to cigarettes in a large number, the demand for combustible products has seen a steady decline in the US in recent times. This is reflected in a 6.3% year-on-year decline in domestic cigarettes shipment volume for nine months ended Sept 30, 2018. During the same period, domestic cigarette industry volumes declined by 4.5% over the previous year period. We expect this trend to continue in Q4 2018 as well, with revenue for the segment coming in at $5.5 billion, marking an 8.8% sequential decline, whereas it would be 4.2% higher on a year-on-year basis due to higher prices and lower excise pay out.

- Marlboro brand: Altria’s Marlboro brand continues to be the number one brand in the US, with a 43.2% share in the country’s tobacco market. The addictive nature of cigarettes reduces the price elasticity of the product. Though Marlboro’s retail share declined by 30 basis points to 43.2% in Q3 2018 due to the continuing effects of the California tax, Altria as a company had a 50.2% market share in the cigarette market during the same period. Given Marlboro’s market share, it is less vulnerable to price hikes than other brands. This would help the company grow despite a decline in volume of cigarettes sold.

- Increased focus on smokeless segment: Due to a decline in the smoking rate in the US, Altria has made a serious effort to increase its share in the smokeless category. Additional focus on e-cigarettes and other non-combustible products has led to more diversity in the company’s offerings. As a result, the share of the smokeable segment in Altria’s revenues has fallen considerably, from 91.0% in 2010 to 86.5% in 2017. On the other hand, the share of its smokeless segment has increased from just 6.0% in 2010 to 10.0% in 2017. The company’s recent major investment decisions (Cronos and JUUL) would help Altria increase the share of smokeless products even further and lead to higher and stable revenue growth.

- Growth in Wine segment: Net revenues from wine increased by 3.8% in the first nine months of 2018. This was mainly driven by higher shipment volume and favorable premium mix. We expect the trend to continue going forward. The fourth quarter is generally considered to be the best quarter for the segment because of the holiday season, Christmas and New Year festivities. This is expected to lead to a 11% growth in revenues from this segment on a year-on-year basis.

Outlook for FY 2018

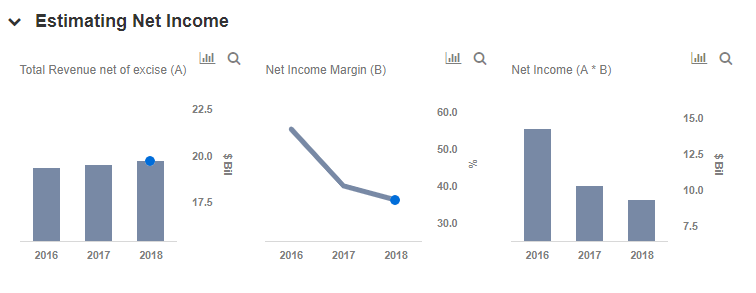

For the full year 2018, we expect revenues (net of excise) to increase to $19.7 billion, 1.1% higher than the $19.5 billion in 2017. This would primarily be driven by an 8.4% increase in the smokeless category on the back of higher shipments and prices, as demand from young adults for products from this category increases. Revenue from wine is also expected to rise by about 6.1% due to higher volumes, premium pricing, and a stronger Q4 because of the holiday season, Christmas and New Year festivities. However, the smokeable products segment, which contributes the most to Altria’s revenues, is expected to remain flat for the year due to lower demand and decreasing shipment volume.

Altria’s net income margin is expected to decline to 36.1% in 2018 from 40.0% in 2017. The Smokeable products segment would see margins being flat on a year-on year basis due to lower shipment volume, higher costs related to strategic initiatives, and increased tobacco and health litigation expenses, slightly offset by higher pricing. Smokeless products segment would contribute the most to margins due to better pricing, higher volumes, and lower costs achieved through consolidation of facilities. The Wine segment is expected to drive net margins for the company lower in 2018. Wine will likely witness a significant decline in margins primarily due to higher general and administrative expenses owing to one-time employee bonuses declared during the year.

Support for stock price

In Q3 2018, Altria announced two major investment decisions which would provide long-term benefits to the company. Altria announced the acquisition of a 45% equity stake in Cronos Group, a leading global cannabinoid company. This comes at a time when interest in marijuana is soaring among young adults, amid legalization of recreational marijuana in multiple U.S. states and in Canada, as well as an increasing use of cannabis for medicinal purposes. In December 2018, Altria also announced its decision to acquire 35% in JUUL Labs Inc. A 35% stake in a company that represents ~30% of the total US e-vapor category, will help Altria complement its non-combustible offerings in the smokeless category. Along with its investment in Cronos group, Altria’s investment in JUUL is expected to strengthen its financial profile and enhance future growth prospects. Altria has also initiated a cost reduction program to save costs of around $500-$600 million annually by the end of 2019, by reducing third-party spending across the business and workforce reductions, which would likely drive margins higher in 2019.

2018 saw Altria increase its overall quarterly dividend rate by 21.2% since the beginning of the year. The current annualized dividend rate has increased to $3.20 per share. Additionally, the $1.0 billion share repurchase program announced in January 2018 has been doubled to $2.0 billion in May 2018. Altria repurchased shares worth close to $1.3 billion in the first nine months of 2018. Thus, we believe that the two major strategic investment decisions (Cronos and JUUL) along with an enhanced dividend pay out and share repurchases, would provide a good support for Altria’s stock price going forward.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.