What Is The Key Factor That Will Drive Medical Marijuana Producer Aphria’s Value Going Forward?

As Canada comes close to legalizing recreational marijuana, cannabis stocks have witnessed a sudden surge in their valuation. Despite the vast upside opportunity for pot stocks, the opening up of the recreational marijuana market may be faced with regulatory hardships, just like the tobacco industry. However, the investors seem to be positive about these stocks, hoping these stocks replicate the growth trajectory of tobacco stocks, such as Philip Morris and Altria. This trend has been witnessed lately with Aphria Inc. (TSX:APH), a low cost of producer of medicinal marijuana in Canada, gaining momentum over the last one month.

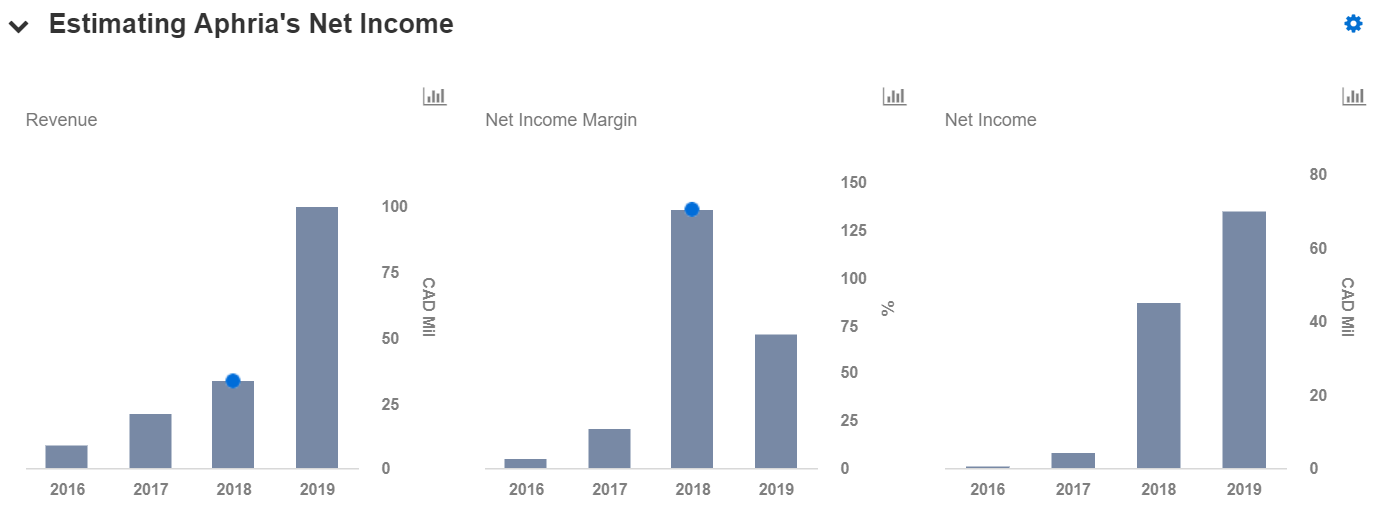

In our previous analysis – Here’s Why We Believe That Medical Marijuana Stock Aphria Is Undervalued – we had talked about how we think that Aphria is undervalued compared to its peers based on a Price/Sales multiple basis. In this note, we aim to discuss the key driver that will drive its value going forward. You can view our valuation for the company on our interactive dashboard and create scenarios to suit your assumptions.

- What’s Next For Altria Stock After A 15% Fall In A Year?

- What’s Next For Altria Stock After A 6% Fall In A Month Amid Downbeat Q3?

- Is Boston Scientific A Better Pick Over Altria Stock?

- Will Altria Stock Rebound To Its 2022 Highs?

- Here’s What To Expect From Altria’s Q1

- Should You Buy Altria Stock At $44?

International Expansion Will Drive Top Line Growth

Australia

As more and more companies are legalizing the medical use of marijuana, Aphria has aggressively entered into partnerships and joint ventures to supply its output to these international markets in the last couple of months. For instance, the Canadian company completed its first shipment of medical cannabis to its Australia-based partner Althea in late April of this year. The initial shipment, which is the first of the four shipments due in the next 12 months, included a mix of cannabis oil products and dried flower, which will be distributed to pharmacies for eligible medical cannabis patients in Australia. Australia serves to be a strategic market for Aphria and its branded cannabis products, and is expected to bolster its sales in the coming months.

Africa

Apart from Australia, Aphria also has plans to capture the South African market, since it has a vast potential for growth in the long term. Consequently, the company entered into a joint venture with South African company Verve Group of Companies (VGC) to form a new entity known as CannInvest Africa Ltd. The newly formed entity will acquire an interest in Verve Dynamics (Verve), which is a licensed producer of medical cannabis extracts in Lesotho, for a sum of CAD 4.05 million. With Verve Group’s resources and Aphria’s expertise and low cost of production, Verve will be able to supply high-grade low-cost cannabis isolates throughout the African continent and to markets across the globe using Aphria’s international distribution network. Wider reach in newer markets will boost Verve’s revenue and, in turn, complement Aphria’s valuation.

Do not agree with our forecast? Create your own price forecast for Aphria by changing the base inputs (blue dots) on our interactive platform.