Groupon Q4 Earnings: Key Takeaways

Groupon (NASDAQ:GRPN) reported its Q4 earnings on February 12. The company’s struggles in transitioning its business model from a coupon company to a full-fledged marketplace appear to have continued, with a decline in units sold. Despite reporting a higher than expected revenue number, the company’s earnings came in below consensus estimates. We note lower traffic and a focus on gross margins are likely to put some pressure on the company’s business.

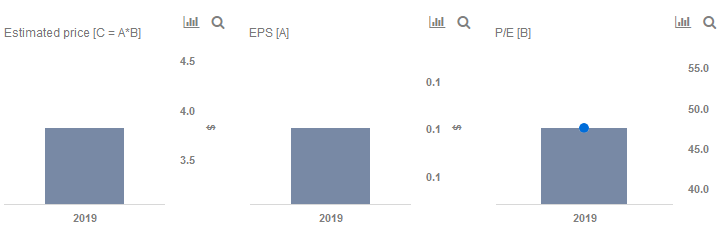

Our interactive dashboard on Groupon’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation, and see all of our Internet and Technology company data here.

- Is Groupon’s Stock Attractive At $21?

- Does Groupon Have Upside Once Pandemic Subsides?

- Why A Groupon-Yelp Deal Is A Bad Idea

- Groupon’s Presence AI Acquisition Is A Good Deal If It Didn’t Cost More Than $350 Million

- Groupon’s Q1 Weakness Likely To Remain In Q2, But The Outlook For The Year Isn’t All Bad

- What To Watch For In Groupon’s Q4 Earnings

Overview Of Q4 Earnings

In North America, Groupon’s Local gross profit declined to $180 million (-9% y-o-y) in the quarter due to lower traffic, while Goods gross profit increased to $56 million (+2% y-o-y) and Travel gross profit declined to $12 million (-13% y-o-y). Active customers at the end of quarter declined to 30.6 million (-6% y-o-y), while the number of units sold declined 13% y-o-y.

In the International business, gross profit declined to $119 million (-3% y-o-y) due to FX headwinds. On a currency neutral basis, gross profit was up 1% y-o-y. Meanwhile, active customers at the end of quarter stood at 17.6 million (+5% y-o-y) and the number of units sold grew 3% y-o-y.

Groupon’s management’s guidance of flat EBITDA growth to $270 million further points to potential headwinds until the company’s transition is complete. While the company also witnessed a marginal decline (-2% y-o-y) in its marketing expenses, and its SG&A expenses have also trended down (-13% y-o-y), the key issue appears to be the global unit decline to 51 million units (-8% y-o-y).

We note that the company faces an uphill task in ramping up lower-margin, higher-volume marketplace customers in favor of its traditional audience of higher-margin, lower-volume coupon customers. Not only does this transition necessitate a fundamental change in the company’s unit economics, but also requires significant investments on the platform side.

Do not agree with our forecast? Create your own price forecast for the Groupon by changing the base inputs (blue dots) on our interactive dashboard.

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

All Trefis Data

Like our charts? Explore example interactive dashboards and create your own