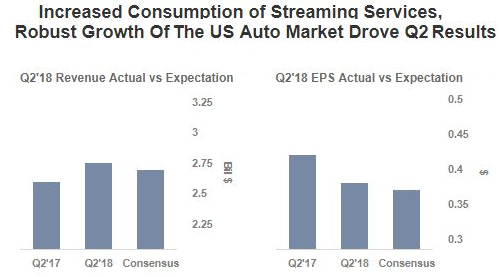

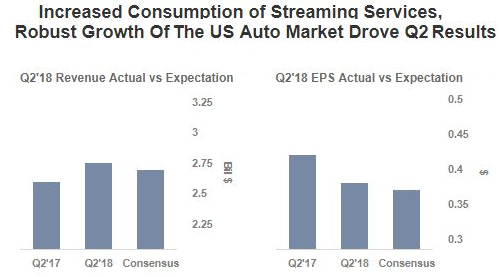

Corning (NASDAQ: GLW) announced its Q2 earnings on July 25, beating both revenue and earnings estimates. The company reported a solid 10% increase in revenues to just under $2.75 billion. Much of the revenue growth came from its Optical Communications segment, as a result of increased demand for its products by data center and carrier businesses. Optical Communications revenue was up 16% year-on-year to just over $1 billion, forming nearly 37% of the company’s net revenues. In addition, Environmental Technologies segment was the fastest growing segment, with a 21% year-on-year increase in revenues to $317 million. Further, higher shipments of Gorilla Glass drove better than expected Specialty Materials results, with a 2% year-on-year increase in revenues to $343 million. A noteworthy highlight in the Q2 earnings was the recovery of its Display Technologies segment, as a result of

improved LCD pricing environment and ramp up of Gen 10.5 plant. Increased consumption of streaming services,

robust growth in the U.S. auto market, and

improvement of the heavy-duty truck market in North America should drive the company’s full year results. Below, we provide a brief overview of the company’s results and what lies ahead.

Factors That May Have An Impact In The Upcoming Quarters

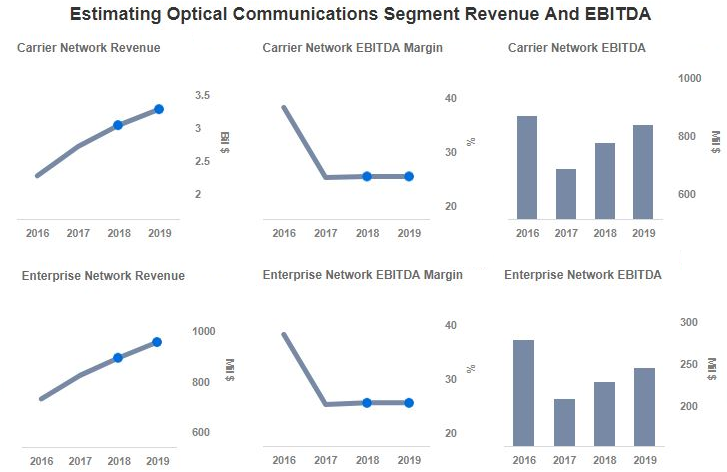

The Optical Communications segment continued its strong performance in Q2, as margins improved as a result of increased demand for Corning products by data center and carrier businesses. This was largely driven by increased consumption of streaming and cloud services. Corning is one of the

leading players in the Optical Communications segment and is well-positioned to increase its share over time. In addition, the acquisition of 3M’s Communication Markets Division, which is likely to expand both its global reach and portfolio, should provide for reasonable growth opportunities in the upcoming quarters and provide for significant long-term growth opportunities. The Optical Communications segment holds substantial growth potential for Corning as a result of robust growth in the amount of data being transmitted and processed.

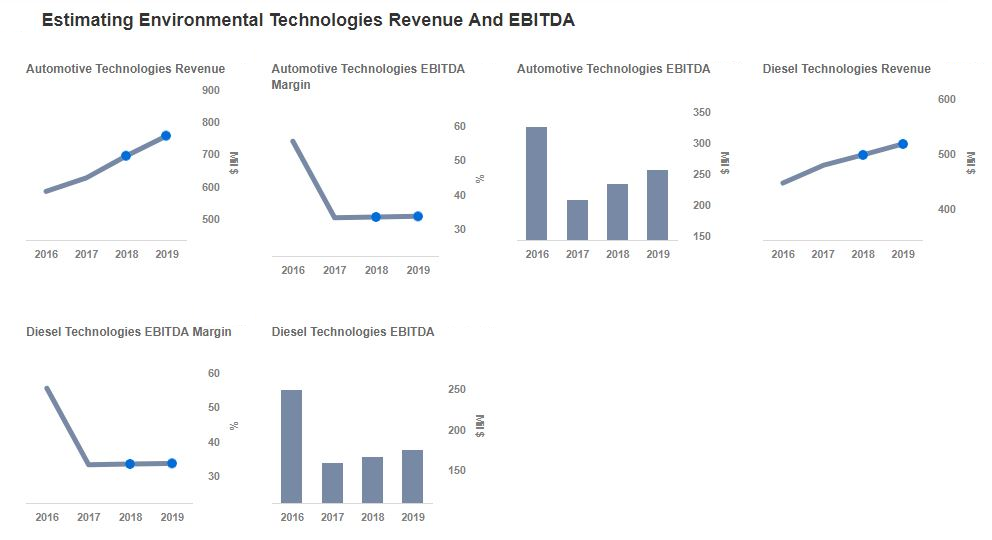

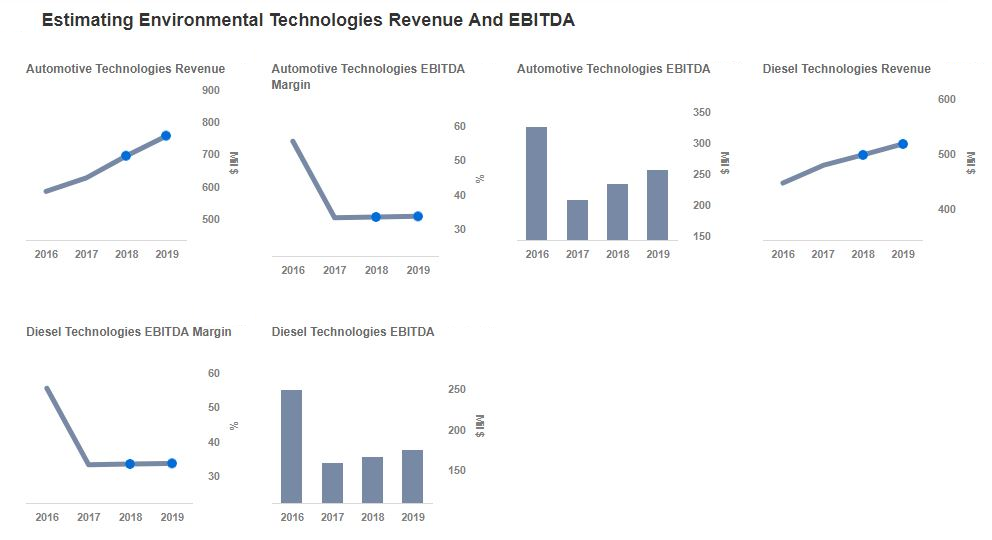

The Environmental Technologies segment continued its robust showing in Q2, as a result of increased demand for Corning’s gas particulate filters (GPF’s). This was largely driven by the continued strength in the auto market in the U.S. and

improvement of the heavy-duty truck market in North America. As a result, we expect strong demand for Corning’s gas particulate filters (GPF’s) as auto OEMs ramp up for full adoption of EURO VI emission standards and as governments look to tighten emission standards. This should drive its Environmental Technologies segment.

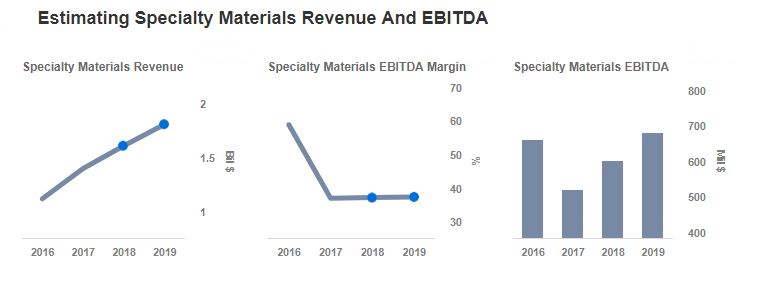

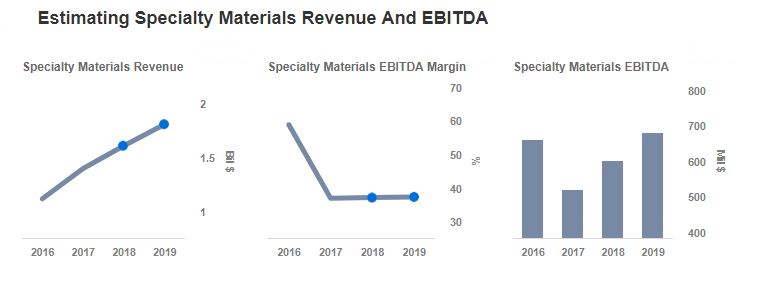

The Specialty Materials segment performed better than expected in Q2, as a result of higher shipments of Gorilla Glass. With the launch of

Gorilla Glass 6, coupled with the

anticipated launch of several new smartphones later this year, should provide for significant growth opportunities in the second half of 2018. Further, Corning’s introduction of Gorilla Glass DX and DX+ into the wearables market should further boost the sales from this segment.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs