What Is Deutsche Bank’s Fundamental Value Based On 2019 Results?

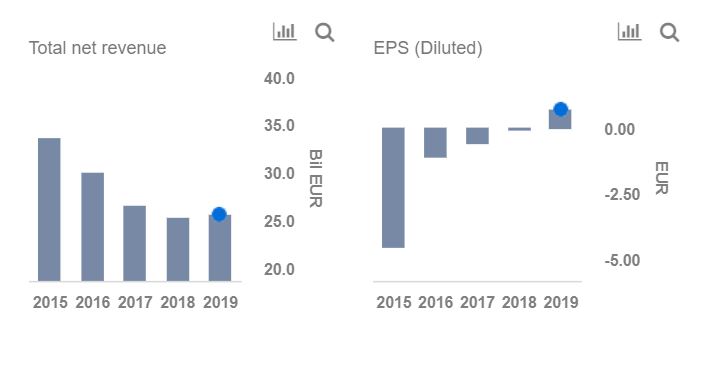

Deutsche Bank (NYSE:DB) delivered its first annual net profit of €340 million since 2014, but the bank’s share price continued to fall, hitting record lows on numerous occasions in 2018. The bank’s annual revenue declined for the third consecutive year, reaching its lowest level since the 2008 financial crisis. However, the bank remained on course to achieve its primary objective of cutting down costs (the bank’s operating expenses have declined by approximately 40% since 2015).

We anticipate the bank to achieve minimal revenue growth in 2019, though it will continue to cut down its operating expenses. Geopolitical risks, slowing economic momentum, receding global central bank liquidity, and gently rising interest rates are likely to adversely impact the bank’s revenues across all operating divisions. Increased volatility in the financial markets is likely to have an increasing impact on consumer and corporate behavior. This in turn will negatively impact the bank’s Investment Banking revenues, constituting approximately 37% of bank’s total revenues. We currently have a price estimate of $9 per share for DB, which is similar to the current market price. We have summarized our full year expectations for DB, based on the company’s guidance and our own estimates, on our interactive dashboard Is DB Fairly Valued?. You can modify any of our key drivers to gauge the impact changes would have on its valuation, and see all Trefis Financial Services company data here.

Impact of Uncertain Macroeconomic Environment

Geopolitical risks, and lower liquidity as many central banks slowly tighten monetary policy, will keep markets jittery, leading to moderation of growth, but a large-scale collapse remains unlikely. Uncertainty around the escalation of trade disputes resulting in higher tariffs and Brexit uncertainty, in addition to other macro uncertainty, will continue to impact the global economy, leading to reduced client activity and poor investment sentiment. Deutsche Bank’s Investment Banking revenues tumbled by 30% in Q4 2018, and uncertainty in the macroeconomic environment is further expected to adversely impact these revenues. The bank’s Debt Origination fees tanked by approximately 19% in 2018, resulting in its share of the global debt origination industry shrinking from nearly 7% over 2011-13 to just 3% for full-year 2018 (as reported by Thomson Reuters) and we do not expect the bank to recover and reach its historically high levels in the near term.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own.