Revenues For Credit Suisse’s Wealth Management Business Could Cross $10 Billion In Five Years

Credit Suisse (NYSE:CS) has transformed itself business model over the last decade from one that depended primarily on capital-intensive investment banking operations to one that is anchored around its cornerstone wealth management business. After the recession, Credit Suisse shifted its focus away from the highly volatile securities trading business. Besides stricter regulation, economic uncertainty, widening of credit spread and low capital market volatility forced the bank to reduce its emphasis on investment banking. In 2015, Credit Suisse began work on a 3-year restructuring plan to focus on wealth management, and the plan has yielded strong results for the Swiss banking giant over recent years.

Trefis has summarized the changes in the bank’s wealth management business in its interactive dashboard – How Has Credit Suisse’s Wealth Management Business Changed Over The Last 10 Years, And What’s The Forecast Over The Next 5 Years? Additionally, you can see more Trefis data for financial services companies here.

How Has Credit Suisse’s Revenue Composition Changed Over The Last Decade And What’s The Forecast?

- 2007: Before the financial crisis of 2008, Trading Revenues contributed around 35% to Credit Suisse’s total revenues while the contribution of Wealth Management was roughly 30%.

- 2011: WM’s contribution remained stable while the contribution of Trading revenues fell to 30% of total revenues.

- 2015: Although the contribution of trading revenues increased to 35%, the bank had begun its restructuring plan. By 2016, Wealth Management’s contribution increased to 40% while trading revenues were reduced to 29%.

- 2018: Wealth management now accounts for almost 41% of Credit Suisse’s total revenues while Trading division’s contribution has been reduced to just 24%.

- Trefis projects this contribution to remain stable around 40% over coming years.

- What To Expect From Credit Suisse Stock?

- What To Expect From Credit Suisse Stock?

- Where Is Credit Suisse Stock Headed?

- Credit Suisse Stock Missed The Street Expectations In Q3, What To Expect?

- Is Credit Suisse Stock Attractive At The Current Levels?

- Credit Suisse Stock Lost 21% Last Week, What’s Next?

How Has Credit Suisse’s Wealth Management Business Evolved Since The Economic Downturn?

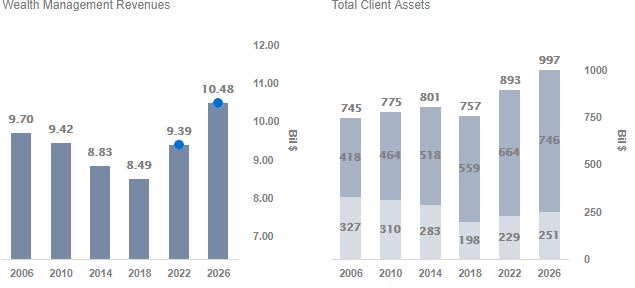

- An increase in the number of high net-worth individuals as well as an increase in their assets helped Credit Suisse increase its Client Assets from around $682 billion in 2012 to over $757 billion in 2018 (despite the negative impact of lower asset valuations on the asset base in December 2018).

- Additionally, Credit Suisse has increased its foothold in the Asia-Pacific region over the last decade, as wealth for Asian citizens grew at a faster pace than their counterparts globally. This helped contribution of International Clients (excluding Switzerland) increase from just under 60% in 2010 to almost 74% in 2018.

- Credit Suisse’s wealth management fees as have declined gradually over the last decade as a percentage of its client assets. This was primarily because an increase in asset base has been accompanied by a smaller increase in revenues.

- The fee pressure is understandable, given increasing competition in the global wealth management industry. Trefis expects the average fee figure as a % of client assets to continue to decrease gradually over coming years.

How Do Changes In Credit Suisse’s Wealth Management Business Compare With That For Peers?

- As detailed above, Credit Suisse’s focus on its wealth management business since the economic downturn has helped its contribution to total revenues increase from around 31% in 2010 to more than 40% in 2018.

- Its Swiss counterpart, UBS, also doubled down on its wealth management business after the economic downturn. Notably, UBS’s wealth management business now contributes more than 55% of its total revenues as compared to around 40% in 2010

- However, the largest American bank JPMorgan has a much more diversified business model and has been able to achieve growth on all fronts since the downturn – especially since it added Bear Stearns investment banking operations to its own in 2009. As a result, contribution of its Wealth Management business to its total revenues has largely remained stable around 12% over recent years

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.