Bank of America’s Generous Capital Return Plan Indicates A Payout Ratio Exceeding 100% For 2019

Bank of America (NYSE:BAC) recently announced plans to return $37 billion to its shareholders over the next twelve months, which is in line with the investor expectations after the latest round of the Fed’s annual stress test released last week. Trefis has analyzed the trends in Bank of America’s dividend payouts and share repurchases over the last 5 years and has summarized our expectations for the next three. You can modify Trefis forecasts to see the impact any changes would have on the Bank of America’s key metrics. Additionally, you can also see more Trefis data for financial services companies here.

Capital Return Plan (2019)

- Under the new plan, Bank of America will hike its quarterly dividends by 20% – from 15 cents now to 18 cents a share beginning Q3 2019. This works out to total dividends of $6.1 billion assuming average outstanding shares of 8.5 billion.

- The bank will also repurchase $30 billion worth of its common shares over the next twelve months (excluding the additional $0.9 billion in share repurchases to offset an increase in shares from its stock-based employee compensation plan).

- The latest capital return plan of $37 billion over Q3 2019-Q2 2020 represents a 42% jump compared to the $26 billion in dividends and share repurchases Bank of America announced in 2018. Further, it would be the highest ever payout for the bank over a twelve month period.

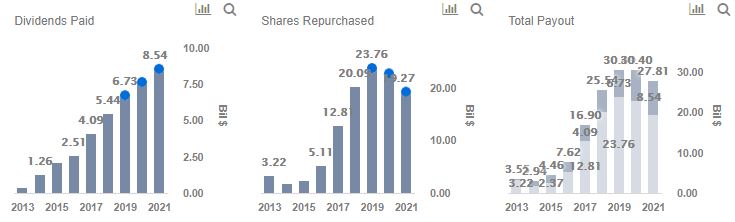

The chart below details Bank of America’s total shareholder payouts for each year since 2013, and includes our forecast for the next three years.

- Trailing S&P500 by 26% Since The Start Of 2023, What To Expect From Bank of America Stock?

- Bank of America Stock Has An 83% Upside To Its Pre-Inflation Shock

- Bank of America Stock Is Trading Below Its Intrinsic Value

- Bank of America Stock Is Trading Below Its Intrinsic Value

- Is Bank Of America Stock Undervalued?

- Is Bank of America Stock Fairly Priced?

Historical Payouts

- Over the 2005-07 period, Bank of America paid generous dividends to its common stockholders (averaging $9.3 billion), and also bought back shares worth an average of $8 billion each year.

- However, the economic downturn and the added burden from the acquisitions of Countrywide and Merrill Lynch, forced the bank to slash dividends to less than $2 billion a year over 2009-13 – having to wait for five years before it could begin distributing any meaningful amount of cash to investors.

- Although quarterly dividends increased in 2014 from 1-cent to 5-cents per share, a calculation error in its CCAR submission that year resulted in the Fed restricting the bank’s share buybacks.

- While dividends were flat in 2015, share buybacks helped the total payout figure reach almost $4.5 billion.

- A sequential increase in dividends to 12 cents a share and bigger share repurchase programs helped total payout swell to $16.9 billion in 2017.

- The same trend continued in 2018 with 53% increase in share repurchase and dividend leading to total payout of $26 billion with $0.15 as quarterly dividend.

- Further, we expect the dividend will be 18 cents per share over Q3 2019 – Q2 2020.

Over the last ten years, Bank of America has returned $62.6 billion in cash to common shareholders, an average of $6.3 billion a year – representing about 74% of its average retained earnings of $8.5 billion for this period. The total dividend payout over this period has been around $17.4 billion, while share buybacks have cost the bank $45.3 billion.

What To Expect In 2019

- We expect total dividends to be around $6.7 billion, as the annual dividend per share will increase to 72 cents from 54 cents in 2018. Also, the bank repurchased $6.3 billion in shares in Q1 2019 and has further declared to repurchase $2.5 billion in shares by second quarter.

- Taken together with $15 billion in proposed purchases for the rest of the year (half of the total proposed repurchases of $30 billion), total share repurchases is expected to be around $23.8 billion in 2019.

- The total payout for the year is, therefore, likely to be over $30.5 billion – exceeding our forecast for the bank’s net income ($28.6 billion) by 7%. This should also make 2019 the best year for Bank of America’s investors in terms of total payout, as it easily surpasses the $25.5 billion in dividends and buybacks in 2018.

We factor in these payouts in our analysis of Bank of America in the form of an adjusted payout rate (which is the total payout ratio), shown in the chart below.

Do not agree with our forecast? Create your own forecast for Bank of America by changing the base inputs (blue dots) on our interactive dashboard.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams| Product, R&D, and Marketing Teams

All Trefis Data

Like our charts? Explore example interactive dashboards and create your own