Largest U.S. Banks Captured Over 36% Of Global Equity Capital Market In Q3

There was a visible decline in the volume of global equity capital market deals over Q3 2017 compared to Q2 2017 – something that can be partially attributed to the fact that the third quarter is a seasonally weak period, and partially to the fact that Q2 2017 figures were unusually upbeat after the slump seen over most of 2016. But that did not deter the five largest U.S. banks from increasing their market share to over 36% in Q3 – the highest in ten quarters. Notably, the average market share for these banks over the first nine months of 2017 (35.7%) is well above the figure of below 32% for full-year 2016.

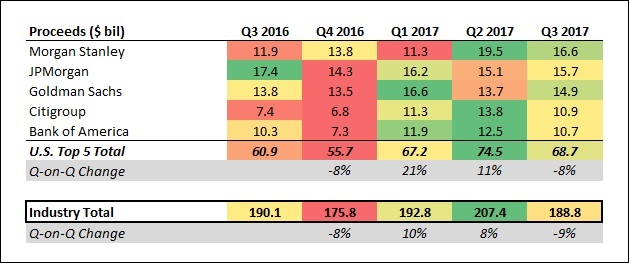

The chart below captures the total size of equity capital market deals completed by the five largest U.S. investment banks since Q3 2016. The green-to-red shading for figures along a row show the variations in deal size for a particular bank over this period.

- Trailing S&P500 by 26% Since The Start Of 2023, What To Expect From Bank of America Stock?

- Bank of America Stock Has An 83% Upside To Its Pre-Inflation Shock

- Bank of America Stock Is Trading Below Its Intrinsic Value

- Bank of America Stock Is Trading Below Its Intrinsic Value

- Is Bank Of America Stock Undervalued?

- Is Bank of America Stock Fairly Priced?

Equity underwriting volumes for individual banks were taken from Thomson Reuters’ investment banking league tables for the last five quarters. The table below captures the respective market shares for each of these banks over this period. The green-to-yellow shading for figures in a quarter should help compare the relative standings of these 5 banking giants in a particular quarter.

It should be noted that the largest equity capital market deals (IPOs and FPOs) employ more than one investment bank, so the market share figures are not exclusive.

Notably, the five largest U.S. investment banks have captured the top five ranks in the global equity underwriting league table for almost every quarter over recent years. Their market share suffered in 2016 as IPO activity in the U.S. – their core market – was fairly depressed, even as China saw a spurt in equity underwriting deals over the period. The fragmented nature of the Chinese market has made it more difficult for these banks to gain a strong foothold in the region – although Goldman and Morgan Stanley have definitely done better than their other American and European peers.

You can see how changes to Bank of America’s share of the equity underwriting industry impact our price estimate for the bank’s shares by making changes to the chart below.

See the links below for more information and analysis about the 5 largest U.S. investment banks:

- Q2 2017 Was A Great Period For The Largest U.S. Banks In Terms Of Investment Banking Fees

- U.S. Investment Banking Giants Generated More Than $2.5 Billion In Advisory Fees In Q2

- Morgan Stanley’s Role In Largest Equity Deals For Q2 Helps It Pocket More Than $400 Million In Fees

- JPMorgan, Bank of America Benefit From Upbeat Debt Capital Markets

- How Much In M&A Advisory Fees Did The 5 Largest U.S. Investment Banks Generate In 2016?

- How Much In Equity Underwriting Fees Did The 5 Largest U.S. Investment Banks Generate In 2016?

- How Much In Debt Origination Fees Did The 5 Largest U.S. Investment Banks Generate In 2016?

- How Much In Total Advisory & Underwriting Fees Did The 5 Largest U.S. Banks Earn In 2016?

See full Trefis analysis for Goldman Sachs | JPMorgan | Morgan Stanley | Bank of America | Citigroup

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research