Prime Air: Amazon’s Quest For Shipping Optimization

Amazon (NASDAQ:AMZN) leased 40 cargo jets some time ago to augment its shipping capabilities and ensure timely delivery to Prime customers. These planes, called Prime Air, are reportedly flying nearly full this holiday season to cater to the rapid growth in demand. Although Amazon maintains that Prime Air is only meant to supplement its shipping capacity provided by UPS and FedEx, owning a greater piece of the supply chain would certainly help with costs and delivery optimization.

Prime Air is shipping items with more volume than weight in order to cut shipping costs. The major shipping carriers recently started charging by volume instead of weight which made items such as diapers and toilet paper more expensive to deliver. Carrying such large but lightweight items itself should not only help reduce shipping costs through third-party carriers but also help cut fuel costs (which are dependent on weight) of Prime Air jets. [1]

Although Amazon’s fleet of 40 jets is currently no match for FedEx’s fleet of 659 aircraft or UPS’s fleet of 236 aircraft, it is an important step in Amazon’s plans for controlling a greater share of the logistics chain. The retailer earlier had a 25% stake in French delivery company Colis Privé and it bought the remaining 75% in January this year. The company had also bought a minor stake in U.K.-based delivery firm Yodel in 2014.

- Amazon Stock Is Up 22% YTD, What’s Next?

- Rising 18% YTD, What To Expect From Amazon Stock In Q1?

- Up More Than 100% Since The Start Of 2023, Where Is Amazon Stock Headed?

- Amazon Stock Outperformed The Q3 Estimates, What’s Next?

- Amazon Stock Is Up 50% YTD, Can It Top The Estimates In Q3?

- Amazon Stock Surpassed The Street Expectations In Q2

Recent reports also suggest that Amazon is building an app that matches truck drivers with shippers which is scheduled to be launched in the summer of 2017. This app is designed to make it easier for truck drivers to find shippers and eliminates the need of third party brokers who usually charge a 15% commission for these services. The trucking market is estimated at $800 billion. (Also read Here’s Why Amazon Might Be Focusing On A Logistics Business)

Amazon’s Current Shipping Costs

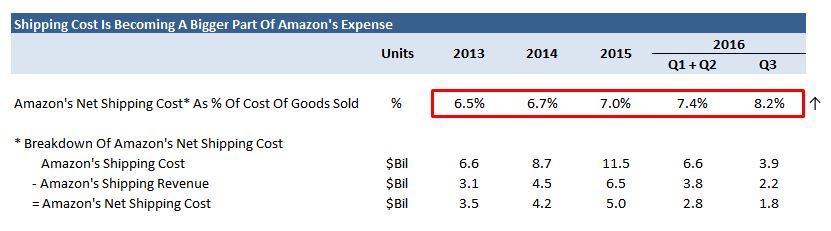

In the third quarter ending September 2016, Amazon’s net shipping costs increased to 8.2% of the cost of goods sold, compared to 7% in 2015 and 7.4% in the first half of 2016, owing to the rising number of Prime subscribers who expect faster delivery. This rapid increase in shipping costs is both good news and bad news because it indicates that sales are rising but it also puts a dent in profits.

In the first half of 2016, operating income in North America increased 131% driven by robust rise in Prime subscribers and total sales. However, this growth declined to 37% in Q3 2016 because of higher costs related to acquisition and licensing of digital media content as part of Amazon Video and Amazon Music, and higher shipping expenses (43% growth y-o-y to $3.9 billion).

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- Amazon starts flexing muscle in new space: air cargo, Reuters, Dec 23 2016 [↩]