Can Adobe’s Digital Experience Revenues Exceed Digital Media Revenues By 2025?

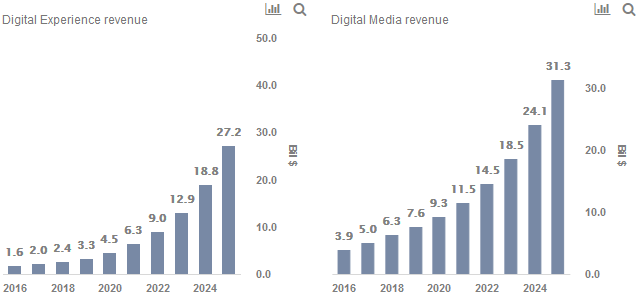

Adobe’s (NASDAQ:ADBE) Digital Experience revenues have grown at a much faster rate than its cornerstone Digital Media revenues over recent quarters, and we expect this trend to continue over the foreseeable future. While this is expected to increase the contribution of the Digital Experience to the company’s top line over coming years, the segment will very likely remain smaller in size compared to Digital Media through 2025.

Trefis forecasts Adobe’s Digital Experience and Digital Media revenues in a detailed interactive dashboard. You can modify our forecast to see the impact on Adobe’s revenues over coming years. Additionally, you can see more Trefis technology company data here.

- Down 14% In The Last Trading Session, Where Is Adobe Stock Headed?

- Down 8% YTD, What To Expect From Adobe Stock In Q1?

- Up 77% Last Year, What To Expect From Adobe Stock?

- Adobe Stock Is Trading Below Its Fair Value

- Adobe Stock Outperformed The Street Expectations In Q2

- Adobe Stock Topped The Consensus In Q1, What’s Next?

- Digital Experience (2018 revenue of $2.4 billion, c.27% of total revenue): Segment revenue is derived from the sale of subscriptions to Adobe Experience Cloud, a cross channel marketing optimization tool that analytics, targeting, campaign management, content delivery and commerce enablement.

- Adobe had in the past estimated the Digital Experience Total Addressable Market (TAM) to grow from $40 billion in 2018 to $71.2 billion in 2021 at a CAGR of 33.4%.

- We expect the TAM to see strong growth on the back of an increasing focus on user experience and Adobe’s push towards build a unified customer profile. Per our estimates, the TAM of this segment could expand to $243 billion by the end of 2025 – growing at a CAGR of 36%.

- Going forward, we expect Adobe’s share in the Digital Experience market to steadily expand from an estimated 8% in 2019 to 11% by the end of 2025.

- This share expansion is likely to be supported by inorganic growth (for example the acquisitions of Magento and Marketo and thus the additional capability of commerce) and alliances (such as the Open data alliance with SAP and Microsoft, and more recently with Amazon).

- Access to additional analytics is likely to help Adobe’s AI/ML engines produce much better user experiences and thus drive growth.

Digital Media

- Digital Media (2018 revenue of $6.3 billion, c.70% of total revenue): Segment revenue is derived from the sale of subscriptions to Creative Cloud (Photoshop, Illustrator, Premiere Pro, Lightroom CC, InDesign, Adobe XD etc) and Document Cloud (Adobe Acrobat, Adobe Sign and Adobe Scan).

- Adobe had in the past estimated the Digital Media TAM to grow from $24 billion in 2018 to $36.7 billion in 2021 at a CAGR of 23.7%.

- We expect the TAM to see steady expansion on the back of a sustained need to differentiate content by making it more engaging. Per our estimates, the TAM of this segment could expand to $99 billion by the end of 2025 – growing at a CAGR of 28%.

- Adobe has cornered roughly a third of this market and further expansion is likely to be slow.

- However, the company’s leading products and brand perception is likely to help the company maintain share.

- Going forward, we expect Adobe’s share in the Digital Experience market to remain around an estimated 32% from 2019 to 2025.

Despite our expectations of the relatively stronger growth in the Digital Experience business versus the Digital Media business, we expect the Digital Media revenue to continue to be a larger than the Digital Experience revenue over our forecast period.

Do not agree with our forecast? Create your own forecast for Adobe by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.