Declining Investment Demand For Gold Likely To Translate Into Lower Prices

The global demand for gold fell considerably in Q1, largely due to a decline in the investment demand for the metal, as per the World Gold Council’s Q1 2017 Gold Demand Trends report released last week. [1] The following table provides a snapshot of the major trends in the jewelry and investment demand for gold in Q1 2017.

Source: World Gold Council

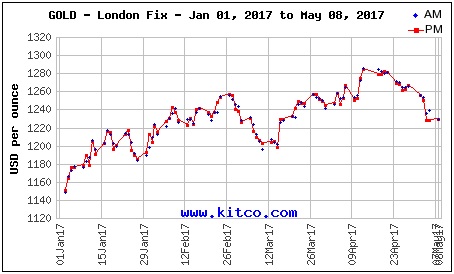

The investment demand for gold fell considerably on a year-over-year basis in Q1 2017. Gold is largely seen as a safe-haven asset from an investment point of view, with macroeconomic and geopolitical uncertainty driving up the demand for the metal. In addition, since gold as an investment only yields capital gains in terms of returns, rising interest rates tend to dampen the investment demand for gold. The investment demand for gold was considerably higher last year as a result of concerns pertaining to global economic growth, the Bank of Japan lowering benchmark interest rates to negative territory, as well as the prevalence of negative interest rates in Europe. [2] A strengthening economy and jobs market in the U.S. and rate hikes by the Federal Reserve in December 2016 and March 2017 weighed on the investment demand for gold in Q1 2017, which translated into lower overall demand for the commodity. [3] The following chart illustrates the trajectory of gold prices so far this year.

Gold Prices in 2017, Source: Kitco

Gold prices rose sharply post the Fed’s March rate hike, in the weeks leading up to the first round of the French Presidential election on April 23. Investors remained jittery with presidential candidate Marine Le Pen, who favored a potential withdrawal of France from the EU, gaining ground politically. However, though Le Pen was among the top two candidates in the first round of elections, she finished behind pro-EU candidate Emmanuel Macron in the polling and lost out to him in the second round of elections in May. With Macron commanding the maximum votes in the first round of elections, concerns pertaining to the outcome of the French elections dissipated, resulting in a decline in gold prices. In addition, a better than expected U.S. jobs report for April further dampened gold prices. With political uncertainty receding, we expect gold prices to remain subdued over the rest of the year as the Fed tightens interest rates. However, unfavorable developments pertaining to ongoing geopolitical tensions such as the conflict in the Middle East and North Korea’s nuclear missile program could potentially drive up prices. In the absence of any such development, we expect gold prices to average lower in 2017 as compared to last year, as illustrated by the chart shown below.

Have more questions about Barrick Gold? See the links below.

- Why Did Barrick Sell Off A 25% Stake In The Cerro Casale Mining Project?

- Gold Prices To Average Lower This Year As Fed Maintains Interest Rate Hike Outlook

- IQOS Helps Philip Morris Navigate Well In Q1

- Down 45% Year To Date, What’s Happening With Sirius Stock?

- Meta Platforms Stock Dropped 10.6% In A Day, What’s Next?

- What Factors Will Drive Pfizer’s Q1 Performance?

- A Rebound In Asia Travel Will Likely Drive Estée Lauder’s Q3 Performance

- Higher Medical Costs Likely Weighed On CVS Health’s Q1 Earnings

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)

Notes:

- Gold Demand Trends Q1 2017, World Gold Council [↩]

- Bank of Japan’s Negative Interest Rate Decision Explained, Bloomberg [↩]

- US created 211,000 jobs in April, vs 185,000 jobs expected, CNBC [↩]