How Mobile Devices Are Impacting Viacom?

Nickelodeon, the cable network owned by Viacom (NASDAQ:VIA), has been witnessing a decline in viewership since 2012. This trend is visible across all top cable networks catering to viewers aged 2-11, such as Disney Channel and Cartoon Network. Nickelodeon’s average daily viewership fell from over 1.2 million in 2010 to around 0.6 million in 2015 [1]. The increasing popularity of alternative streaming platforms such as Netflix, You Tube, and others, that are easily accessible on mobile devices is one of the primary reasons for this decline. Kids-centric content is one of the most popular categories on You Tube. Kids-ocused videos on You Tube recorded 5.6 billion views in Q1 2015, up 224% from the same period previous year. [2]. Declining viewership is likely to slow down Nickelodeon’s advertising revenue growth. We estimate the network to constitute around 10% of Viacom’s price estimate. A significant decline in Nickelodeon’s advertising revenues can cause a 5% downside in our price estimate.

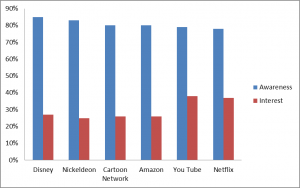

Awareness Of Nickelodeon Is High, But You Tube Is More Interesting

A recent survey released by PricewaterhouseCoopers reveals that although awareness of traditional channels is higher, other modes of entertainment draw more interest.

- Meta Platforms Stock Dropped 10.6% In A Day, What’s Next?

- What Factors Will Drive Pfizer’s Q1 Performance?

- A Rebound In Asia Travel Will Likely Drive Estée Lauder’s Q3 Performance

- Higher Medical Costs Likely Weighed On CVS Health’s Q1 Earnings

- What’s Next For PepsiCo Stock After A Q1 Beat?

- Down 9% This Year, What Lies Ahead For Starbucks Stock Following Q2 Earnings?

Higher interest in online streaming media platforms can be attributed to the ease of watching videos on mobile devices, availability of high quality content on digital media, and the ability of parents to monitor content. This has prompted advertisers to increase their online ad budget. eMarketer estimates that advertisers will spend $64.25 billion worldwide on mobile advertising in 2015, which is an increase of nearly 60% over 2014. Budget for TV ads is expected to shrink by 3% every year until 2020 (Read Trends in Global Advertising Industry: Winners and Losers Part I).

Decline In Nickelodeon’s Advertising Revenues Can Cause A 5% Downside To Our Price Estimate

Our price estimate of $72 for Viacom is almost 50% higher than its current market price. Nickelodeon U.S. constitutes around 10% of our price estimate and U.S. advertising revenues is a key driver for Nickelodeon’s valuation. These revenues declined by 20% from $815 million to $660 million between 2011 and 2014. We expect a gradual increase in advertising revenues over our forecast period to $700 million in 2020, primarily driven by a continued increase in ad pricing, given its popularity, penetration and increased investment in original programming. If Nickelodeon is not able to meet our estimates and there is negative growth in advertising revenues, there can be a 5% downside to our price estimate.

TV channels are rising to the threat of alternate streaming media and are experimenting with alternative platforms to maintain viewership. Developing kids’ content for mobile viewing, launching video games along with content and creating interactive videos for mobile screens are some of their new initiatives. Nickelodeon plans to launch an animated series “Pinky Malinky” in 2016 which will be available on its digital platform. The online extension of this series is an example of how Nickelodeon is planning to meet the new requirements of kids to access content anytime, anywhere.

While digital media is threatening TV channels’ advertising revenues from kids-centric content, the active counter measures should help retain viewers and ensure that advertising revenues do not see a significant decline.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research