Can MediaTek Disrupt Qualcomm’s Market Share?

According to Strategy Analytics, Qualcomm’s (NYSE:QCOM) smartphone application processor revenue share declined from 52% in 2014 to 45% in 2015. However, during this time, Qualcomm’s rival – MediaTek saw its market share improve from 14% to 19%. It would be interesting to note the operating margins of the two companies, as the future market share gains would be dependent on this key metric. Further, both the company’s valuations are also dependent on how effectively they operate. In the analysis below, we compare the operating margins for the two companies.

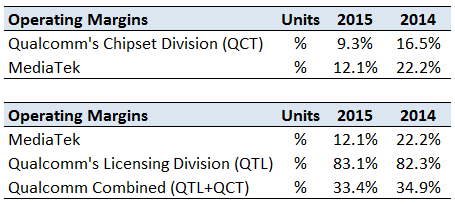

It must be noted that MediaTek is aggregated into just one segment as its major sales come from the sale of multimedia and mobile phone chips only. However, Qualcomm has two operating segments – QCT (Qualcomm chipset technologies) and QTL (Qualcomm Technology Licensing). Qualcomm’s QCT division constitutes chipset sales and Qualcomm’s QTL division constitutes licencing and royalty fees collected from its customers. Therefore, it would make sense to compare the operating margins of MediaTek with Qualcomm’s chipset business’ operating margins. In the table below we compare the margins for the two companies:

From the above table we can see that Qualcomm’s chipset business is less operationally efficiently as compared to MediaTek’s. Further, operating margins have declined considerably for both the companies in the last two years as both the companies have focused on the strategy of offering lower cost chips to gain market share. However, Qualcomm’s combined operating margins (operating margin for QTL and QCT) was way higher than MediaTek’s operating margin. This can be attributed to the fact that Qualcomm’s licensing business is highly profitable and has a very high operating margin of more than 80%.

Going forward, Qualcomm might be able to operate its chipset business at even lower margins, owing to the fact that its licensing business is highly profitable. This might help the company sustain or even improve its market share from its current levels. However, Qualcomm’s rival – MediaTek might find it difficult to conduct business at such low margins. For the reasons stated above, it would be difficult to imagine that market share for MediaTek would improve in the near term.

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will Qualcomm Stock Return To Pre-Inflation Shock Highs Of $189?

- Will Qualcomm Stock Return To Pre-Inflation Shock Highs Of $190?

- With Expectations Low For Q4, Will Qualcomm Spring A Surprise?

- Will Qualcomm Stock Return To Pre-Inflation Shock Highs Of Over $180?

- Will Qualcomm Stock Recover To Highs Seen Prior To Inflation Shock?

A Message From Trefis Marketing

Download our eBook “Create More Accurate Forecasts and Plans” and learn:

- The costs of missed forecasts

- The three reasons why companies do a poor job

- How you can create more accurate forecasts and plans