Can Netflix Face Serious Competition From Amazon?

A study by the Consumer Intelligence Research Partners (CIRP) estimates that the number of Amazon Prime memberships in the U.S. is now at around 54 million, which would translate to around 46% of the U.S. households having at least one prime member. [1]. Netflix‘s (NASDAQ:NFLX) U.S. streaming subscriber base was around 45 million at the end of 2015, which means that Amazon’s prime members, who get access to free streaming services, now exceed Netflix’s subscribers in the U.S. As the domestic market saturates, Netflix is witnessing a slower growth in the U.S. In Q4 2015, it added 1.56 million domestic subscribers, lower than the 1.65 million number forecast by the company in the beginning of the quarter. While Amazon Prime memberships are increasing at a rapid pace, the primary reason for this increase appears to be free shipping. CIRP estimates that only 40% of the U.S. Amazon Prime members use the free streaming service at least once a week. [2]. We believe since Netflix is a pure play streaming service and remains focused on original, good quality, exclusive content, it has a competitive edge over Amazon. However with its deep pockets, Amazon has the capacity to focus aggressively on its streaming segment, spending heavily on content and expanding globally. While Netflix does have a strong position currently, it needs to be on its toes to maintain and grow its market share in the U.S.

See our complete analysis for Netflix

Quality Content, Better Features Will Be The Key Differentiation

- Up 27% Year To Date, Will Q1 Results Drive Netflix Stock Higher?

- Netflix On A Roll As It Benefits From Paid Sharing And Ads. Is The Stock Undervalued At $610?

- Up 50% Over Last Year, Will Q4 Earnings Drive Netflix Stock Higher?

- Will Netflix Stock Rally 40% To Return To Pre-Inflation Shock Highs?

- How Will The Password Sharing Crackdown Help Netflix Q3 Results?

- Will Netflix Stock Return To Pre-Inflation Shock Highs Of Over $650?

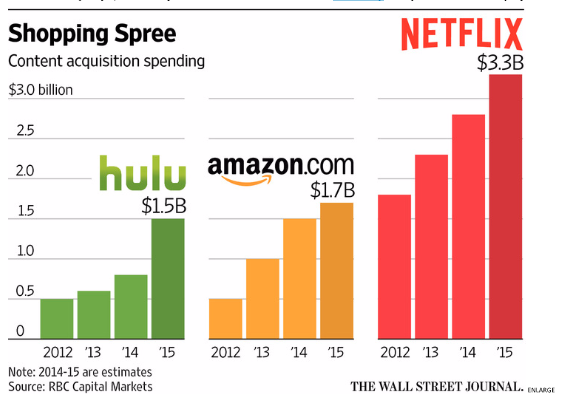

While streaming service is gaining adoption in the U.S., efforts by Amazon to ramp up its content can impact Netflix. Both companies invested heavily on developing original content in 2015 and Netflix is distancing itself from third party content which can be easily watched elsewhere, thus focusing on providing exclusive content to its subscribers. We believe content quality in terms of availability of popular original or sourced content will be the key differentiation for subscribers to choose one service over the other and based on data from RBC capital markets, it appears Netflix’s content acquisition spending has been the highest among its competitors over the past few years.

We expect Netflix’s U.S. subscribers to grow at a slow rate and reach around 62 million by the end of our forecast period.

In September 2015, Amazon announced that its Prime members could start downloading movies and TV shows to mobile devices for offline viewing, a feature that Netflix does not offer. [3]. The ability to watch videos on the move, without an internet connection, does give Amazon an edge over Netflix. That said, original and exclusive content would be the deciding factor for subscribers, in ourview. Netflix’s strategy of acquiring and creating TV shows and movies which the viewers cannot watch elsewhere does put it in an advantageous position.

Ability To Capture International Markets Will Be Important

Netflix went global at the end of 2015 and is now available in 130 countries. Its international user base grew by 4.04 million in Q4 2015 and the company had 30 million international subscribers at the end of 2015. Netflix is facing challenges in global expansion, with the competition in places forming alliances to gain global rights for movies and TV shows. Morevoer, it has limited content supply for several regions. Still, the company is ramping up efforts to get global rights for most of its movies and shows. The company is facing pressure on margins due to high costs of global rights and the international segment is not profitable yet. But it has the first mover’s advantage in several regions providing a huge growth potential. Amazon’s Prime membership’s in the U.S. might be the nearing their peak and it has limited presence internationally. While Amazon is looking to expand its Prime membership internationally, the pace at which it can add international members will be key for its success.

For Netflix to stay ahead of Amazon Prime it needs to focus on delivering high quality popular content in the U.S. to retain and grow its market share while continuing to work on initiatives to make its international segment profitable.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

Notes:- Amazon Prime now reaches nearly half of U.S. households, CNN Money, January 26, 2016 [↩]

- Amazon.com Has More U.S. Streaming Subscribers Than Netflix, Investors Business Daily, January 25, 2015 [↩]

- Why Amazon Prime Is Now A Better Deal Than Netflix, Fortune, September 2015 [↩]