Can Dr Pepper Snapple Beat Earnings Estimates In Yet Another Quarter?

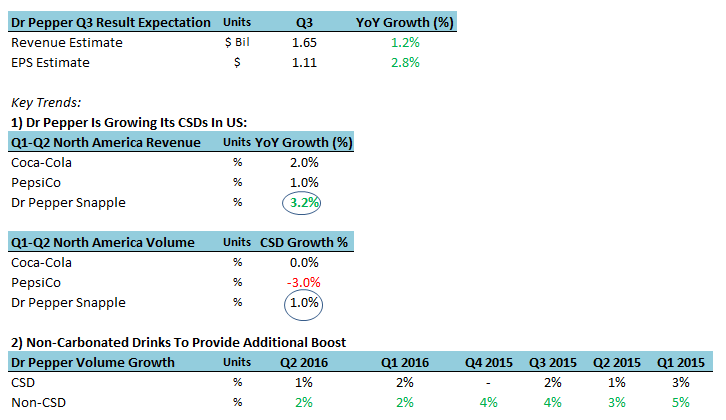

Dr Pepper Snapple (NYSE:DPS) is scheduled to announce its Q3 results on October 27, and we expect another solid quarter from the beverage company, which depends heavily on its domestic market for growth. Dr Pepper ranks behind Coca-Cola and PepsiCo in the U.S. CSD market, but compared to its much larger compatriots, the former is less exposed to the effects of currency translation. In 2015, while 46% and 56% of Coca-Cola and PepsiCo’s net sales came from the U.S., a larger 89% of Dr Pepper’s revenue came from the home market. Dr Pepper is also more dependent on carbonated soft drinks (CSD) compared to both Coca-Cola and PepsiCo, with CSDs forming 82% of its net volume. However, Dr Pepper Snapple has been able to increase both its volume and revenue in the U.S. CSD market in the last few years despite the slowdown in the overall market, by nabbing market share from its chief competitors, and we expect this trend to continue into the second half of 2016.

Dr Pepper has managed to surpass quarterly estimates of earnings per share in the last 12 quarters, on the back of growth of its CSDs and especially its non-carbonated portfolio. In addition, allied brands are expected to add incremental volume in Q3, yet again. Allied brands allow Dr Pepper to leverage its large scale distribution network and participate in growing emerging categories where it doesn’t have a considerable presence as of now. The allied brands growth is included in the packaged beverage volumes for Dr Pepper, which is the distribution wing for these small but fast growing brands, such as Bai 5, Vita Coco, etc.

- IQOS Helps Philip Morris Navigate Well In Q1

- Down 45% Year To Date, What’s Happening With Sirius Stock?

- Meta Platforms Stock Dropped 10.6% In A Day, What’s Next?

- What Factors Will Drive Pfizer’s Q1 Performance?

- A Rebound In Asia Travel Will Likely Drive Estée Lauder’s Q3 Performance

- Higher Medical Costs Likely Weighed On CVS Health’s Q1 Earnings

The company raised its full-year core EPS guidance, after net sales rose 2% year-over-year on a 1% rise in sales volume in Q2, and now expects core EPS to be in the $4.27 to $4.35 range, up from the $4.20-$4.30 range forecast previously, in 2016. While Dr Pepper expects CSD volume to be flat this year, non-carbonated beverages are expected to grow slightly. Pricing actions taken across several of the company’s warehouse direct brands are expected to hinder growth in NCB volume this year, however, continued growth from other brands such as Snapple, Clamato, and the allied brand portfolio should offset this decline. CSD volume growth is expected to remain tepid, considering how PepsiCo reported a 3% decline in CSD volume in Q3, while Coke reported a slightly positive growth, rounding to even. However, despite lower volume sales, what is expected to work for Dr Pepper is continual emphasis on smaller packages that have higher price per unit volume. This should boost the company’s top line in Q3.

Have more questions on Dr Pepper Snapple? See the links below.

- How Can Dr Pepper’s Latin America Segment Grow In The Next Five Years?

- Dr Pepper Raises EPS Guidance On Solid Q2 Results

- Dr Pepper Snapple Is Heavily Dependent On CSDs, But That’s Not A Problem

- Dr Pepper Beats Consensus Estimates; Grows Volume In Carbonated Beverages Too

- What’s Dr Pepper Snapple’s Revenue And EBITDA Breakdown?

- By What Percentage Have Dr Pepper Snapple’s Revenues And EBITDA Grown Over The Last Five Years?

- What’s Dr Pepper Snapple’s Fundamental Value Based On Expected 2016 Results?

- How Has Dr Pepper Snapple’s Revenue And EBITDA Composition Changed Over 2012-2016E?

- Why North America NCB Revenue Will Grow 5x North America CSD Revenue Over 2015-2018 For Dr Pepper

- Why Latin America Revenue Will Grow 2.5x North America Revenue Over 2015-2018 For Dr Pepper

- How Much Revenue Can Latin America Add By 2018 For Dr Pepper?

- Breakdown Of Dr Pepper’s U.S. CSD Vs Mexico CSD Presence

- How Much Can CSDs Add To Dr Pepper’s Top Line By 2018?

- How Much Can NCBs Add To Dr Pepper’s Top Line By 2018?

- 2015 Year In Review: Dr Pepper Snapple

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)