Here’s How Growth In The Chinese Internet Ad Market Will Impact Baidu

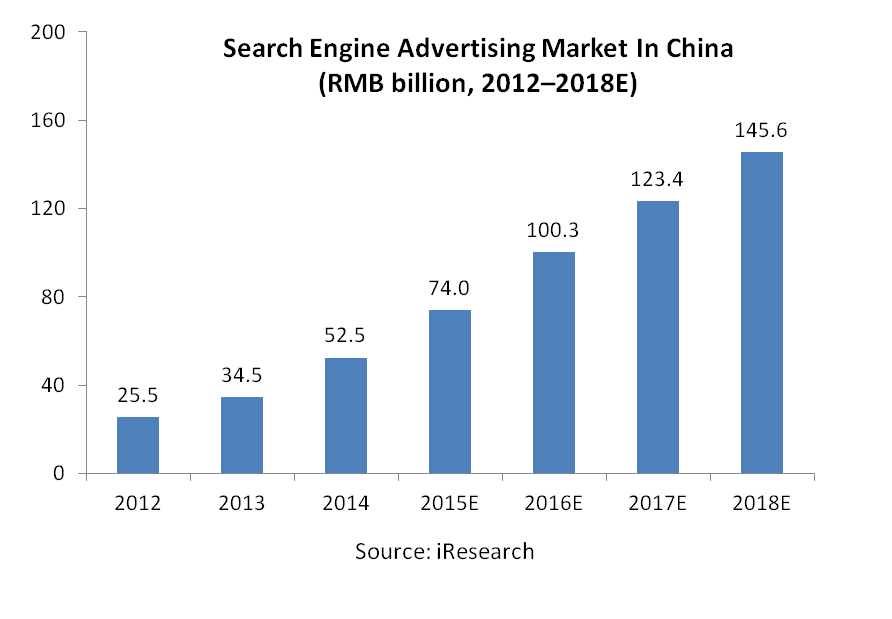

Baidu (NASDAQ:BIDU) is the leading player within the Chinese search engine market, commanding over 80% market share by revenue. As a result, the company is expected to capitalize heavily on the future growth within the Chinese Internet advertising market: Revenue in the country’s search advertising market could increase from RMB 52.5 billion in 2014 to RMB 145.6 billion by 2018, according to iResearch. [1] However, increasing threats to Baidu’s dominance in the search market represent a significant risk, in our view. Under a more pessimistic scenario for Baidu’s market share outlook, we believe there could be greater than 15% downside to our price estimate.

See our complete analysis of Baidu here

Chinese Internet Advertising Market Could Surpass $65 Billion By 2018

The Internet advertising market in China (which includes advertising on PC and mobile devices, with the exclusion of overlapping devices) is forecast to rise at a 28% CAGR during the 2014-2018 period to reach RMB 420 billion ($ 65.6 billion), as forecast by iResearch. [1] Though market maturity and macro-economic challenges could lead to deceleration in growth in the future, the Internet advertising market will continue to be propelled by rapid growth in mobile advertising budgets. Mobile advertising revenue in China is estimated to rise sharply from RMB 30 billion in 2014 to RMB 220 billion by 2018, according to iResearch.

The share of search engine in the overall online advertising market is expected to rise from 34.1% in 2014 to 37.0% by 2018. Moreover, revenue in the Chinese search engine market is forecast to surge at 29% CAGR over 2014-2018 to RMB 145.6 billion ($22.8 billion), as per iResearch.

The share of search engine in the overall online advertising market is expected to rise from 34.1% in 2014 to 37.0% by 2018. Moreover, revenue in the Chinese search engine market is forecast to surge at 29% CAGR over 2014-2018 to RMB 145.6 billion ($22.8 billion), as per iResearch.

In our present valuation model, we estimate Baidu’s search revenues to rise rapidly over our forecast horizon, from $5.7 billion in 2014 to over $30 billion by 2021. This is as we largely expect Baidu to retain its dominance over the search engine market, owing to its increasing market share on mobile search. Hence, the company is expected to gain heavily from rapid growth within the Chinese Internet advertising market. However, increasing competition from Qihoo and Sohu present risks to Baidu’s leading market share. In the event Baidu’s search revenues rise only to $25 billion by 2021 (instead of our previous estimate of $30 billion), then this scenario will take our price estimate 15% lower to $180. Hence, we’d advise investors to keep a close track on Baidu’s search market share in the future, as this could heavily influence its top-line outlook.

In our present valuation model, we estimate Baidu’s search revenues to rise rapidly over our forecast horizon, from $5.7 billion in 2014 to over $30 billion by 2021. This is as we largely expect Baidu to retain its dominance over the search engine market, owing to its increasing market share on mobile search. Hence, the company is expected to gain heavily from rapid growth within the Chinese Internet advertising market. However, increasing competition from Qihoo and Sohu present risks to Baidu’s leading market share. In the event Baidu’s search revenues rise only to $25 billion by 2021 (instead of our previous estimate of $30 billion), then this scenario will take our price estimate 15% lower to $180. Hence, we’d advise investors to keep a close track on Baidu’s search market share in the future, as this could heavily influence its top-line outlook.

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

Notes:- 2015 China Online Advertising Report (Brief Edition), iResearch, May 25, 2015 [↩] [↩]