Key Takeaways From Viacom’s Fiscal Q3 Earnings

Viacom (NYSE:VIA) announced mixed Q3 results on August 3, as its earnings per share came in ahead of market expectations but revenues missed. The company’s stock fell 8% after the results announcement. Below we discuss some of the key takeaways from the earnings release.

Media Networks, Filmed Entertainment Drive Revenue Growth

Viacom’s total revenue increased 8% year-over-year (y-o-y) to $3.3 billion, due to growth in both the Media Networks and Filmed Entertainment segments. The company’s top line growth was driven by growth in advertising and affiliate revenues at the Media Networks business, along with robust growth in theatrical revenues due to a stronger film sate at Paramount studio.

- American Express Stock Is Up 17% YTD, What To Expect From Q1?

- Down 37% This Year, Will Roku Stock Recover Following Q1 Results?

- Will PepsiCo Beat The Consensus In Q1?

- How Will An Expanding Postpaid Phone Business Drive AT&T Stock’s Q1 Results?

- T-Mobile Stock Has Traded Sideways This Year. Will It See Gains Following Q1 Results?

- With The Stock Flat This Year, Will Q1 Results Drive SLB Stock Higher?

Viacom’s operating expenses grew 14% y-o-y, due to higher segment expenses. In addition, the company’s operating income declined 3% y-o-y to $746 million, due to increased programming expenses at the networks and marketing costs at Paramount.

Viacom also posted adjusted earnings of $1.17 per share, up 11% year-on-year.

Operating Income Flat

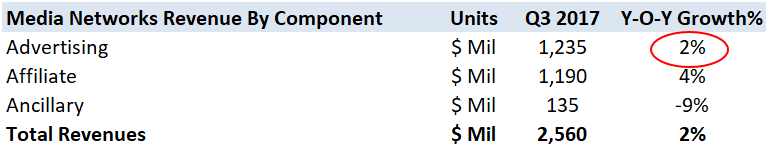

In Q3, Viacom’s media networks saw 2% y-o-y revenue growth, driven by a 2% y-o-y increase in affiliate revenues, along with 4% growth in the segment’s advertising revenues. However, Media Networks adjusted operating income remained flat due to investments in programming and employee costs.

Rate Increases

On the domestic front, Media Networks witnessed 4% y-o-y growth in affiliate revenues, driven by rate increases and the impact of SVOD and OTT agreements, partially offset by a decline in pay TV subscribers. Meanwhile, on the international front, the segment’s international affiliate revenues increased 1% y-o-y on the back of the acquisition of Telefe, the impact of rate increases, subscriber growth, new channel launches, as well as higher revenues from SVOD and OTT arrangements.

Viacom’s Filmed Entertainment revenues in the quarter were up 36% y-o-y, primarily due to growth across all its revenue streams, led by the theatrical business. The company collected $263 million in theatrical revenues during the June quarter, primarily led by the success of Transformers: The Last Knight and Baywatch. Moreover, the segment generated an adjusted operating profit of $35 million in the quarter, primarily reflecting the operating results as mentioned above.

Have more questions on Viacom? Please refer to our complete analysis for Viacom

See More at Trefis | View Interactive Institutional Research (Powered by Trefis) Get Trefis Technology