How Does Union Pacific Plan To Improve Its Profitability?

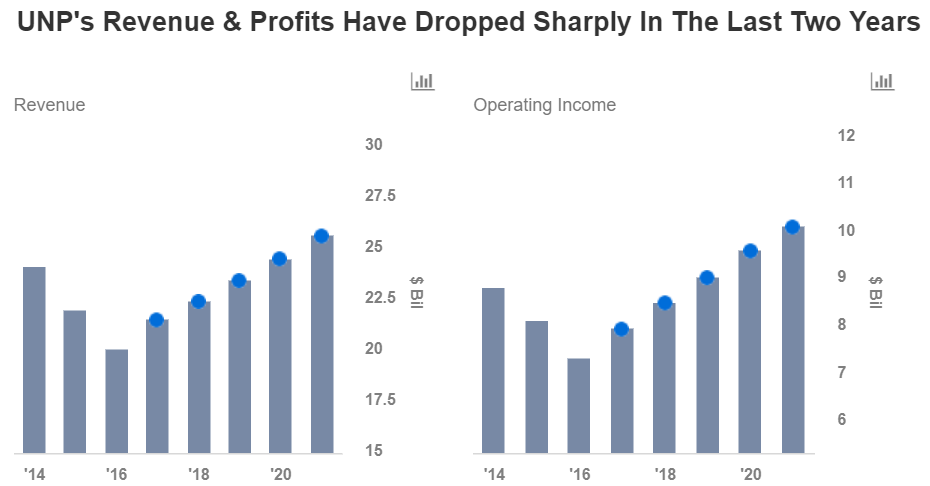

The last two years have been a downhill ride for the railroad companies in the US. While coal and commodity shipments were declining sharply, lower oil prices created pressure on the fuel surcharge fees, pulling down the company’s top-line. Consequently, the profitability of these companies also shrunk notably. However, the year 2017 has been a turnaround year for railroad companies, such as Union Pacific Corporation (NYSE:UNP). The company has not only witnessed a surge in coal and commodity shipments due to the changing business environment in the US, but has also worked consistently to control its operating costs to maintain its margins. Thus, in this note, we talk about the measures taken by Union Pacific to improve its profitability and deliver higher returns to its shareholders.

As mentioned earlier, Union Pacific experienced a steep drop in its coal shipments over the last couple of years, owing to the increased awareness about climate change and its implications. This, coupled with a slump in commodity prices, led to a significant fall in its revenue and profitability. However, things have changed since the appointment of Donald Trump as the US President. The implementation of favorable business policies has caused the shipments of coal and metals to surge in the last few months. Further, with improving oil prices, the company’s fuel surcharge has also gone up, resulting in a jump in its top-line. Based on the current trends, we expect Union Pacific’s revenues to grow strong in 2018 and beyond.

- Should You Pick Union Pacific Stock At $250 After 20% Gains Last Year And Q4 Beat?

- Up Over 2x In 2023 Is AMD A Better Pick Over Union Pacific Stock?

- Should You Pick Union Pacific Stock After An 18% Fall In Q3 Earnings?

- What To Expect From Union Pacific’s Q3 After Stock Up Only 2% This Year?

- Should You Pick Union Pacific Stock Over McDonald’s?

- Earnings Beat Ahead For Union Pacific Stock?

Apart from the improvement in the revenues, Union Pacific has been working towards streamlining its operations in order to enhance its margins. In 2015, the company had announced its “G55 + 0” program to improve its profitability. The term G55+ 0 breaks down to read Grow to 55% and 0, which implies that the company plans to reduce its operating ratio to 55% and injuries to zero in the next few years. A lower operating ratio (operating expenses as a percentage of total revenue) would result in higher operating profits for the company and its investors. Further, a zero injury rate will improve client and investor confidence, as well as yield productivity gains for the company.

Source: UNP’s 3Q’17 Presentation

Thus, the company aimed to rationalize its work force, improve fuel efficiency through longer train lengths and reduce its support costs to achieve the targeted operating ratio. With these initiatives, the company estimates to realize cost savings of $350-$400 million by the end of 2017. This would enable UNP to reduce its operating ratio to around 60% by 2019 and further to 55% in the years beyond 2019.

In terms of the progress so far, Union Pacific has brought down its operating workforce by 550 employees, and engineering and mechanical workforce by 800 employees in the third quarter compared to the last year. Further, the company lowered its locomotive servicing and repair costs, and improved its resource utilization, resulting in cumulative cost savings of $270 million year-to-date. Given the impressive results from its cost reduction initiatives, the company expects to achieve its targeted cost savings by the end of the year.

Above, we present our forecast for Union Pacific’s operating ratio over the next few years. Feel free to create your own scenarios about the company’s operating ratio and visualize the impact on the company’s stock price using our interactive platform. We have a price estimate of $130 per share for the company, which is in line with its current market price.

See Our Complete Analysis For Union Pacific Corporation Here

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap