Strong 3Q’17 Earnings Cause Union Pacific’s Stock To Surge

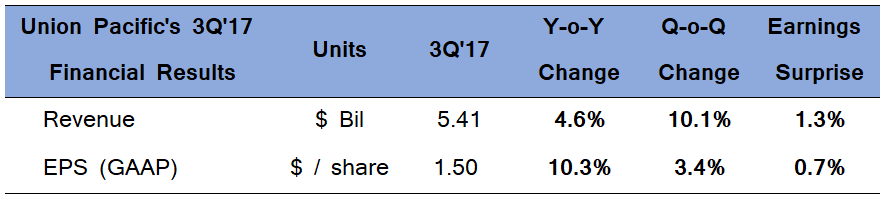

As anticipated, Union Pacific Corporation (NYSE:UNP), the Omaha-based railroad company, posted a stellar performance for the September quarter on 26th October 2017 ((Union Pacific Corporation Announces Its 3rd Quarter 2017 Earnings, Union Pacific News Release)), beating the consensus estimate for both revenue and earnings by small margins. While the rise in revenue was driven by higher industrial shipments, the earnings growth was backed by cost savings from productivity improvements during the quarter. The earnings beat impressed the investors, causing the company’s stock to surge by almost 6% post the announcement of results. We have a $106 price estimate for UNP’s stock, which is now roughly 10% below the current market price.

See Our Complete Analysis For Union Pacific Corporation Here

- Should You Pick Union Pacific Stock At $250 After 20% Gains Last Year And Q4 Beat?

- Up Over 2x In 2023 Is AMD A Better Pick Over Union Pacific Stock?

- Should You Pick Union Pacific Stock After An 18% Fall In Q3 Earnings?

- What To Expect From Union Pacific’s Q3 After Stock Up Only 2% This Year?

- Should You Pick Union Pacific Stock Over McDonald’s?

- Earnings Beat Ahead For Union Pacific Stock?

Key Highlights of 3Q’17 Earnings

- Union Pacific’s volumes for the quarter dropped 1% due to weakness in the agricultural products, automotive, and chemicals shipments. However, this decline was partially offset by the growth in its industrial products volumes. Further, the company experienced better pricing during the quarter, which resulted in an overall 5% jump in its top-line.

- While the company realized cost savings of $70 million backed by its productivity gains, the disruption caused by Hurricane Harvey weighed negatively on its operational performance. Consequently, Union’s quarterly operating ratio (operating expenses as a % of revenue) rose to 62.8%, 0.7 points up from the third quarter of 2016.

- Yet, Union Pacific is confident of achieving its targeted productivity savings of $350-$400 million by the end of the year and aims to bring down its operating ratio to around 60% by 2019. Year-to-date, the company has realized savings of $270 million.

Going Forward

- Union Pacific expects its food and refrigerated shipments to see continued growth in the coming months, driven by Cold Connect penetration, weather recovery and tightening truck capacity. Further, it anticipates sustained demand for sugar and import beer for the rest of the year.

- In addition, the railroad company foresees a modest growth in its chemicals franchise and strength in its plastics shipments due to continued domestic and export demand, along with new facilities coming online.

- On the flip side, the company expects weakness in the auto sales to continue due to current sales trends, high inventory, and rising incentives. However, the damages caused by the recent hurricanes could provide some short-term opportunities for the industry.

- Besides, Union Pacific expects its coal volumes to remain flat in the fourth quarter due to normalized demand. Also, high global production of both feed grains and wheat, coupled with a lower quality domestic wheat harvest, could continue to create headwinds for the company in its export markets.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap