Is The Market Pricing Travelzoo Fairly?

Travelzoo (NASDAQ: TZOO) has been struggling with its performance for almost three years now. Travelzoo’s introduction of a hotel booking platform in 2014, and subsequently attempting to make it the focus of its business, while gradually reducing the stress on the local deals and search segments, didn’t seem to work well enough for the company. However, the company started 2018 on a strong note with over 8% growth in revenue in Q1 and 2.5x jump in its stock price in less than a month. We have a $16 price estimate for Travelzoo’s stock, which is slightly below the current market price.

We have also created an interactive dashboard which shows our forecasts and estimates for the company; you can modify the key value drivers to see how they impact the company’s revenues, bottom line, and valuation.

- Why Did Travelzoo’s Stock Grow Despite Only Modest Revenue Growth?

- Could Travelzoo’s Stock Rise By 50% Post COVID-19 Crisis?

- How Does Travelzoo Make Money?

- Why Has Travelzoo’s Stock Price See-Sawed So Much Since Early 2018?

- Can Travelzoo End Fiscal 2018 On a Strong Note?

- What Is TripAdvisor’s Revenue And EBITDA Breakdown?

Steps To Arrive At Our Price Estimate

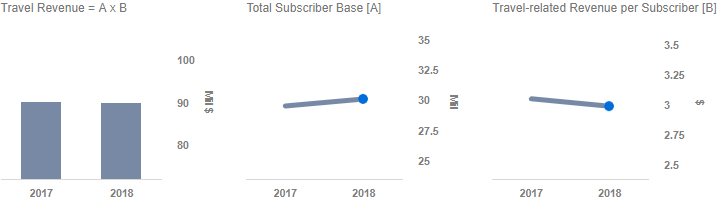

Travelzoo generates revenue from two segments: Travel revenue and Local revenue. We expect the travel-related subscriber base to hit 30 million in 2018. The company has witnessed increased subscribers over the past couple of years. However, a decline in revenue per subscriber led to a decline in revenue from this segment. With a revenue per subscriber of $2.99, which is similar to the figure for the past few years, we estimate Travel revenue of $90 million for 2018.

Local revenue declined by 19% annually over the past couple of years. We expect a further decline in revenue from this segment owing to increased competition and lower deal advertisements on the website.

The company is working on technology that will better help gauge the member usage behavior. It will work more aggressively toward more member acquisition once this technology is in place. It has also increased focus on the areas of hotel bookings and vacation packaged bookings. The company is also looking for acquisition targets to strengthen its offerings in the packaged booking segment. Finally, the Getaways deals contribution to the business has declined and gradually it will be replaced by offerings from the hotel booking platform.

As the company continues to focus on cost-cutting measures, we expect Travelzoo’s net margin to increase slightly to 1.7%.

A revenue estimate of $104.4 million results in net income of $1.8 million. Given the average share count of 12.9 million, this gives us Earnings per share of $0.14. Keeping in trend with the growth over the past two years, we expect Travelzoo’s trailing twelve-month P/E multiple to be around 113 at the end of 2018, which when multiplied with expected earnings per share, gives us $16 as a fair price estimate.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.