Here’s What to Expect from Wheaton Precious Metals Q3 2017 Earnings Results

Wheaton Precious Metals (NYSE:WPM) is set to announce its third quarter results on 9th Nov, 2017 and conduct a conference call with analysts the following day. [1]

The company saw a strong third quarter in 2016 owing to a surge in demand for safe-haven assets due to the increased global uncertainty in the wake of the June EU referendum. This will most likely post as an offset for the current quarter when compared on a Y-O-Y basis, even though price realization for precious metals averaged at a nominal level on Q-O-Q basis. Precious metals saw a steady demand this quarter due to the ongoing uncertainty prevailing in the Korean Peninsula, which was slightly offset with the increased probability of interest rate hikes in the U.S.

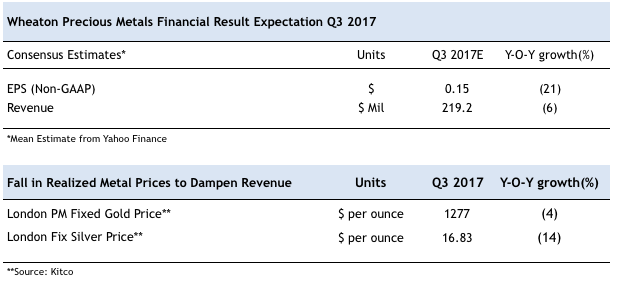

Below is the consensus market estimate for the upcoming earnings release which is much lower on a Y-O-Y basis due to the aforementioned reasons.

- A 3x Expected Rise In Mounjaro Sales Is Likely To Drive Eli Lilly’s Q1

- What Should You Do With Danaher Stock At $250 After Q1 Beat?

- Will A Macau Recovery Drive MGM Stock Higher Following Q1 Results?

- Lockheed Martin Stock Will Likely Remain In Focus After A Stellar Q1

- Up 17% YTD, What To Expect From eBay Q1 Results?

- Rising 21% This Year, What Lies Ahead For Exxon Stock Following Q1 Earnings?

In addition to that, the company is yet to provide an update regarding the status of the company’s tax dispute with the Canadian Revenue Agency (CRA) and we would be looking forward for more information during the upcoming earnings conference call. Most of Wheaton Precious Metals’ income generating activities are conducted by its subsidiary, Silver Wheaton (Caymans) Ltd, which is subject to the income tax jurisdiction of the Cayman Islands and hence does not pay income tax. [2] The CRA reassessed the taxes on the income earned by Wheaton Precious Metals’ foreign subsidiaries for the period 2005-2010 in 2015 and has argued that this income should be subject to taxes in Canada. [2] Furthermore, the CRA is also conducting an audit of Wheaton Precious Metals’ international transactions for the years 2011-2013. [2] The outcome of this dispute would have significant implications on the company’s future prospects and we look forward to see how these developments take shape.

We have a $19 price estimate for Wheaton Precious Metals which is 8% lower than the market price.

Have more questions about Wheaton Precious Metals? See the links below.

- Wheaton Precious Metals’ Q2 Earnings Review: Stability In Prices Relative To Last Year Tempers Earnings Growth As CRA Dispute Remains Unresolved

- What Are The Factors Driving Gold Prices This Year?

Notes:

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)

Notes:- Wheaton Precious Metals To Release 2017 Third Quarter Results On November 9, 2017, Wheaton Precious Metals News Release [↩]

- Wheaton Precious Metals’ Q3 2016 Earnings Release, SEC [↩] [↩] [↩]