Is Restaurant Brands Undervalued?

Yes, as per Trefis Price estimate Restaurant Brands International‘s (NYSE: QSR) valuation comes to $70 which is higher than the current market price. Restaurant Brands is one of the world’s largest quick service restaurant (“QSR”) companies with more than $30 billion in system-wide sales (in 2018) and over 26,000 restaurants in more than 100 countries and U.S. territories as of September 30, 2019. Their Tim Hortons®, Burger King®, and Popeyes® brands have similar franchise business models and are managed independently by the company.

In this note we discuss our stock price valuation for Restaurant Brands. You can look at our interactive dashboard analysis ~ Restaurant Brands International’s Valuation: Cheap or Expensive? ~ for more details.

- Will Q4 Results Help Extend The 20% Gain In Restaurant Brands’ Stock Since Early 2023?

- After A 9% Top-Line Growth In Q2 Will Restaurant Brands Stock Deliver Another Strong Quarter?

- What To Expect From Restaurant Brands’ Stock Past Q2 Results?

- Restaurant Brands Stock to Likely See Little Movement Post Q1

- What’s Next For Restaurant Brands Stock?

- What To Expect From Restaurant Brands Stock Post Q4?

#1. Estimating Restaurant Brands’ Total Revenues:

- Total Revenue increased from $4.1 billion in 2016 to $5.4 billion in 2018, and is expected to increase by 5.7% to $5.7 billion in 2019. Our Interactive Dashboard Analysis, How Does Restaurant Brands Make Money?, Provides An In Depth View Of The Company’s Revenues.

#2. Deriving Restaurant Brands Net Income:

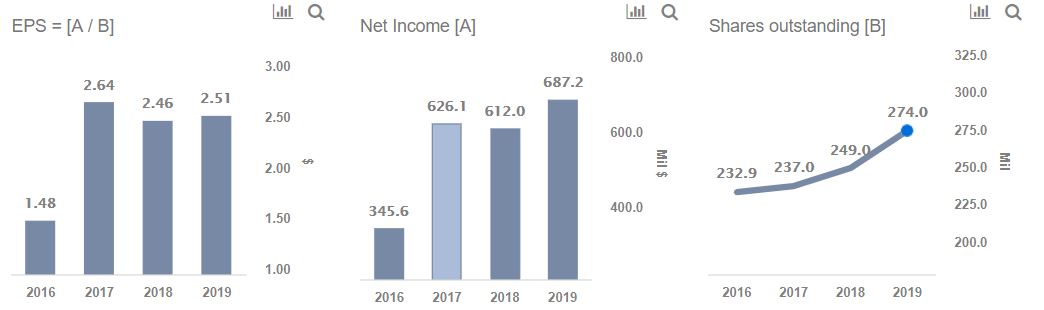

- Net Income margin moved from 8.3% of Total Revenue in 2016 to 13.7% in 2017 and back to 11.4% in 2018. The sudden high increase in Net Income Margin in 2017 was a result of favorable income tax expenses for the year. Trefis estimates the margin to be around 12.1% in 2019.

- In absolute terms, Net Income grew from $345.6 million in 2016 to $612 million in 2018, and is expected to be around $687.2 million in 2019. This increase will likely be led by an increase in margins and higher revenues.

#3. Determining Restaurant Brands’ EPS:

- EPS has grown from $1.48 in 2016 to $2.46 in 2018, and we estimate it to be $2.51 in 2019.

- EPS fall in 2018 can be attributed to lower Net Income and higher Shares outstanding.

#4. Estimating Restaurant Brands’ Share Price:

- Our Price Estimate of $70 For Restaurant Brands’ Stock is based on our Detailed Valuation Model, and implies a 28.1x P/E Multiple on expected 2019 EPS of $2.51

For more information regarding how the company compares with its competitors in terms of Revenue and P/E multiple please visit our interactive Dashboard – Restaurant Brands Valuation.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.