Paychex Earnings Preview: Steady Growth In Payroll Processing, HR Services To Drive Results

Paychex (NASDAQ:PAYX) is scheduled to announce its Q3 FY 2017 earnings before markets open on March 29. [1] Paychex has reported high single digit revenue growth over the last few years, with HR outsourcing and services business driving much of the growth. HR outsourcing revenues have grown at over 15% over the last few years, while its core payroll processing business has grown at a steady 3-4% in the same period. Keeping up with the trend, Q1 and Q2 FY’17 revenues were up by high single digits, with HR outsourcing revenue growth in the mid-teens in the same period. Comparatively, revenues from payroll processing revenues and interest earned on client funds were up by mid-single digits, as shown below.

- Can Paychex Stock Recover To Its Pre-Inflation Shock Highs?

- Can Paychex Stock Recover To Its Pre-Inflation Shock Highs?

- With The Job Market Holding Up, What To Expect From Paychex Q2 Results?

- What To Expect From Paychex Q1 Results

- What’s Happening With Paychex Stock?

- Forecast Of The Day: Paychex Management Solutions Revenue

Steady Growth For Payroll Processing

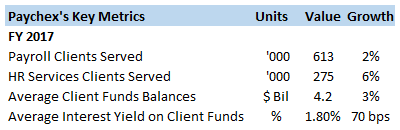

The total number of payroll processing clients served by Paychex has increased by 1-2% in the last few years, complemented by a 2-4% price increase. [2] We expect payroll processing clients served to increase by around 2% for the year.

HR Outsourcing To Continue Growth Spree

Over the years, Paychex has cemented its dominant position in the HR outsourcing market for small and medium-sized businesses. On the other hand, competing firm ADP (NASDAQ:ADP) has a significant presence in the large enterprise space. With the small business job market trending upward over the last couple of years, Paychex is poised to capitalize on that growth. [3] We forecast the growth in Paychex’s HR outsourcing business to continue, with the total number of HR services clients increasing by 6% through FY 2017 to 275,000 clients.

The third key area of growth for Paychex in the near term will likely be the interest earned on client assets. Revenues generated via interest on client funds for the first half of the fiscal year were up by 7% to $23 million. Despite a relatively flat average client fund balance over the prior year period, the revenue generated was higher on a y-o-y basis due to a high yield on these funds. Over the last few years, interest rates have been extremely low, due to which the yield on client funds stayed flat at around 1.0-1.1% over the last few years. The eventual hikes in interest rates should help the company post significant revenue growth from this segment over the coming years. We forecast the yield on client funds to improve to around 1.6% in FY 2017 and subsequently increase to over 4% by the end of our forecast period.

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- Paychex, Inc. Schedules Third Quarter Fiscal 2017 Earnings Release Conference Call For March 29, 2017, Paychex Press Release, March 2017 [↩]

- Paychex Q2 2016 Earnings Call Transcript, Seeking Alpha, December 2015 [↩]

- Small Business Employment Growth Consistent with 2015, According to Paychex, IHS Small Business Jobs Index, December 2016 [↩]