Company Of The Day: Lululemon Athletica

What?

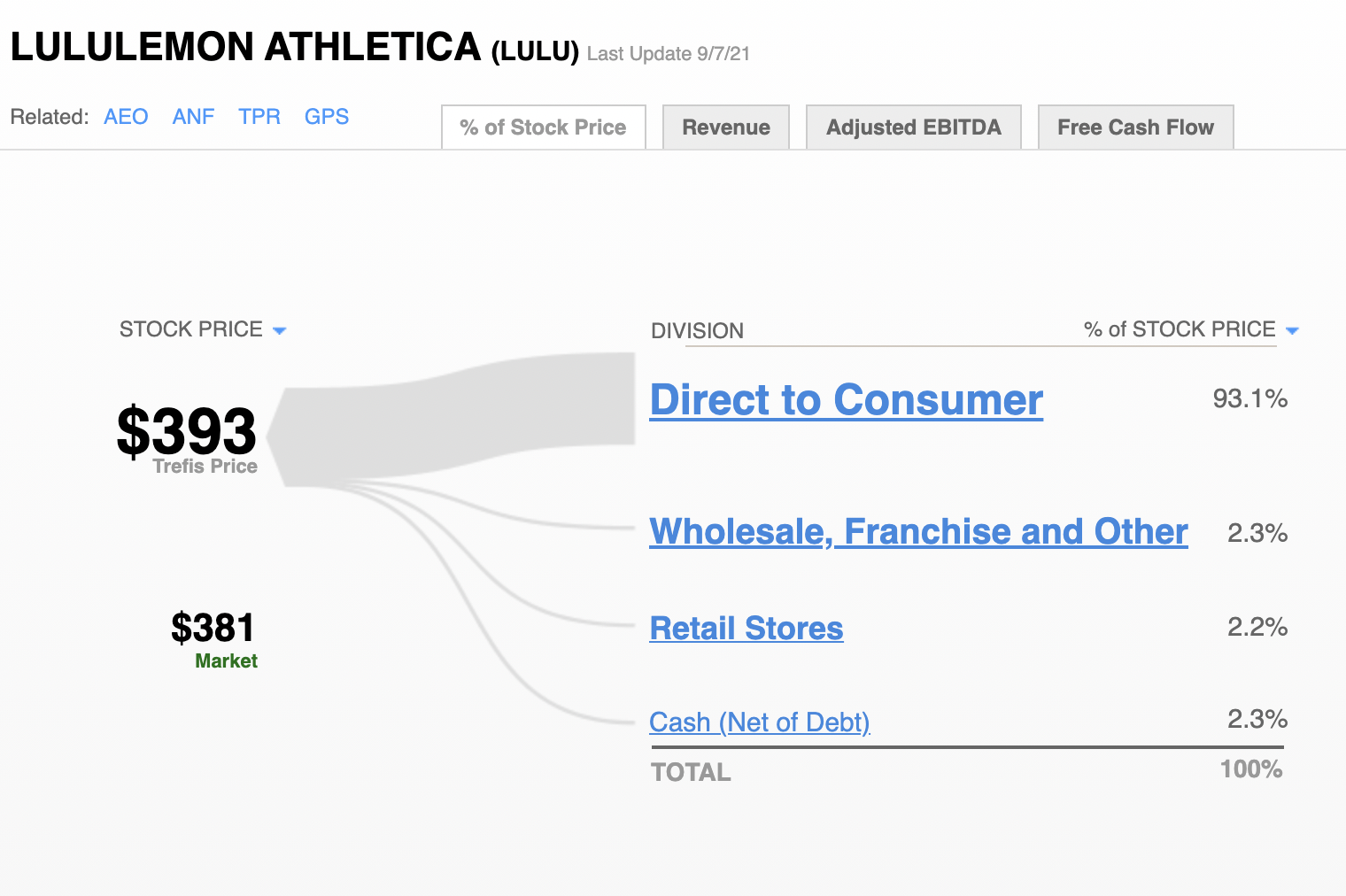

Lululemon Athletica (NASDAQ:LULU) reported a stronger than expected set of Q2 2021 results, with revenue rising 61% year-over-year to $1.45 billion and adjusted EPS coming in at $1.65, up from $0.74 in Q2 2020.

Why?

- Lululemon’s Stock Down 34% YTD, What’s Happening?

- Down 9% This Year, What’s Next For Lululemon’s Stock Past Q4 Results?

- Lululemon Stock Up 52% In Past Year. What Should You Expect Now?

- Will Lululemon Stock Trade Higher Post Q2?

- Will Lululemon Stock See Higher Levels Post Q1?

- Earnings Beat In The Cards For Lululemon Stock?

The results were driven primarily by company-operated stores, which saw revenues rise 142% year-over-year. Direct to consumer revenue also rose by about 8%. Gross margins also increased 390 basis points versus last year.

So What?

Lululemon stock was up by almost 13% in Wednesday’s after-hours trading following the earnings report.

See Our Complete Analysis For Lululemon

What if you’re looking for a more balanced portfolio instead? Here’s a high-quality portfolio that’s beaten the market since 2016

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams