Can Baidu End The Year On A Strong Note After Mixed Q3?

Baidu (NASDAQ:BIDU) recently announced its third quarter earnings, reporting a 27% increase in net revenue to ¥28.2 billion ($4.1 billion) for the quarter. Growth came from both the Baidu Core segment (+25%) as well as iQiyi (48%). Despite strong revenue growth, the company’s adjusted EBITDA stood at ¥6.8 billion ($1 billion), which was flat over the comparable prior year period. As a result, Baidu’s adjusted EBITDA margin compressed by around 5 percentage points to 24%. The fall in margins was attributable to an increase in content costs primarily for iQiyi. However, Baidu’s net income and resulting earnings per ADS were up 55% to ¥12.4 billion ($1.8 billion) and ¥19 ($2.77), respectively, due to gains from the disposal of Baidu’s financial services business Du Xiaoman.

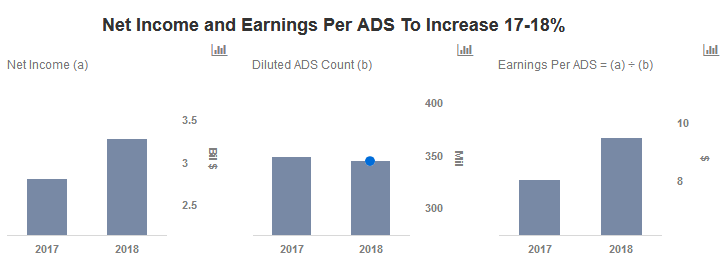

We forecast Baidu’s full year revenues to increase 16-17% to $15 billion. Our revenue estimate is slightly higher than consensus estimates. On the other hand, we expect margins to expand by around 1 percentage point through 2018 to 24% for the year, leading to a 25% increase in its operating profit. We have summarized our full year estimates on our interactive full year earnings forecast dashboard for Baidu. You can modify our forecasts for segment revenues and margins to gauge how it would impact the company’s earnings for 2018.

Growth Metrics

The total number of active online marketing customers at Baidu rose to 522,000 by the end of September, up from 490,000 in the comparable prior year period. To complement the increase in marketing customers, the average revenue generated per customer was up 12% on a y-o-y basis to ¥43,100 ($6,300). This resulted in an 18% increase in advertising revenues to ¥22.5 billion ($3.3 billion). This represents revenues generated across both core services as well as marketing revenues on video streaming platform iQiyi.

Non-marketing revenues or other revenues (primarily from iQiyi subscriptions) were up 80% on a year-over-year basis to ¥5.7 billion ($833 million). Correspondingly, content costs surged by over 70% compared to Q3’17 to ¥6.7 billion ($1 billion) due to the company investing in creating new original content for iQiyi. In recent quarters, the increase in Baidu’s traffic acquisition costs has slowed down to single digits, representing organic growth in traffic on its platforms. This is a huge positive for the company going forward. Similarly, the increase in bandwidth cost has stabilized at 10-12%. This trend has been evident through the year thus far, and is expected to continue through the end of the year. As a result, operating profit margin is expected to pick up by 1 percentage point through the December quarter even as content costs remain high.

See Our Full Analysis For Baidu

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own