Is Blue Apron Undervalued Right Now?

Blue Apron’s (NYSE: APRN) valuation has taken a nosedive since it decided to go public last year. In 2015, the company was a dominant player in the meal-kit delivery market, and as per the last round of funding it received, its valuation was estimated at roughly $2 billion. However, prior to the IPO, its target price range was slashed from the range of $15 to $17 per share, to between $10 and $11, implying a valuation that would be just under $2 billion. Meanwhile, the stock currently trades at $2, with a market cap of roughly $400 million. While a lot of the blame for this decline rests on the company, which has noted a reduced customer count, a fall in order value, and a decline in orders per customer, some of the factors have been outside the control of the company, such as the acquisition of Whole Foods by Amazon (NASDAQ:AMZN) soon after APRN filed for its IPO, which paved the way for the tech giant to enter this fast-growing industry. Looking ahead, Blue Apron is aiming for double-digit revenue growth and adjusted-EBITDA breakeven in 2019. In this article, we’ll focus on estimating Blue Apron’s valuation, and why we feel it is currently undervalued.

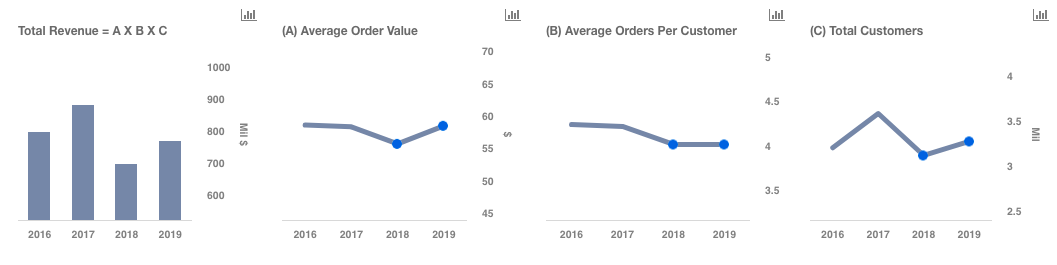

We have estimated a $3.64 price for Blue Apron, which is substantially higher than the current market price. The charts have been made using our new, interactive platform. You can click here for our interactive dashboard on Estimating The Valuation Of Blue Apron to modify different drivers, and see their impact on the revenue and price estimate for Blue Apron.

- Meta Platforms Stock Dropped 10.6% In A Day, What’s Next?

- What Factors Will Drive Pfizer’s Q1 Performance?

- A Rebound In Asia Travel Will Likely Drive Estée Lauder’s Q3 Performance

- Higher Medical Costs Likely Weighed On CVS Health’s Q1 Earnings

- What’s Next For PepsiCo Stock After A Q1 Beat?

- Down 9% This Year, What Lies Ahead For Starbucks Stock Following Q2 Earnings?

We have arrived at a $3.64 price estimate for Blue Apron based on revenue projections of $768 million for 2019, a P/S multiple of 1, and a share count of 211 million. The market price stood at $2.24 as of August 9, 2018, implying our price estimate is higher by 60%.

We have kept the P/S multiple low, at 1, given the high volatility and increased level of competition in the industry. The company’s leading competitor, HelloFresh, which took over the number 1 spot in the U.S. meal-kit delivery market, is currently trading at a P/S multiple of 1.8.

We have computed revenues of $697 million in 2018 and $768 million in 2019 based on three drivers – Average Order Value, Average Orders per Customer, and Total Customers. While all three metrics are expected to undergo a decline in 2018, based on the trends seen in the financials posted by the company in the first six months, we expect a recovery to be posted next year. A number of factors are responsible for this, which have been highlighted below:

1. Growth In The Industry: The meal-kit industry in the U.S. was valued at almost $5 billion in 2017, a significant growth from $1.5 billion in 2016, with the cost-effective nature and convenience of these meals being the main factors driving this increase. The market is expected to grow to roughly $11.6 billion by 2022. In a survey conducted by Nielsen earlier this year, it was found that 9% of Americans had purchased a meal-kit in the previous 6 months, translating to 10.5 million households. Meanwhile, 25% of consumers were considering trying a meal-kit in the next 6 months (roughly 30 million households).

2. Deal With Costco: Blue Apron started a pilot program with Costco in early May, in a bid to make its meal-kits available to a larger audience. Since then, it has already grown to 80 locations, from 17 originally. The company intends to continue testing more locations and more recipes, with regional tastes taken into account. Such a partnership not only allows Blue Apron to reach more consumers, but also attracts customers who may not be comfortable with a subscription model. Moreover, the customer acquisition and shipping costs are much lower in the retail model than in the direct-to-consumer (DTC) model.

3. Partnership With Fox Show Bob’s Burgers: In late June, APRN announced a partnership with 20th Century Fox, which will result in three recipes from the Emmy-winning show, Bob’s Burgers, turned into recipes consumers can cook at their home. In May, the company also announced a partnership with New York Times bestselling cookbook author Chrissy Teigen, who is known for creating easy-to-make recipes. Such partnerships will aid in increasing consumer awareness and creating added relevance for the company.

4. Increased Marketing: Blue Apron had been spending a substantial amount on marketing prior to its IPO – $144 million in FY 2016 and $61 million in Q1 2017. On the other hand, post the listing, the marketing expenses fell to $35 million, $24 million, and $25 million in Q2, Q3, and Q4 2017, respectively. Consequently, its number of customers also fell from 1,036K in Q1 to 943K, 856K, and 746K in Q2, Q3, and Q4 2017. The company was rewarded for sequentially increasing its marketing spend in Q1 2018 with an increase in the customer count to 786K. For the remainder of the year, the company is focusing on marketing efficiency, as well as investments in influential brand partnerships and experiential activations. While the company was not able to continue the momentum in the second quarter, these efforts should begin to show results in the medium term.

5. Opening Of New Fulfillment Center: After delays and unexpected costs in the development of Blue Apron’s fulfillment center in Linden, New Jersey, it is now up and running. During its second quarter earnings conference call, CEO Brad Dickerson stated that the new fulfillment center has resulted in “greater cost savings, increased speed of execution, and improved agility.” By being flexible and able to quickly adapt to new product offerings, the company can deliver better customer experiences, which may encourage repeat orders.

6. Expanding Menu Offerings: Blue Apron is working to bring new additions to its menu based on extensive data and analytics conducted by the company. For example, in the second quarter, the company increased recipes and protein options in its family plan. APRN is also focusing on strengthening its e-commerce platform, and in the quarter, it launched two new offerings – special occasion meal and summer grilling box – both of which are aimed for larger gatherings. The company intends to continue to innovate and add customized recipes, such as the introduction of recipes that can be prepared in 20-25 minutes in September, coinciding with the back-to-school season, and launching recipes compliant with Whole30, a lifestyle program that encourages consuming wholesome, nutritious foods.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.