Building a Platform To Do The Job Of

1 Million Analysts

Milestone: HQ Strategy Beat S&P each year, 2021, 2022, 2023. We found '0' ETFs or funds like that.

Correct, you just can't do this anywhere else!

- Spans companies, countries, markets and macro issues

- New data and analyses added each week

Save time. Reduce friction.

- Modify forecasts and see the impact real-time

- Eliminate "number crunching" latency

- Modify as many forecasts as you like

- Save unlimited scenarios

- Present scenarios as strategic alternatives for team discussions

- Assess risk-reward

- Compare

- Control the default view for your forecasts.

- Allow collaborators to change views on the fly.

- Access entire 1M strong dataset via simple search

- Use suggested comparisons or create your own within seconds

- Trefis aligns with your workflow

- Rich commentary along with charts

- Span variety of topics

- Change layout and charts

- Include your own commentary

- Insert your own forecasts

Upload Excel model directly from desktop. Convert into a dashboard in minutes. Try for yourself.

Trefis is Excel model plug-and-play.

- No Excel templates

- No IT deployments

- No integration consultants

- Trefis transforms your Excel models in a matter of minutes

Correct, you just can't do this anywhere else!

- Modify assumptions, see impact on revenue, other financial metrics, right-away

- Reduce friction, add clarity to discussions

- Reduce rework, follow-ups, and meeting iterations

- Eliminate "number crunching" latency

Don't try mind-reading or just guesswork!

- Use saved individual assumptions to focus dialog in live meetings

- Revise assumptions and record as often as needed

- All opinions and charts in one place. Lose nothing

- Preserve the alternatives. Pick up exactly where you left

- Don't just meet, or guess the impact, instead see impact of opinions on financials and metrics that matter

- Present scenarios as strategic options for executive consideration, accelerate buy-in and richer dialog.

- Modify as many forecasts and create as many scenarios as you wish.

- Provide team members with secure access to your interactive models and scenarios.

- Control the default view for your forecasts.

- Allow collaborators to change views on the fly.

- Put forecast discussions in context by pulling in relevant data from other models or databases.

- Conveniently access data via search.

- Plot data on forecast inputs or outputs.

Editorial curation built into Trefis so you can control the narrative.

- Decide which forecasts and data are accessible via Trefis as easily as drag and drop.

- Hide or exclude forecasts or results that aren't core.

- Add headings, commentary or takeaways to provide context.

- Skip the charting in Excel, pasting into PowerPoint for discussion process entirely in some cases.

Editorial curation built into Trefis so you can control the narrative.

Now people have become used to it.

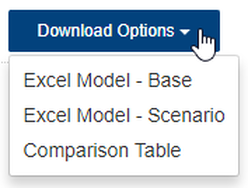

- Download forecast changes and scenarios made via Trefis back into Excel.

- Re-upload in minutes revisions made in Excel to Trefis and see your changes reflected.

Whether internal work-sessions, or executive meetings - we are passionate about how clients are using Trefis in new and creative ways for their business dialog to:

- Answer what-ifs real-time.

- Compare differences in opinion and assumptions, instantly see impact on finances.

- Record the differences, without losing the consensus.

Ultimately - Break The Iterative Cycle!

- Reduce repetition & friction.

- Meet less. Produce more.

- Align better.

Excel. PowerPoint. Meetings.

Excel. PowerPoint. Meetings.

Repeat.

Loop.

Is this a familiar iterative cycle?