Coca-Cola Earnings Review: Strong Organic Growth Reflects Solid Core Business Performance

Currency headwinds continue to hamper growth for The Coca-Cola Company (NYSE:KO). The world’s largest beverage maker reported a solid 4% year-over-year rise in organic revenues in Q2 on July 22, only to be let down, yet again, by negative currency translations, which were a 7 percentage point headwind on the top line. Coca-Cola’s Q2 results tell a story of a strong core business, which seems to be doing well (even the sugary sodas, surprisingly), but unfavorable foreign exchange have taken a toll on the financials of the company, which generates more than 55% of its net sales from markets outside the U.S. However, currency may only be a near-term headwind, and the focal point of our discussion will be the performance of the core beverage business.

We estimate a $44 stock price for Coca-Cola, which is above the current market price.

See our full analysis for Coca-Cola

- Should You Pick Coca-Cola Stock At $60 After Q4 Beat?

- Down 10% This Year Is Coca-Cola Stock A Better Pick Over AbbVie?

- What’s Next For Coca-Cola Stock After 4% Gains In A Week Amid Q3 Beat?

- Down 15% This Year Will Coca-Cola Stock Rebound After Its Q3?

- Which Is A Better Beverage Pick – Coca-Cola Stock Or Monster Beverage

- Pricing Actions To Bolster Coca-Cola’s Q2?

Successful Marketing And Pricing Initiatives Drive Growth

Coca-Cola accounts for a substantial 42.3% of the net volumes in an already somewhat saturated and mature U.S. carbonated soft drinks (CSD) market, but still managed 1% growth in CSD volume in North America, and a 3% rise in net revenues from this operating unit. This reflects how the company’s various marketing strategies and product campaigns have resonated with the consumers, which is crucial considering that soft drinks are mostly an impulse buy, and what gives a company an edge is more reach, availability, and its social connect with the customer.

The top line growth in North America came mainly on 4 percentage points of effective net pricing. The consumer price index for non-alcoholic beverages rose throughout Q2 in the domestic market, bolstered by stronger economic conditions, allowing beverage companies to raise their retail prices. In addition, while Coca-Cola’s sparkling volume rose 1% in North America, transactions rose 2%–this means more proportionate sales of smaller packages. Why this stands to benefit Coke is because these smaller bottles and cans have a higher price per unit and contribute positively to the mix, driving top line growth. In this quarter again, Coca-Cola’s mini can sales increased by double digit percentages, pushing-up average revenue per unit.

Another win for Coca-Cola has been the growth in its Coke Zero volumes, which rose 6% globally in the quarter. Customers remain wary of low/no calorie soft drink consumption, mainly due to the possible harmful effects of the artificial substances used in these drinks. Although Diet Coke declined 7% in the quarter, the growth in Coke Zero might be a sign of how even the segment which is considered the biggest liability, as of now in beverages, and for Coca-Cola, is ready for a turnaround.

Bottled Water Growth Is Not To Be Neglected

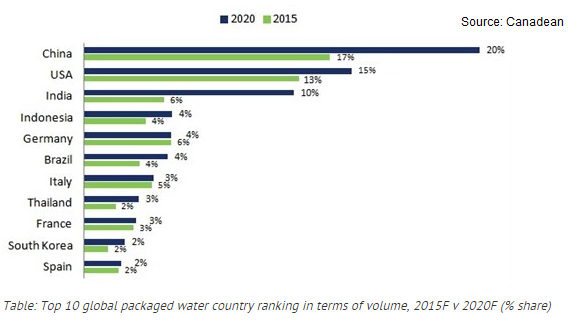

Water contributes ~14% of Coca-Cola’s net value, according to our estimates, and with this beverage segment set to overtake CSDs as the most consumed beverage worldwide this year, we take a look at Coca-Cola’s bottled water business. According to the Canadean, consumption of packaged water will reach 233 billion liters in 2015, more than the intake of CSDs, which is estimated to be around 227 billion liters. [1] Packaged water grew 8% globally for Coca-Cola this quarter, and could be a growth driver in the coming quarters, too, considering the potential in this market.

The company’s water brand Dasani sells approximately 16% of net volumes sold by the drink Coke in the U.S. Coca-Cola’s still water brands – Dasani, Glaceau Vitaminwater, and Glaceau Smartwater – had combined sales of roughly $2 billion last year, and PepsiCo’s Aquafina had sales of $0.86 billion, with both companies holding market shares of 21.4% and 9.2%, respectively, in the still water category (the largest bottled water category) in the U.S. However, the leader in this market is Nestlé Waters with a share of ~24% owing to successful brands such as Nestlé Pure Life, Poland Spring, Deer Park, and Ozarka. So, unlike the dominance in U.S. CSDs, Coke still has some way to go in packaged water in the country. Although packaged water has traditionally been a low-margin business, Coca-Cola stands to gain from the growing demand for products such as Smartwater, which is marketed as a premium product, in both the U.S. and Europe.

Coca-Cola’s solid organic growth in the first half could continue into the second, which could be a testament to the company’s resilience in its transitional year. The company is focusing on improving its operating performance in North America–looking to refranchise two-thirds of its bottling territories in the region by the end of 2017, and a substantial portion of the remaining territories no later than 2020, in a bid to move away from the capital intensive and low-margin business of distribution. And then there are the Monster and Keurig deals, and the premium milk brand Fairlife, which could add incremental sales going forward. The Monster deal, which gives Coca-Cola a 16.7% stake in the company for $2.15 billion, closed during the second quarter. These new developments are expected to alter the dynamics at The Coca-Cola Company in the future. Sales are expected to be dented by negative currency translations in the near term, but strong organic growth (even in CSDs), could pave the way for future growth.

See the links below for more information and analysis:

- Coca-Cola mid-year earnings preview: strong dollar to weigh on results again?

- Bottled water is a potential growth category that can’t be ignored

- Soda makers wonder: where could growth in U.S. come from?

- Coca-Cola beats consensus estimates; delivers strong growth in Q1

- Negative currency translations overshadow PepsiCo’s strong organic growth in Q1

- Trefis analysis: Coca-Cola Coke U.S. Revenues

- Trefis analysis: Coca-Cola Diet Coke International Revenues

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research