Securitizing Sunlight Could Help Fund Next Solar Boom

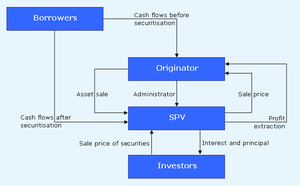

Underwriters from multiple banks are looking at opportunities for the securitization of power output from rooftop solar installations to fund future solar installations. [1] The proposed structures are similar to mortgage or loan based securities in that the returns to the holder are backed by future payments on the underlying assets (in this case, the electricity generated from solar installations).

Such securities could come as a major step forward in financing solar installations as developers are facing reductions in government incentives. According to estimates, securitization could become a major source of funding for developers such as First Solar (NYSE:FSLR).

- Down 6% This Year, What’s Happening With First Solar Stock?

- Down 17% In The Last Six Months, Will First Solar Stock Recover Post Q4 Results?

- Up A Mere 15% In 2023, Is First Solar Stock Poised To Do Better In 2024?

- Down 30% From Highs Seen In May 2023, Where Is First Solar Stock Headed?

- Why Is The Hydrogen Theme Underperforming This Year?

- Why This Renewables Theme Is Underperforming In A Strong Market

We have a $22 price estimate for First Solar, which is 50% premium to its current market price.

Click here for our full analysis of First Solar.

New wave

Solar developers in the U.S. are looking for alternative means to finance solar development after the expiration of tax incentives last year. Installations in the country are expected to jump by 75% to over 3.2 GW in 2012 and securitization could provide a new source of funds for the proposed development. [1] Securitization can lower the cost of funding for developers that currently depend on bank loans or the sale of tax credits to generate capital. Developers could finance rooftop installations by structuring securities to divert monthly payments for the electricity generated to holders. The trend is expected to catch up as solar electricity reaches retail grid parity can consumers can purchase solar energy from rooftop installations at prices lower than those offered by utilities.

First Solar is involved in multiple large scale solar developments in the U.S. Some of its projects have qualified for subsidized loans from the Department of Energy and the company has also managed to sell some of its projects to major utilities, which are required to source some of their electricity production through renewable sources. Securitization can result in another major source of funding for the company’s future projects. First Solar is becoming increasingly dependent on its systems installations business to drive its revenues as well as panel sales. The emerging trend of securitization could lead to a significant increase in the solar installations, boosting its systems business in thh long run.

Understand how a company’s products impact its stock price on Trefis.

Notes:- First Solar Bonds Financing $4.6 Billion U.S. Panel Boom, Bloomberg [↩] [↩]