Cree’s Growth Shines On LED Lighting Demand

Quick Take

- Strong growth in lighting products and lower per lumen LED cost led to higher LED adoption, which in turn increased Cree’s Q3 2013 sales by 23% y-o-y and gross margins to 38.1%.

- The LED market dynamics are improving with the lighting segment witnessing the fastest growth. Available for as low as $10, Cree’s new LED bulb will go a long way in accelerating LED adoption.

- The LED lighting segment is estimated to increase from around $1.5 billion in 2012 to approximately $8 billion by 2015.

- The acquisition of Rudd in August 2011 made Cree the market leader in both LED components and LED Lighting products.

- With cost reductions across product lines, increased volumes and lower costs of new product designs, we expect Cree’s gross margins to continue improving in the future.

Cree (NASDAQ:CREE), a leading LED manufacturer, announced its Q3 2013 earnings on April 23. Though seasonal factors restricted its sequential growth, the company witnessed a 23% annual increase in revenues to $349 million. Strong growth in lighting products and its ability to reduce the per lumen LED cost led to higher LED adoption despite the slow macro environment. Improving factory utilization, process improvements and new lower-cost product designs increased Cree’s gross margin to 38.1%, compared to 34.9% in Q3 2012. Additionally, a strong execution and focused capital spending increased its cash and cash equivalent by more than $50 million in the quarter.

Cree claims that its current quarter order backlog is stronger compared to the same quarter last year. Its product innovation has opened new applications and improved LED payback in turn driving demand for its products. Cree remains committed to driving LED adoption and closing down the gap with conventional lighting through innovation. In the long run, it aims to drive mass LED adoption and achieve 100% upgrade to LED lighting by its customers.

With improving LED market dynamics we believe Cree’s top line will continue to grow at a rapid pace for years to come. It has a solid balance sheet with strong cash position and no debt, which gives it the ability to continue investing in growing its business in the future as well.

See Our Complete Analysis for Cree Here

See Our Complete Analysis for Cree Here

Accelerating Growth In LED Lighting

Despite the soft macro conditions, Cree claims that the LED market dynamics are improving as manufactures focus on driving global LED adoption and cut excess manufacturing capacity. Cree witnessed strong growth across its LED product portfolio in Q3 2013. While its LED component revenues increased by 8% y-o-y, LED lighting sales grew at a robust 51% during the same period. Strong sales of commercial indoor fixtures and the launch of CREE LED bulb in the quarter more than offset the seasonally lower outdoor lighting sales in the cold weather regions.

Cree claims that its LED bulb is the biggest announcement in the lighting industry in perhaps the last few years and will go a long way in accelerating LED adoption. Available for as low as $10, its new LED bulbs consume 84% less energy and provide similar levels of brightness compared to traditional bulbs.

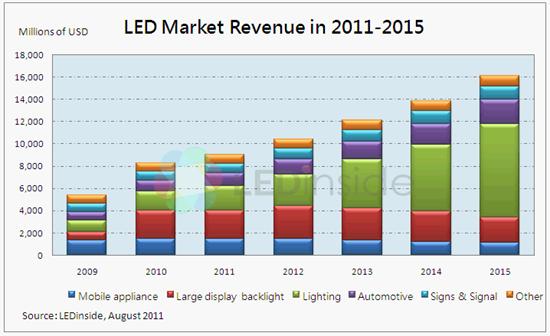

With the demand from the backlight market nearing saturation, the expanding general lighting market is slated to drive LED sales in the future. As per LED Inside, the LED lighting segment is estimated to increase from around $1.5 billion in 2012 to approximately $8 billion by 2015, a CAGR of over 70%.

Cree has a fully integrated vertical lighting model and intends to continue working on building new lighting systems to reduce the cost of LED lighting and improve payback. It made good progress in releasing several new fixtures in the last few months, including the performance upgrade to its LEDway Series and LED Streetlights.

With the acquisition of Rudd’s portfolio in August 2011, Cree became the market leader in both LEDs and LED Lighting products. LED lighting products currently account for 35% of Cree’s total revenue, a substantial increase from 19% a year ago. While we expect LED component sales to continue increasing, we believe that a higher revenue contribution from the LED lighting market will be the key driver for Cree’s future growth.

Improving Gross Margins

Decreasing LED selling prices and high operating expenses led to a drastic decline in Cree’s gross margins in 2011. However, despite a very competitive market environment, it marked a continuous improvement in gross margins in 2012 on account of factory cost reduction, improved production yields and lower cost of new products. Improving LED demand led to higher factory volumes which in turn increased gross margins to over 38% in Q1 2013. Owing to cost reductions across its product lines, increased volumes and lower costs of new product designs, Cree expects margins to improve this quarter as well.

Cree continues to make incremental R&D investment each quarter and anticipates higher operating expenses in Q4 to support its media campaign, seasonal trade shows and sales expenses. However, we expect its marketing expense to decline in the future. Additionally, as adverse macro conditions subside and demand further picks up, we expect higher revenues for a similar cost base to increase Cree’s margins over the years.

Q4 2013 Outlook

– Revenue in the range of $365 million to $385 million

– Double digit growth in lighting, single digit growth in LEDs and a marginal increase in power and RF

– GAAP gross margins to increase to 39%

– GAAP operating expenses to increase to $4 million

– Tax rate of 20%

– GAAP net income in the range of $25 – $31 million

– GAAP EPS between $0.34 and $0.40 per diluted share