Why Honeywell Will Likely Report An Earnings Miss For FY19

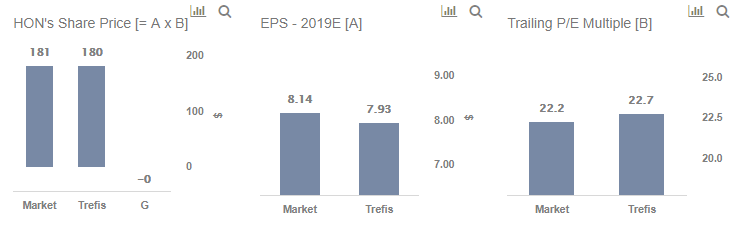

As per Trefis estimates, Honeywell (NYSE: HON) will report earnings per share of around $7.93 for full-year 2019 compared to the consensus expectations of $8.14. The company will release its Q4 and full-year 2019 results on Friday, January 31. We believe that Honeywell’s revenues will beat the consensus, but the earnings won’t. Honeywell should report revenues of $37 billion (vs. consensus estimate of $36.8 billion), which would be 0.4% higher than the figure for the previous year. However, earnings are likely to be around $7.93 (vs. consensus estimate of $8.14) – down from $9.02 reported in 2018. We believe that negative revenue growth and weaker-than-expected earnings for FY 2019 will result in a slight reduction in Honeywell’s stock price once it announces earnings. Our forecast indicates that Honeywell’s valuation is $180 a share, which is slightly below its current market price.

A] Honeywell’s Revenues expected to be slightly below consensus

- Total Revenues have increased from $39.3 billion in 2016 to $41.8 billion in 2018.

- Trefis estimates Honeywell’s revenues to decrease in 2019 due to the spin-off of its Turbo Chargers division (which was a part of the Aircraft and Automotive Components segment), as well as the spin-off of some businesses in the Safety and Security Products segment.

- Is An Earnings Beat In The Cards For Honeywell?

- Should You Pick Honeywell Stock After A 5% Fall This Year?

- Will Honeywell Stock See Higher Levels After A 15% Fall This Year?

- Which Is A Better Pick – Honeywell Stock Or Travelers?

- Which Is A Better Pick – Honeywell Stock Or Amgen?

- Which Is A Better Pick – Honeywell Or 3M Stock?

A separate interactive dashboard for Honeywell provides an in-depth view of Honeywell’s revenue trend and segment-wise revenue performance, along with forecast for 2019.

B] EPS To Be Higher Than Consensus

- Honeywell’s 2019 earnings per share (EPS) is expected to be $7.93 per Trefis analysis, lower than the consensus estimate of $8.14 per share.

- In 2019, a fall in revenues as detailed above will result in the EPS figure declining compared to the figure of $9.02 in the previous year despite a reduction in total expenses and lower share count.

- As we forecast Honeywell’s Revenues to decline at a similar rate as Expenses in 2019 (both 12%), this will result in the Net Income Margin figure shrinking slightly from 16.4% in 2018 to 16.2% in 2019

C] Stock Price Estimate Is Around The Market Price

- A trailing P/E multiple of 22.7x looks appropriate for Honeywell’s stock, which is a little higher than the current implied P/E multiple of 22.2x.

- As per Trefis, Honeywell’s 2019 revenue will be higher than market expectations, while earnings are expected to be lower. This works out to a fair value of $180 for Honeywell’s stock, which is around the current market price.

Additionally, you can input your estimates for Honeywell’s key metrics in our interactive dashboard for Honeywell’s pre-earnings, and see how that will affect the company’s stock price.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams