Shell’s BG Deal: It’s All About LNG and Pre-Salt Development

Anglo-Dutch oil major, Royal Dutch Shell Plc. (NYSE:RDSA), recently announced plans for a mammoth – $70 billion – acquisition of BG Group Plc. (LON:BG) to further extend its leadership position in the global LNG (liquefied natural gas) market and increase its exposure towards the exploration and development of deepwater hydrocarbon reserves, primarily the pre-salt reserves offshore Brazil. In this analysis, we briefly summarize the financial terms of the proposed transaction and then elaborate on why we believe that the deal is essentially a huge long-term bet on the growth in global LNG demand and the development of pre-salt crude oil reserves offshore Brazil. [1]

The Proposed Deal

Shell plans to acquire BG Group in a cash and stock deal valued at 1,350 pence per BG share. The company will pay BG shareholders 383 pence in cash and 0.4454 class B shares in itself for each share of BG held. This translates into a total valuation of around 47 billion pounds or $70 billion – at yesterday’s closing price – which represents a 52% premium to the 90-day volume-weighted average trading price for BG’s stock. The boards of both the merging companies have approved the terms of the deal, and it should be a reality by early next year if all the regulatory and shareholder approvals fall in place as planned. The combined entity will have net proved hydrocarbon reserves of approximately 16.7 billion barrels of oil equivalent and a reserves to production ratio of around 12.4 years, based on the latest annual figures reported by both companies. [1]

Its All About LNG and Pre-Salt Development

Shell is paying a huge premium for BG. One would think that since they are both large multinational oil and gas companies that would have a huge operating cost overlap, which should justify the 52%, or $24 billion, valuation premium. However, according to our estimates, cost synergies don’t even come close to justifying the sort of premium Shell is planning to pay for BG. The company expects to realize annual pre-tax cost savings of around $2.5 billion by 2018. After adjusting that figure for the post-tax operating cash flows impact, and the dilutive effect of the deal, it would mean annual cash inflows of approximately $1.25 billion for Shell’s current shareholders, starting in 2018. If we assume that these cash flows will continue in perpetuity, it would translate into a value addition of around $8.75 billion for its current shareholders at the time of the deal, which is just a small fraction (36.5%) of the total premium being paid by the company. Even if we assume that Shell included a 20% control premium – for not just holding a stake in BG, but gaining a majority control over it’s assets – it still means that the company’s intrinsic value estimate of the U.K.-based gas company is either based on the assumption of a higher growth in global LNG demand or a higher rate of growth in BG’s net crude oil production from Brazil, than what the market was already factoring in before the announcement of the deal, assuming that the company’s crude oil price forecast is in line with the broader market.

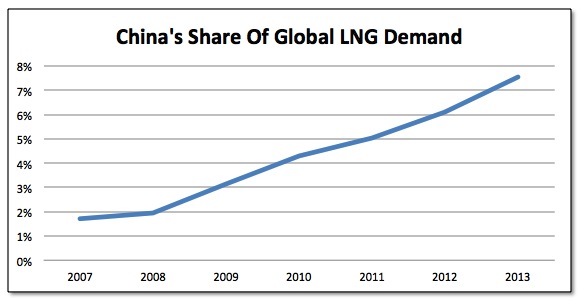

It makes sense for Shell to be optimistic about the outlook for global LNG demand because it is the market leader in terms of net LNG production. At 26 million tons per annum, the company’s current LNG capacity stands at around 11% of the total LNG supply worldwide. If we add BG’s net liquefaction capacity to that, the combined entity would be currently holding around a 14% share in the global LNG market. With the completion of the new liquefaction facilities under construction by 2018, the companies expect their combined net LNG capacity to be around 45 million tons per annum, significantly more than the second largest player in the industry, Exxon Mobil (NYSE:XOM). However, in the short to medium term, the global LNG supply is not expected to be tight, primarily because of the ongoing construction work on significant new capacity additions in Australia and the U.S. This means that there would be pricing pressures in the spot LNG markets and a limited scope for upside in the long-term contract prices, at least in the short to medium term. Therefore, we believe that Shell is probably placing a more longer-term bet on the growth in LNG demand, which could be because they have had a first-hand experience of the challenges associated with tapping shale gas reserves in China, and they believe that the country’s reliance on LNG would only increase in the long run. The chart below depicts how China’s share of the global LNG demand has grown over the past few years. [2]

Source: BP Statistical Review of World Energy 2014

In addition to further extending its share of the global LNG market through this deal, Shell will also be able to increase its exposure to the exploration and development of pre-salt hydrocarbon reserves offshore Brazil. The company’s crude oil production from Brazil stood at just around 50,000 barrels per day last year, but with BG’s non-operating interest in the ongoing development of pre-salt reserves in the deep waters of Brazil, it’s expected to grow to around 550,000 barrels per day by the end of this decade. However, the markets are probably factoring in a much slower rate of growth in BG’s pre-salt production from Brazil, primarily because the development projects are operated by Brazil’s state-owned oil and gas company, Petrobras (NYSE:PBR), which has been hit by a huge corruption scandal that has delayed its earnings announcements thereby significantly limiting its access to the debt markets. (See: Petrobras’ Cost of Capital Set To Rise After Moody’s Downgrade)

Overall, while we do believe that Shell’s broader strategy of acquiring BG to increase its focus on LNG and deepwater development projects is spot on, it has probably valued the target company a bit too aggressively and generating incremental returns from this investment might not be an easy task, at least in the short to medium term.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

Notes: