Key Concerns Impacting Cree’s $29 Valuation

Despite sluggish macro trends, Cree (NASDAQ:CREE) marked a solid start to its fiscal 2013 with record revenues of $316 million in the first quarter. However, the most important highlight of the Q1 earnings was the 60% sequential increase in Cree’s net income. High R&D costs and increasing operating expenses have put a downward pressure on margins, which saw a substantial decline in 2011.

Cree is a leading innovator of lighting-class light emitting diodes (LEDs), LED lighting and semiconductor solutions for wireless and power applications. The company is committed to drive LED adoption by optimizing performance and shrinking the gap between LED lighting and conventional technology. With a focus on investing in new product development and initiatives to drive product sales, we think that Cree is in a good position to leverage future growth in LEDs and that the market assigns a fair valuation to the company.

Here we highlight certain key trends and concerns prominent in the company’s Q1 2013 earnings results.

See our complete analysis for Cree

Will Cree Be Able To Sustain Gross Margin Growth?

While Cree’s gross margins increased significantly in 2010, they declined close to the historical level of around 37% in 2011. The downward pressure resulted from a combination of decreasing selling prices and high operating expenses as Cree stepped up R&D efforts to close down LED gap with traditional lighting. However, after eight quarters of consecutive declines in gross margin, Q3 2012 offered some respite with a slight increase in margins. While margins remained flat in Q4 2012, they rebounded to 37.5% in Q1 2013.

While Cree continues to make incremental investments each quarter, a decline in factory costs, higher yield improvement and the introduction of new lost cost products, both in LEDs and lighting, have somewhat eased the pressure on margins. Though there continues to be a lack of visibility on future demand, Cree looks optimistic of further increasing its factory efficiency and improving margins.

We expect that as the adverse macro conditions subside and demand picks up, higher revenues for a similar cost base would lead to a marginal increase in margins. However, with the shift in product mix toward lower margin fixtures and a potential increase in competition, we expect margins to remain more or less around the same level.

Has Cree Completely Revived From The Agent Transition Setback?

Cree’s revenue from its lighting division took a $9 million hit in Q3 2012 as the company lost its short-term momentum due to agent transition. During the integration with Ruud Lighting, which it acquired in mid-2011, Cree had 80% agent transition (in January 2012) which caused more disruption to the project pipeline than it had anticipated.

However, in subsequent quarters, Cree has seen its lighting business grow stronger. With an expanding product portfolio and increasing customer base, the company is confident that it is on the right track. The robust rate at which it is introducing new lighting products, the company feels that more than the transition, which is an ongoing process, it is imperative to focus on getting the best product to its customers.

We believe the company is making good progress and is well-equipped to leverage the robust growth potential in LED lighting.

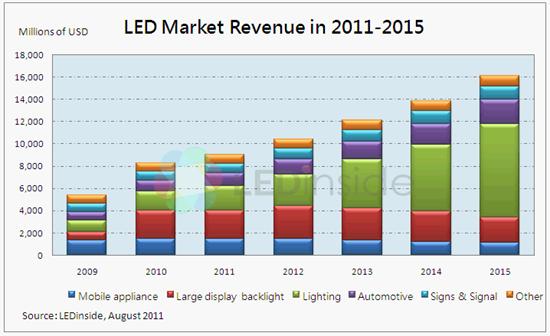

Trends in LED Adoption

With the demand from the backlight market nearing saturation and the general lighting market yet to take off, growth in LED demand has been slow resulting in a huge demand-supply gap that has put downward pressure on average LED selling prices. The increase in LED supply led by Chinese manufacturers has resulted in the LED surplus rising from a relatively low 7% in 2010 to 45% in 2011.

While the macro headwinds continue to suppress demand, the supply side has somewhat stabilized and we believe that the demand-supply dynamics are slated to improve hereon.

Lighting products accounted for 34% of Cree’s total revenue in Q1 2013, a substantial increase from 19% a year ago. The majority of Cree’s lighting business is concentrated in North America, whereas the LED business in more widespread in Asia. Both lighting and LED components are seasonal in nature – outdoor lighting tends to be lower in winters and the LED components business tends to be seasonally lower in the March quarter because of Chinese New Year.

However, we expect to see long-term growth in both these segments, and more so in lighting as we believe that post its acquisition of Ruud Lighting Cree is better equipped to leverage growth in indoor and outdoor lighting.

While China continues to be a promising market, Cree claims that the region remains cautious on the short-term outlook on account of the change in leadership. However, we expect Cree’s expanding presence in China to be an important strategic move for its long-term growth.

Our current price estimate of $28.62 is almost in-line with the current market price.

Understand How a Company’s Products Impact its Stock Price at Trefis